The residential solar market in the United States has seen significant ups and downs over the past few years. As both evidence and a cause of this, what was formerly the largest company in the space, SolarCity, moved from a roughly 1/3 share of the entire residential market to fourth place, falling each quarter towards obscurity under Tesla.

But one company has been growing this entire time. For several quarters now Sunrun has been the largest residential solar company in the United States, recently surpassing 100 MW of quarterly installations. The company’s second quarter results were no exception to this upward trajectory, with a 20% year-over-year growth in revenue to $205 million, and 103 MW of deployments – up 13% year-over-year.

Sunrun reported a net loss of $105 million during the quarter, but this is nothing new – third-party solar companies consistently lose money while building long-term value.

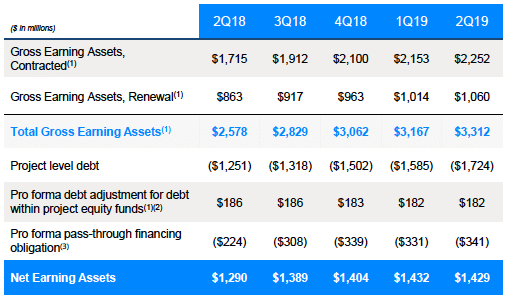

From here things get harder to gauge. Sunrun reported $1.429 billion in “net earning assets”, a metric which reflects the value in the systems it owns, minus the debt they carry, but this metric and its calculation is unique to Sunrun and cannot be compared to other third-party solar companies like Vivint, who also use unique metrics for these values.

From here things get harder to gauge. Sunrun reported $1.429 billion in “net earning assets”, a metric which reflects the value in the systems it owns, minus the debt they carry, but this metric and its calculation is unique to Sunrun and cannot be compared to other third-party solar companies like Vivint, who also use unique metrics for these values.

This net earning assets figure is actually down by $30 million from the previous quarter, but this is largely due to an increase in project level debt, and the company’s cash and restricted cash rose by $50 million, so there’s not much to see here except a company that is good at securing financing.

Instead, you have to look deeper into the company’s earnings to see the main area of concern, and it is an area that is not unique to Sunrun.

The elephant in the room

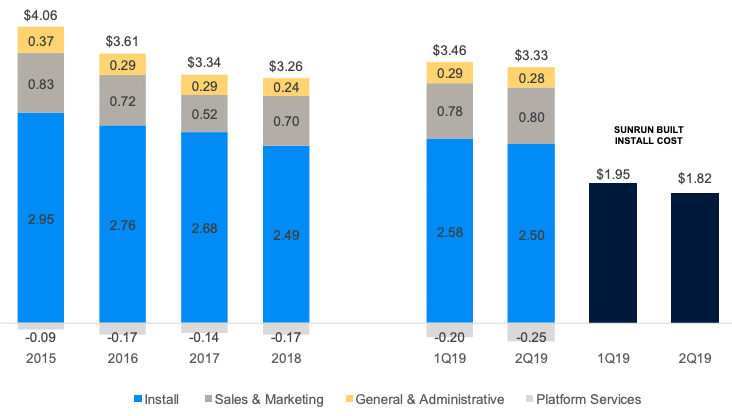

Sunrun brought down the “creation cost” of systems it financed – including those installed by its dealer network – to $3.33 per watt this quarter, but in the first half of 2019 this cost has been higher than in 2018 or even 2017. This is largely due to one category that keeps rising: sales & marketing.

Sales and marketing expense climbed to $0.80 per watt in Q2, which is higher than at any point since 2015. When asked by pv magazine about these costs in an interview last month, CEO Lynn Jurich largely dodged the question, instead focusing on the company’s work on reducing permitting costs and delays.

Rising customer acquisition costs are an issue not only for Sunrun, but also for Vivint Solar, the 2nd-largest third-party residential solar company and Sunrun’s biggest competitor. And at least in part as a response to this challenge Tesla moved solar sales first into its retail stores and then online, which has slashed costs but may be a factor in its rapidly shrinking market share.

And while it may be that no one has a real answer as to what to do about the increase in these costs, other costs such as the cost of PV modules and installation are on a general downward trend. Additionally, despite the falling costs of wholesale power utility rates are generally not declining. And as many of Sunrun’s customers are under net metering arrangements, this means the numbers are far from hopeless.

Also, there is a solution around the corner for at least a portion of the company’s business. California’s mandate that new homes must incorporate solar kicks in in less than six months, and this is expected to eviscerate customer acquisition and other soft costs, given that homebuilders will sign contracts for dozens or hundreds of units at a time.

CEO Lynn Jurich estimates that Sunrun has either entered into agreements or is in conversations with half the homebuilders in California, and the proof of the company’s degree of success – or potentially lack thereof – in this market will come next year.

Extra revenue streams

Another way that Sunrun can navigate these difficulties is by offering more services to increase its revenues. The company has continued to roll out is BrightBox solar + storage solution in new states this year, and has secured its first contract to supply capacity from a pool of rooftop solar and battery systems in New England, as well as a similar contract to help meet local capacity requirements in California.

On Sunrun’s results call Jurich estimated that the supply of capacity from DG solar to meet local reliability requirements is a 9 GW market in California alone, but emphasized that this business will build slowly over time, and will not represent a significant portion of the company’s revenues over the next few quarters.

In the near term the company looks to continue its growth, predicting 107 to 110 MW of deployments during Q3, and 16-18% deployment growth for the full year 2019. But perhaps the main takeaway is that in a difficult market, Sunrun is charting a path towards the future.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Very nice summary of the quarter. Well done. SunRun remains a better investment for those with long term horizons of at least 1-2 years if not longer. And as Vivint’s results show today, neither company has found a way to reduce costs enough to make money yet. But with SunRun, I have a strong suspicion that patient investors will be richly rewarded down the road.