The Solar Energy Industries Association says that PURPA “should be strengthened rather than weakened,” in a filing with the Federal Energy Regulatory Commission (FERC).

Solar facilities up to 80 MW in size may be classified as “qualifying facilities” (QFs) under the Public Utility Regulatory Policies Act of 1978 (PURPA), and thereby obtain the right to sell energy or capacity to a utility.

The U.S. had about 9.3 GWac of PURPA solar projects at the end of 2018, according to SEIA’s analysis of U.S. Energy Information Administration data. On the scale of a single career, Pine Gate Renewables CFO Ron Shem stated in a previous SEIA filing that he has “secured financing for over 800 MW of solar QFs.”

In SEIA’s latest filing, the association took up four issues it sees as key topics of contention raised by 100-plus firms and associations commenting on FERC’s proposed new rules for implementing PURPA.

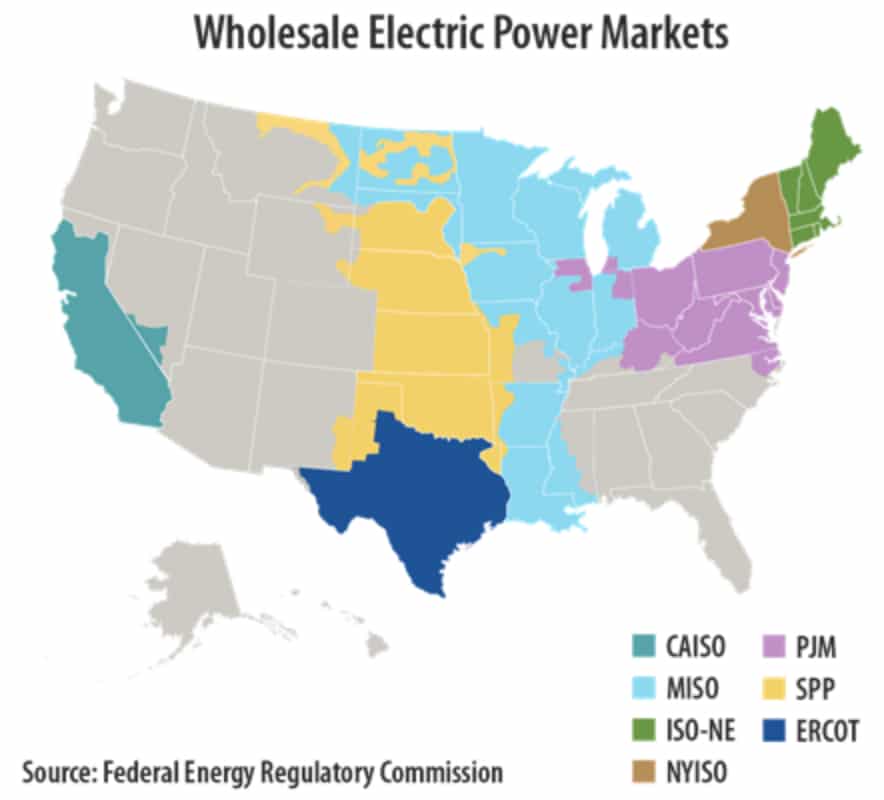

SEIA advocated for PURPA’s role in supporting competition, stating that “in the absence of [a] competitive market structure, such as retail customer choice or mandated competitive procurement of a substantial portion of the generation resources, PURPA provides the only competitive pressure on vertically-integrated utilities whether within or outside of ISO/RTO markets.”

Those markets are shown as colored regions in the map above; an earlier SEIA filing noted that “approximately a third of the country still operates outside of organized wholesale electric markets.”

In a related argument, SEIA noted that “in some states with vertically-integrated utilities, there has been discrimination against QFs,” and said that instead of offering flexibility to “non-compliant states,” FERC should consider an earlier SEIA counterproposal for fair “all-source competitive solicitations in which utilities and their affiliates could participate alongside QFs and other market participants.”

FERC’s proposed “Ten Mile Rule,” for defining the land area encompassing a QF and which facilities would qualify as QFs, is already threatening investments and would continue to do so, partly because it could lead to case-by-case disputes, SEIA said. The association reiterated its earlier proposal for FERC to modify the existing “One Mile Rule.”

SEIA challenged FERC’s proposal to relieve ISO/RTO utilities of the obligation to purchase from QFs under 20 MW in size. Noting the difficulty of interconnecting QFs to a utility’s distribution system, SEIA said FERC should not presume that these QFs have non-discriminatory access to wholesale markets.

In its original comments last December, SEIA made two additional arguments: that proposed reforms to QF rates “must encourage QF development and provide QFs a reasonable opportunity to attract capital;” and that “imposing unreasonable prerequisites” to forming legally enforceable obligations under PURPA “will discourage QF development.”

SEIA has also submitted supplemental comments on FERC’s proposed rule.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.