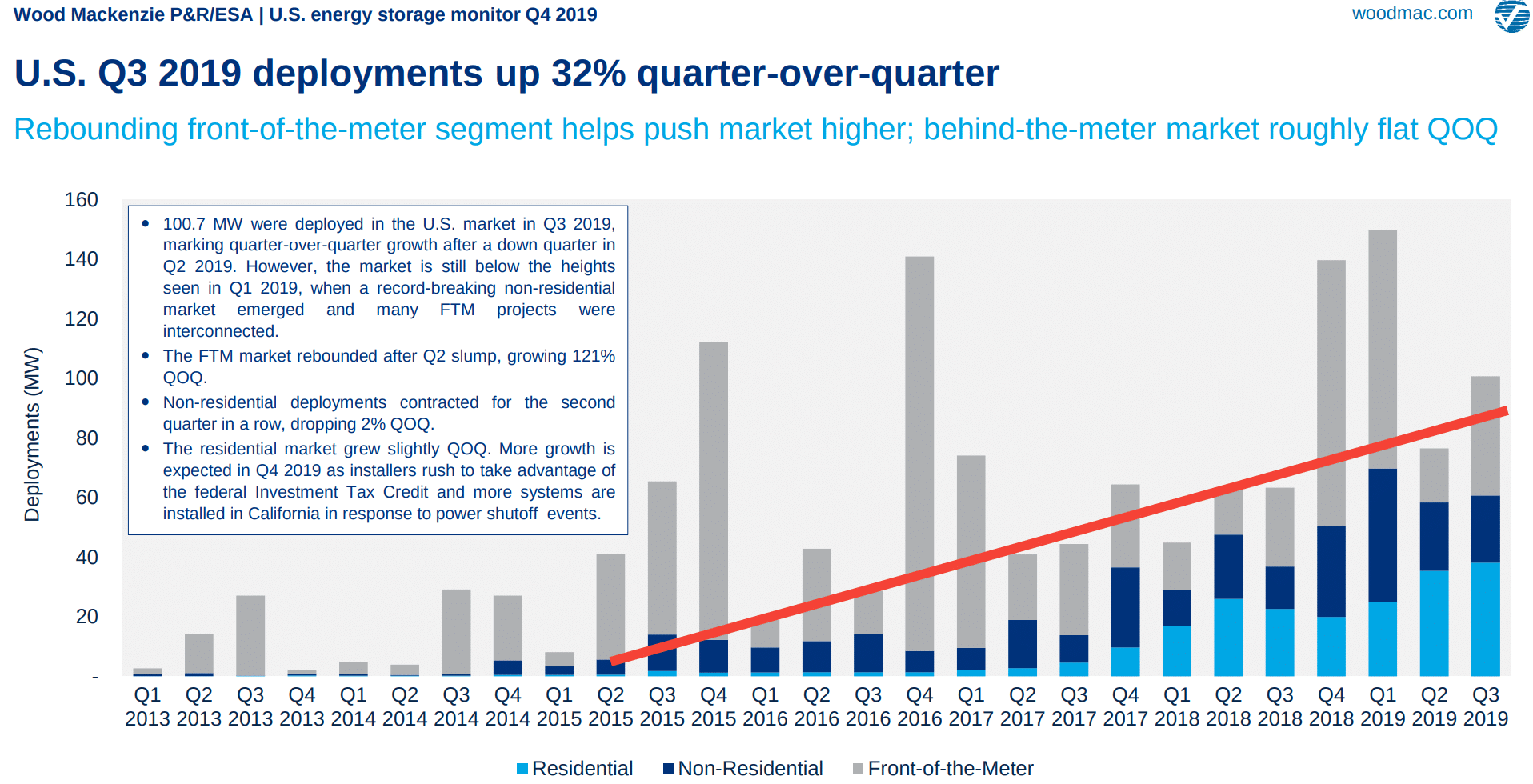

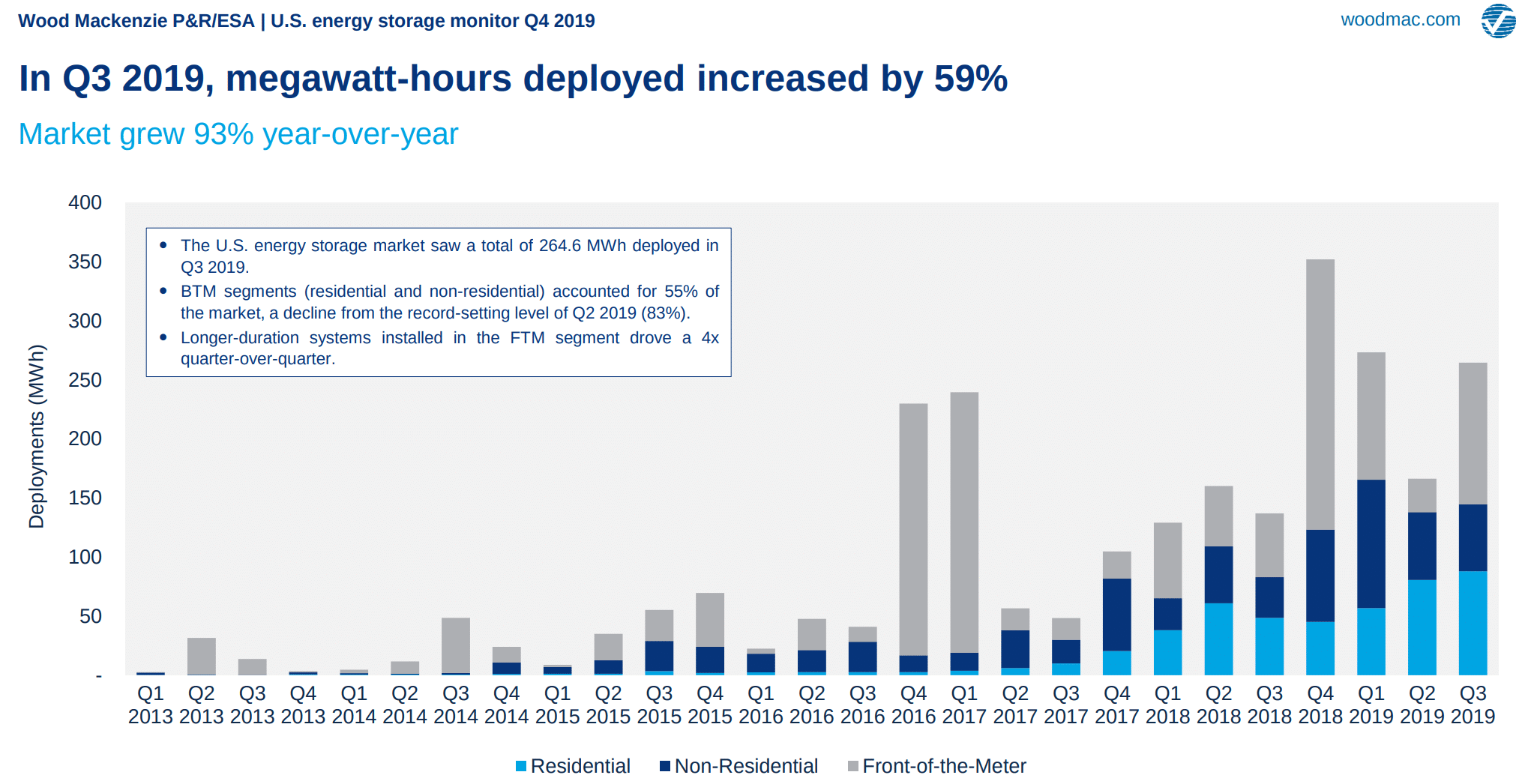

Wood Mackenzie Renewables & Power and the Energy Storage Association have released their US Energy Storage Monitor, which showed that in 100.7 MW / 264 MWh were deployed across the country in Q3’19. The quarter was the highest Q3 so far, and outside of massive months where utility scale projects dominated, is at the end of consistent growth (red line added by pv magazine USA) when combining the various ups and downs of markets.

For battery power, it was the fifth highest volume deployed while battery capacity was the third highest month.

The research group noted 32% growth in megawatts deployed over Q2’19 in the above image, while below they show 59% growth over the prior quarter in terms of megawatt-hours deployed. The 59% was driven by longer duration in front of the meter installations by utilities. Future projects have already signed much longer hourly ratios, with certain developers seeking 24 hour solar – so expect that battery capacity may outgrow battery power.

The document saw the various markets grow in their own patterns. Residential energy storage has consistently grown since a late last year slump due to supply challenges. More growth is projected to come from California due to the power safety shutdowns. The commercial sector has seen two straight months of pull back after a big Q4-Q1’19, no reason was noted. Of course, the wild card is the utility scale sector – whose peaks historically set the record months.

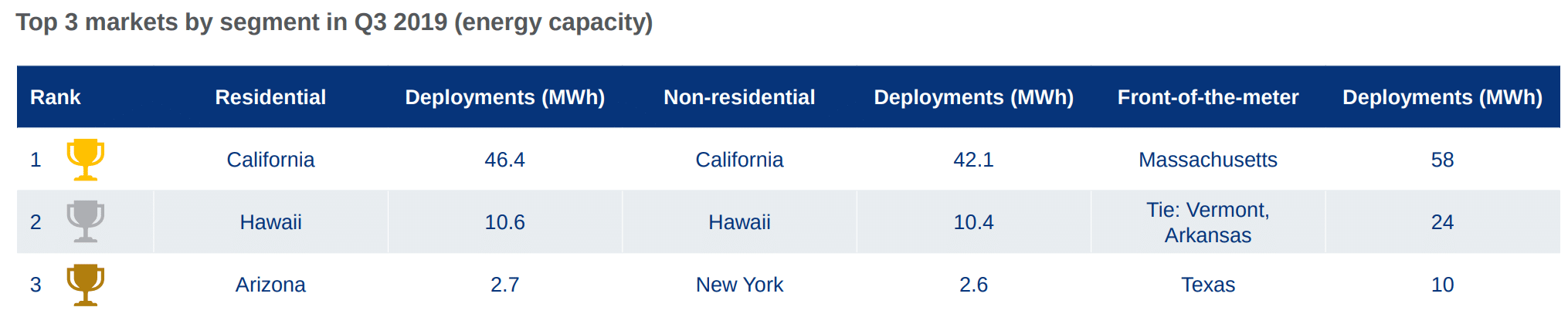

State wise, the Massachusetts SMART program was the quarter’s clear leader for front of the meter deployments at 58 MWh, with Vermont (always smart with storage) and, surprisingly to this author, Arkansas tied for second place at 24 MWh each. California, Hawaii led the residential energy and commercial energy storage markets with with roughly similar volumes each deployed. Considering California is over 25 greater than Hawaii, but only outpacing by 4-5X, its pretty obvious Hawaii is making some serious moves.

Going forward is where the real story is, and this has been growing as fast as the factories can be built really. From 2019 into 2020, the market is expected to triple, then going from 2020 into 2021 the market is projected to more than double. Before, by the end of 2024, another doubling will occur – bring us to 12X growth over this year.

The market will be worth $645 million this year, before hitting almost $2 billion next year, more than doubling in 2021 to $4.2 billion, then cruising up to $5.4 billion in 2024. Front of the meter will make up a most of that market, however, due to its higher cost per unit will itself become a billion dollar market in 2021.

Wood Mackenzie doesn’t offer pricing on on battery packs, only showing the above US market money spent. However, Bloomberg New Energy Finance recently published that battery pack prices have fallen to $156/kWh, and this author has seen bids in the $350/kWh range delivered in a shipping container for smaller volumes.

https://twitter.com/BloombergNEF/status/1201788202274709505

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Coincidentally, I just looked at ERCOT’s November GIS report. 200MW of batteries finally made it to the IA stage with another 7GW in the proposal pipeline.

“Battery prices, which were above $1,100 per kilowatt-hour in 2010, have fallen 87% in real terms to $156/kWh in 2019. By 2023, average prices will be close to $100/kWh.”

If this is the trend, then it looks like about 16% reduction a year in cost per kWh of storage. If it does not taper off and remains at that 16% per year until 2025, it could be possible to get energy storage for about $71/kWh by 2025. Count me in, I want more BTM energy storage and less reliance on the rote electric utility.