Duke Energy has released financial results for the second quarter of 2019, which show continued growth and a strong financial year for the company.

These results were driven by Q2 earnings of $820 million, an increase of $1.12 an adjusted share. For comparison, in Q2 of 2018 the company saw $500 million in earnings, or $0.72 an adjusted share. The company shared that while earnings predictions for the quarter were strong, the results surpassed expectations. And while not as impressive as the earnings figure, the company’s operating revenue for Q2 came in at $5.87 billion, which is still growth over the $5.64 billion posted in Q2 2018.

“We delivered strong financial results in the quarter as we continue creating value for customers and shareholders,” said Lynn Good, Duke Energy chairman, president and CEO. “So far this year, we’ve grown earnings and increased our dividend. We remain on track to meet our commitments, and have reaffirmed our 2019 earnings guidance range and our longterm 4 to 6 percent earnings growth rate.”

Some of the company’s largest year-to-year growth came from the commercial renewables sector, which posted an income of $86 million, a star increase over the $38 million reported in the second quarter of 2018. In terms of Duke’s overall financial outlook, the $86 million in commercial renewable income represents a $0.06 per share increase. Financial growth for commercial renewables was primarily driven by a new solar tax equity financed project placed in service.

Speaking of renewables, the results also included an updated outlook on Duke’s ongoing renewable energy projects.

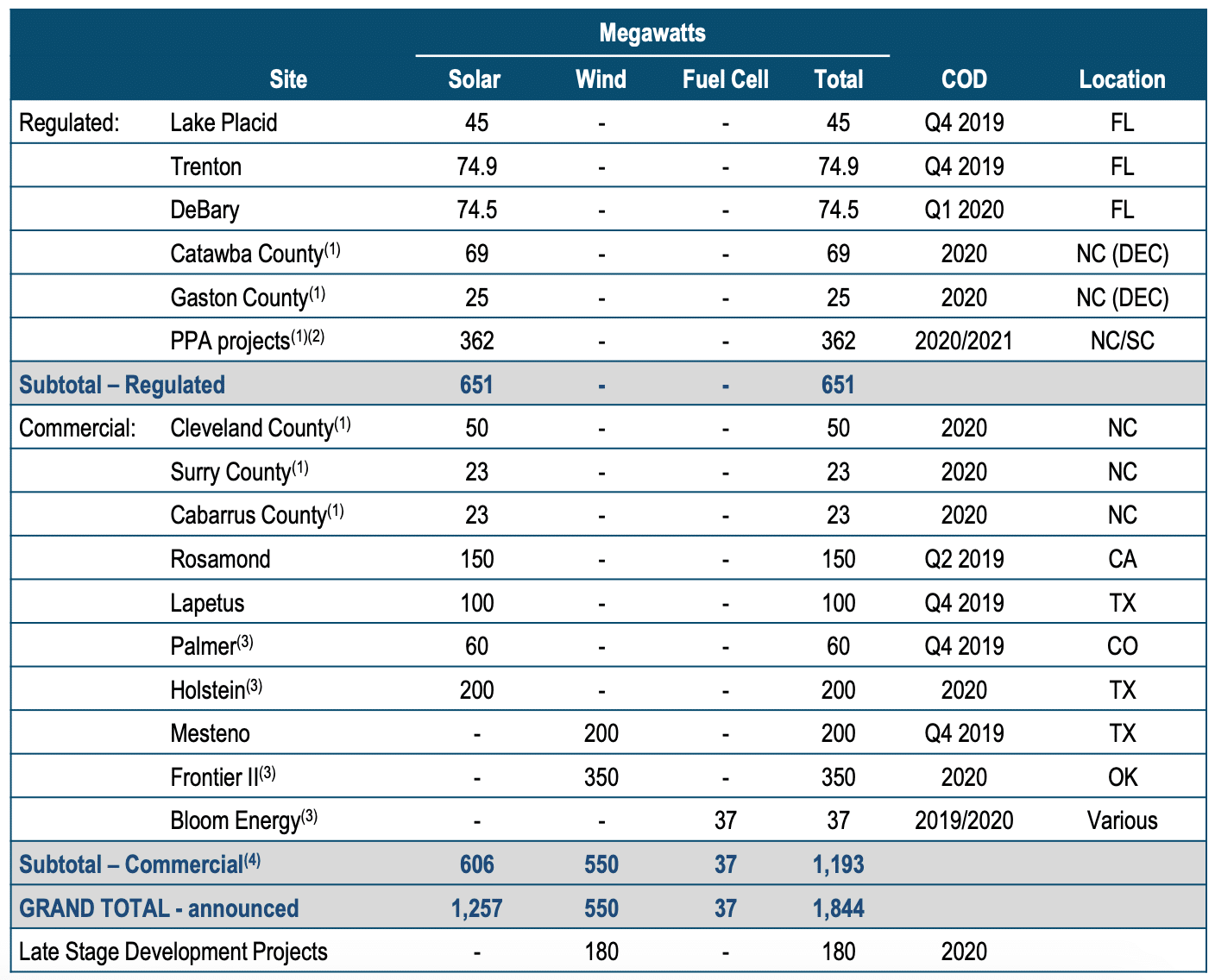

The projects are split between regulated and commercial development, with regulated being the projects that will be built in the service area of Duke’s subsidiary utilities: Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida. Commercial projects are those set to be constructed by Duke Energy Renewables and generating electricity for a non-Duke utility.

While only two projects are set to go on-line for Duke utilities before year’s end, the projects are fairly major, accounting for 120 MW in capacity in Florida, where Duke has to work to keep pace with the rapid development of solar under neighboring utility Florida Power and Light’s “30 x 30” plan. The other part of the regulated section that stands out is the 362 MW of development that will be coming from power purchase agreement (PPA) projects. Nearly 56% of Duke Energy’s near-term development will be coming from PPA projects. What’s more is that these PPA projects, as well as another 94 MW of regulated projects and 96 MW of commercial projects were procured after clearing the first round of request for proposals under North Carolina’s HB 589.

The lone development to achieve commercial operation in Q2 2019 was the 150 MW North Rosamond project in California. however, Q2 held the announcement of four new renewable projects, with two of those being solar. The newly-announced arrays will account for 260 MW in capacity and will be located in Colorado and Texas. Impressively, Duke anticipates that the Palmer project, the 60 MW Colorado development listed earlier, will be completed before year’s end.The much larger Holstein project in Texas will take until 2020 to complete and will boast a 200 MW capacity. Commercial projects will count for 606 MW of capacity through 2020. When combined with the regulated projects, Duke has a total project pipeline of 1.25 GW to come on-line over the next two years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.