While not quite as strong as the way the company wrapped up 2019, Sunrun, the largest residential solar company in the United States, had another successful quarter to kick off 2020, even while operating in one of the hardest-hit sectors of the solar industry.

In Sunrun’s Q1 2020 financial results, the company reveals that it deployed 97 MW to start 2020, down 17% from Q4 2019’s record-setting 117 MW, but up 13% from Q1 2019. Sunrun has now deployed just under 2.1 GW of solar to date, representing 26% growth from the same point last year.

As for Sunrun’s overall customer base, that number jumped to 298,000, up 5% on the Q4 mark of 285,000. Year-over-year, that 298,000 mark is good for a 23% upgrade in Sunrun’s customer base.

As for the most historically difficult aspect of being a residential solar company, Sunrun reported $210.7 in revenue in Q1, down roughly 14% from Q4’s $243.9 million, but up nearly 8% from the Q1 2019 mark of $194.5 million. As is consistently the case, operational expenses outweighed revenue, coming in this quarter to the tune of $273.7 million, which is down roughly 6.5% from Q4’s mark of $292.3 million, but up 13% from Q1 2019’s $238.6.

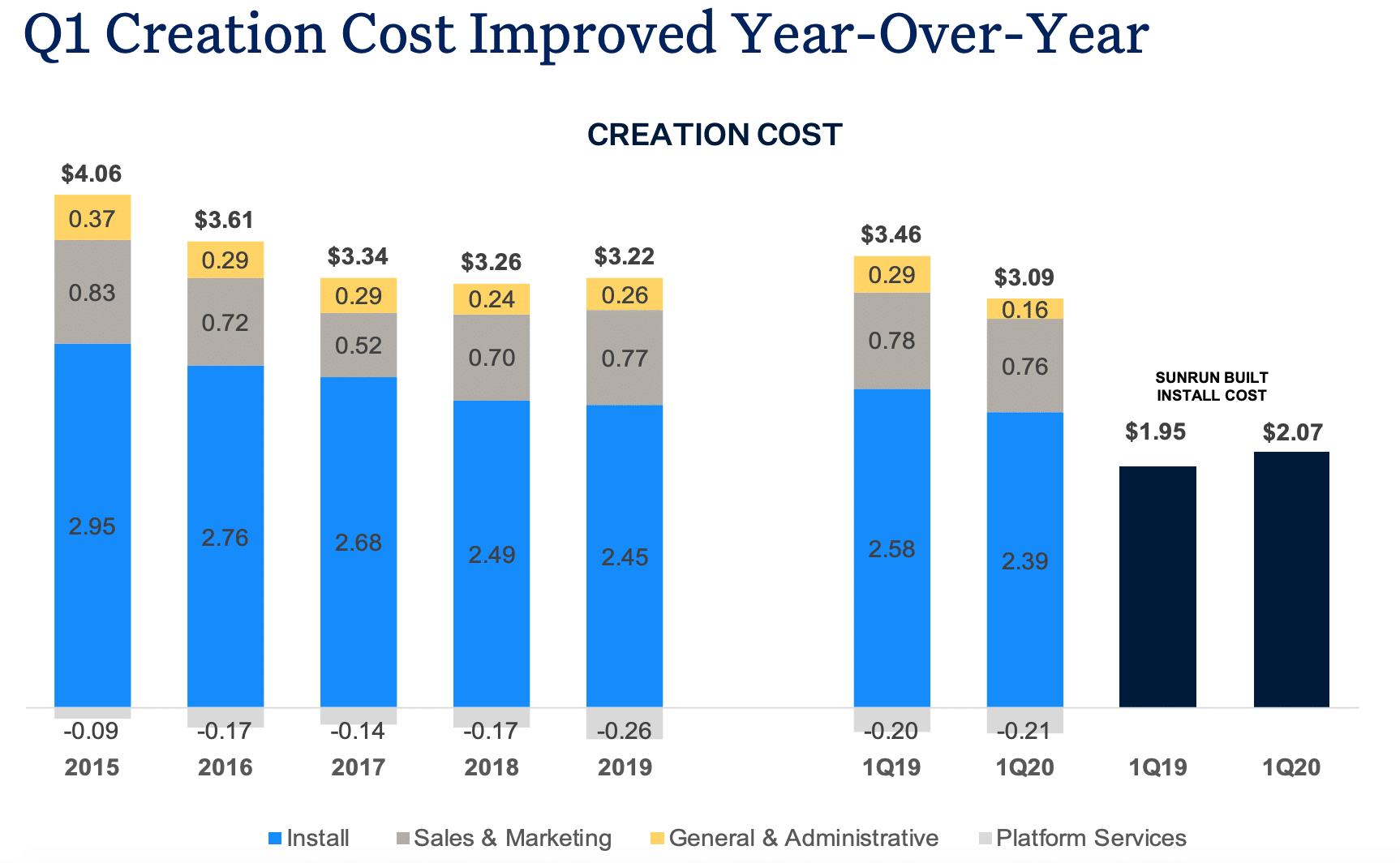

As was the case in Q4, operating expenses are rising alongside a decreasing “creation costs” for systems financed by Sunrun. This number represents the per-watt cost the company incurs for each new system installed, so long as Sunrun finances said system, and can represent a significant portion of each quarter’s operational expenses.

In Q1, creation costs rose to $3.09/watt, up from $2.87/watt in Q4 2019, yet still down year-over-year from $3.46 in Q1 2019. As for the specifics of the creation cost rise, while general and administrative costs fell to $0.16/watt from $0.23/watt in Q4 2019, both install costs and sales and marketing costs rose to $2.39/watt and $0.76/watt, up from $2.25/watt and $.069/watt, respectively.

Keeping on track amid Covid

While residential solar companies were expected to be hit the hardest by the Covid-19 pandemic, Sunrun has been able to weather the storm so far, The company experienced order decreases by as much as 40% in March, though CEO Lynn Jurich assured participants on the results call that these order decreases were brief. Sunrun also touts that orders reached a single-day all time high at the end of April.

Also shared on the call was the estimate that sales in Q2 could be down 30% to 50%, but Jurich said that she believes the number will be much closer to the former. Inspiring confidence, the company touted that more than 60% of Bay Area installations in Q1 included Brightbox battery attachments.

The results call also confirmed some organizational news, with the reminder that Tom vonReichbauer will be joining the company as its new CFO, effective May 11. vonReichbauer will be replacing Bob Komin, who is leaving to spend additional time with his extended family and support his interest in higher education.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.