We continue to track clean energy VC funding and acquisitions: this week it’s solar-plus-storage, ultracapacitors and carbon capture technology.

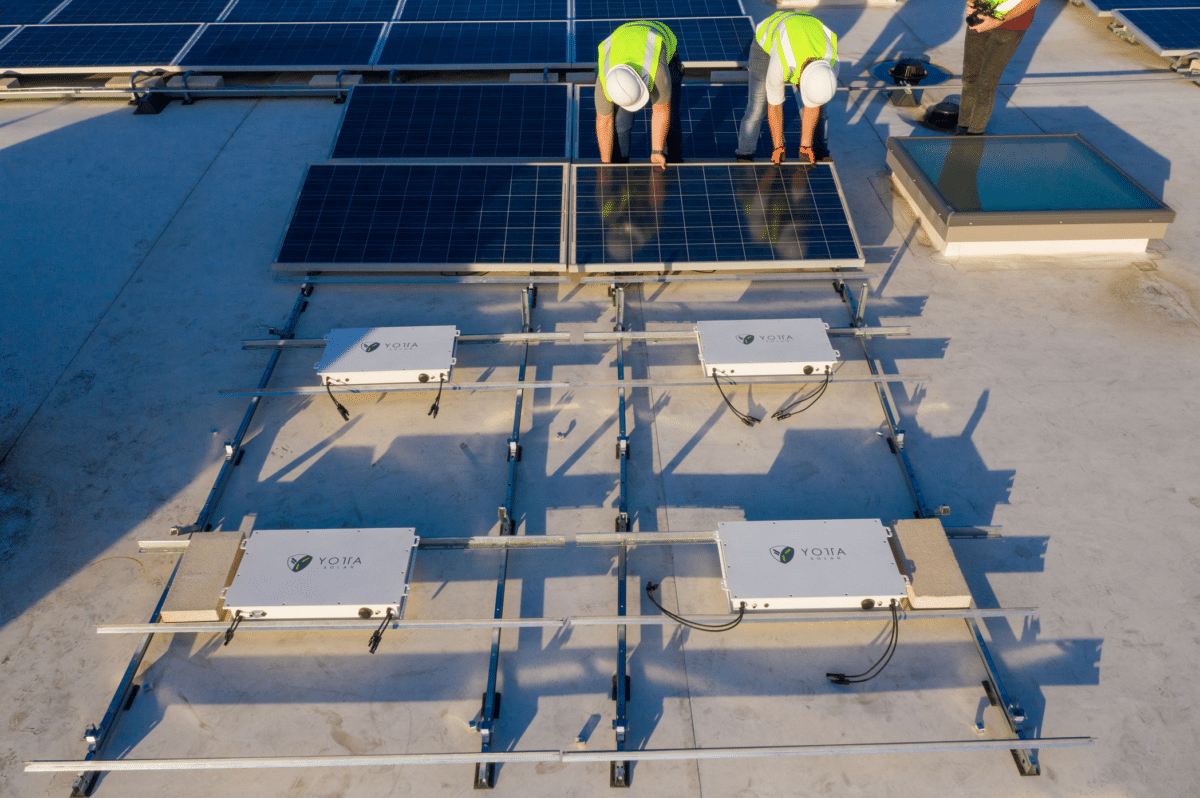

$5 million for batteries under solar panels

Yotta Energy has designed a 1-kWh battery that mounts underneath a roof-mounted solar module. The startup just closed a $5 million seed round to finalize UL certification and begin commercial production. Investors include Fiftysix Investments, EDP Ventures and Skyview Ventures. Earlier funding came from grants and $1.5 million in seed funding.

Ten years ago, the idea of putting a microinverter or optimizer behind a rooftop solar panel was a bit of a reliability stretch. Today, module-level panel electronics warrants its own acronym and enjoys an 80% percent market share in the U.S. residential solar market. Yotta Energy believes batteries are headed in the same direction — to module-level micro-storage — and is deploying a 52-pound, 1 kW-hr lithium iron-phosphate battery on the same solar module racking gear that holds the ballast. The company is targeting commercial customers.

$49 million for ultracaps

Skeleton Technologies, a European manufacturer of ultracapacitor-based energy storage – completed a $49 million round from investors including EIT InnoEnergy, FirstFloor Capital, MM Grupp and Harju Elekter, bringing total funding to over $110 million since its founding. The total commercial backlog is currently over $177 million from automotive and grid companies.

Statkraft acquires solar developer Solarcentury

Statkraft, a Norwegian utility, is acquiring London-based solar power developer Solarcentury for $152 million. The acquisition is expected to close this year and will see Statkraft acquire Solarcentury’s 6-GW project pipeline in Europe and South America. The acquisition could yield floating solar opportunities for the hydropower firm. Solarcentury backers include Capital Stage, Zouk Ventures, Bregal Energy, Frog Capital, VantagePoint Capital Partners and Scottish Equity Partners.

Oil services firm acquires Compact Carbon Capture

Baker Hughes, an oil field services company, is acquiring Dutch carbon capture firm Compact Carbon Capture.

Compact Carbon Capture was created through the collaboration of Fjell Technology Group, Equinor, Prototech and SINTEF. Its technology “differs from traditional carbon capture solvent-based solutions by using rotating beds instead of static columns.” The rotating bed technology enhances the carbon capture process resulting in up to 75% smaller footprint and lower capital expenditures, according to the startup.

And more

Alcazar Energy, a Dubai-based renewables firm, has begun a strategic review that could result in a sale for around $1 billion, according to Bloomberg. Backers include Mubadala and Gateway Partners.

Ardian, a private investment house, acquired Nevel, a district heating and industrial energy solutions company, from Vapo Group. Nevel owns and operates more than 150 heat and power plants and over 40 district heating networks across Finland, Sweden and Estonia.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I do like the battery under solar panel, but would wonder how well it does in weather extremes.

I guess I should look up operational temperature for lithium iron-phosphate.

Battery under a solar panel that can get 200F and freeze is just not going to work.

Product does have some thermal mitigation.