As difficult as it can be to get a grasp of the U.S. residential solar market at large, that’s what EnergySage sets out to do in its Solar Marketplace Intel Report, a report looking at trends of products that are offered and sold through the company’s online solar marketplace.

In the most recent edition of the report, released today, EnergySage includes data about the energy storage solutions being quoted to homeowners through the platform for the first time.

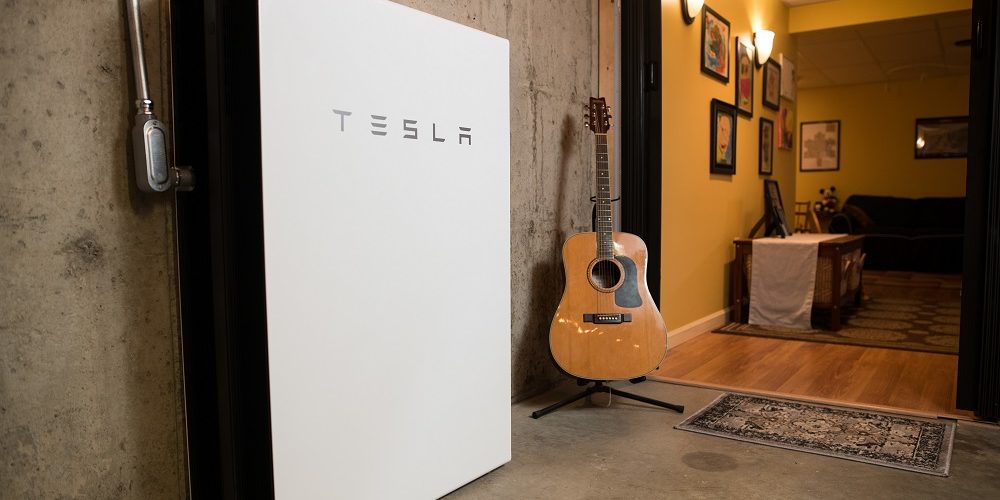

What this new data shows is that, Tesla’s Powerwall 2 is dominating the energy storage market, at least from a quoting perspective. Over half of energy storage quotes on EnergySage included the Tesla Powerwall, making it the most quoted storage option and brand. Part of this popularity can be attributed to the system’s price, as, on a cost per-kilowatt-hour stored basis, the Powerwall 2 is the least expensive storage option quoted in the Marketplace.

Behind the Powerwall 2 came LG Chem and Enphase’s storage offerings, with Panasonic, sonnen, Eguana and Generac’s storage solutions all featuring lesser representation.

Not only does the report track what storage brands consumers are gravitating towards, it also tracks trends in adoption. Nearly two-thirds of consumers who indicate a preference for storage on EnergySage say that they’re interested in storage for emergency backup power, while nearly half of all consumers that want storage are interested because of financial savings.

How solar stacks up

On the solar side, the report focuses mostly on slowing price drops and the effect that the Covid-19 pandemic has had on residential solar purchasing trends.

The company worked with Qualtrics to field a survey to over 500 consumers nationwide in early April, in order to assess how solar sentiment and shopping behavior has shifted due to Covid-19. What the two found was that responding consumers were more interested in solar now than they were pre-Covid, with a third saying their timeline for going solar has actually accelerated and very few moving out their timeline by a year or more.

The survey is backed by concrete data, as EnergySage’s website traffic and solar shopper registrations dipped in March and April before rebounding in May and June to levels significantly above where they were during the same period in 2019.

EnergySage attributes part of this renewed interest to the forced acceleration of digital solar sales. Another survey of consumers found that two-thirds are more likely to shop for solar online now than they were prior to Covid-19. In response, online installer quotes are coming in 30% faster than they did pre-Covid, in order to effectively meet demand.

As for the price of these systems being quoted online, those continue to fall, but not as quickly as before Covid. In every six month period since EnergySage began tracking quoted solar prices in 2014, the quoted price of solar has decreased. While this trend continued in the first half of 2020, it did so at a more sluggish rate than had been seen before. H1 2020 saw the median quoted solar price dropping 1.4%, when compared to H2 2019. During the period from July 2019 to June 2020, however, the median quoted solar price dropped by 2.4%, compared to the period from July 2018 to June 2019. This is a slower rate of decline than had been observed in any previous twelve-month period.

EnergySage prices also come in significantly lower than system price quotes collected by Tracking the Sun 2020, a solar pricing dataset complied annually by Lawrence Berkeley National Laboratory. The median installed cost of solar in the U.S. in 2019 of $3.75/W, as reported by LBNL, is 29% greater than the median quoted price for solar on EnergySage in 2019 of $2.90/W.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.