It’s not alternative energy anymore when the largest, most profit-focused companies build their business around its growth. NextEra’s 2019 Investor Presentation (pdf) showed a company confident in the future of solar, wind and energy storage.

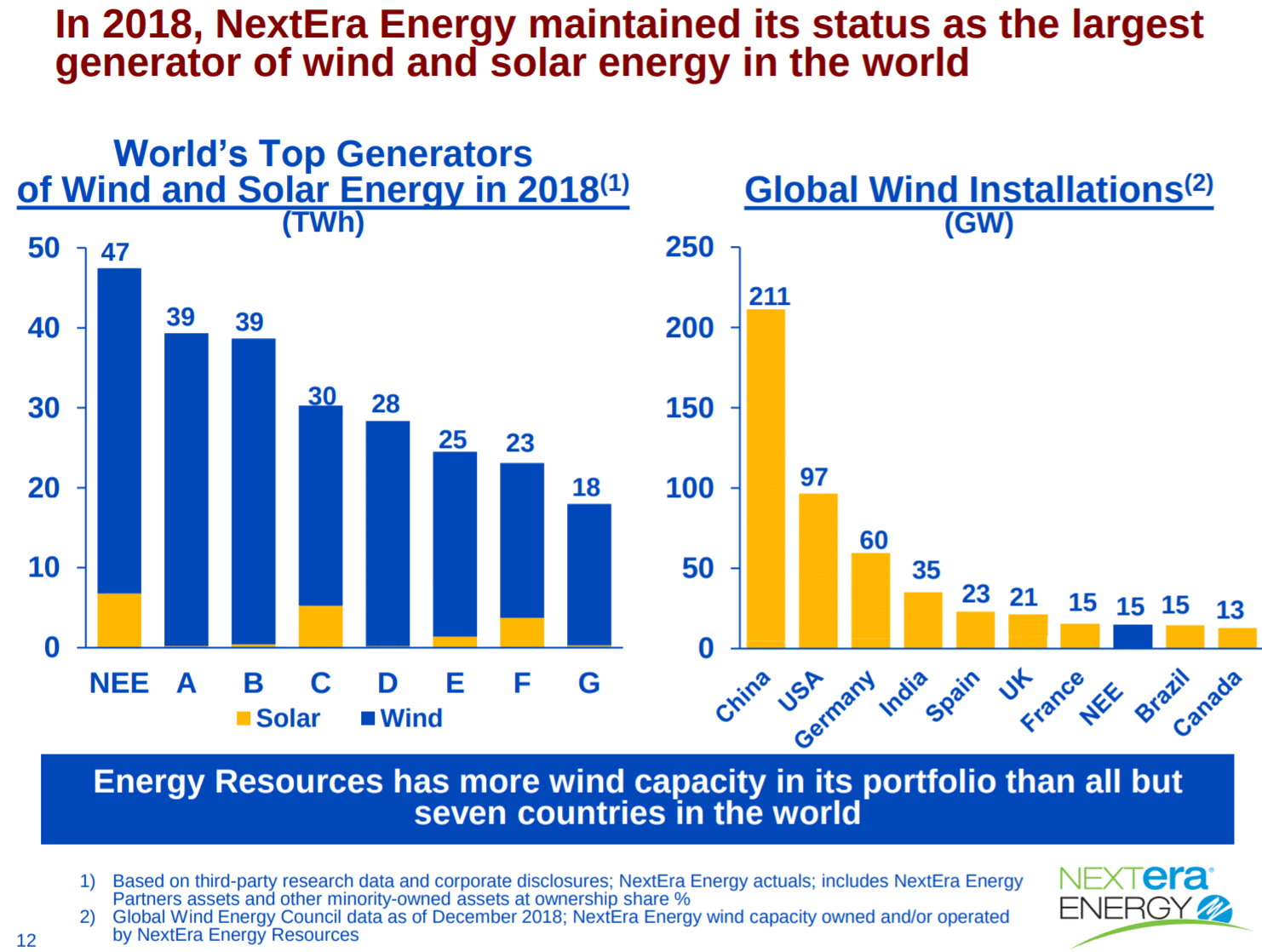

NextEra as a whole gets to say that they are the largest generator of wind and solar energy in the world, with more wind in its portfolio than all but seven countries in the world.

Investment arm NextEra Energy Resources reported a goal of building America’s leading renewable business, and gave evidence of this in that they’ve put ~4.8 GW of capacity in service in 2017 and 2018, while signing another 10+ GW of renewables contracts during the same period. The company revealed that 40% of those solar contracts include an energy storage component.

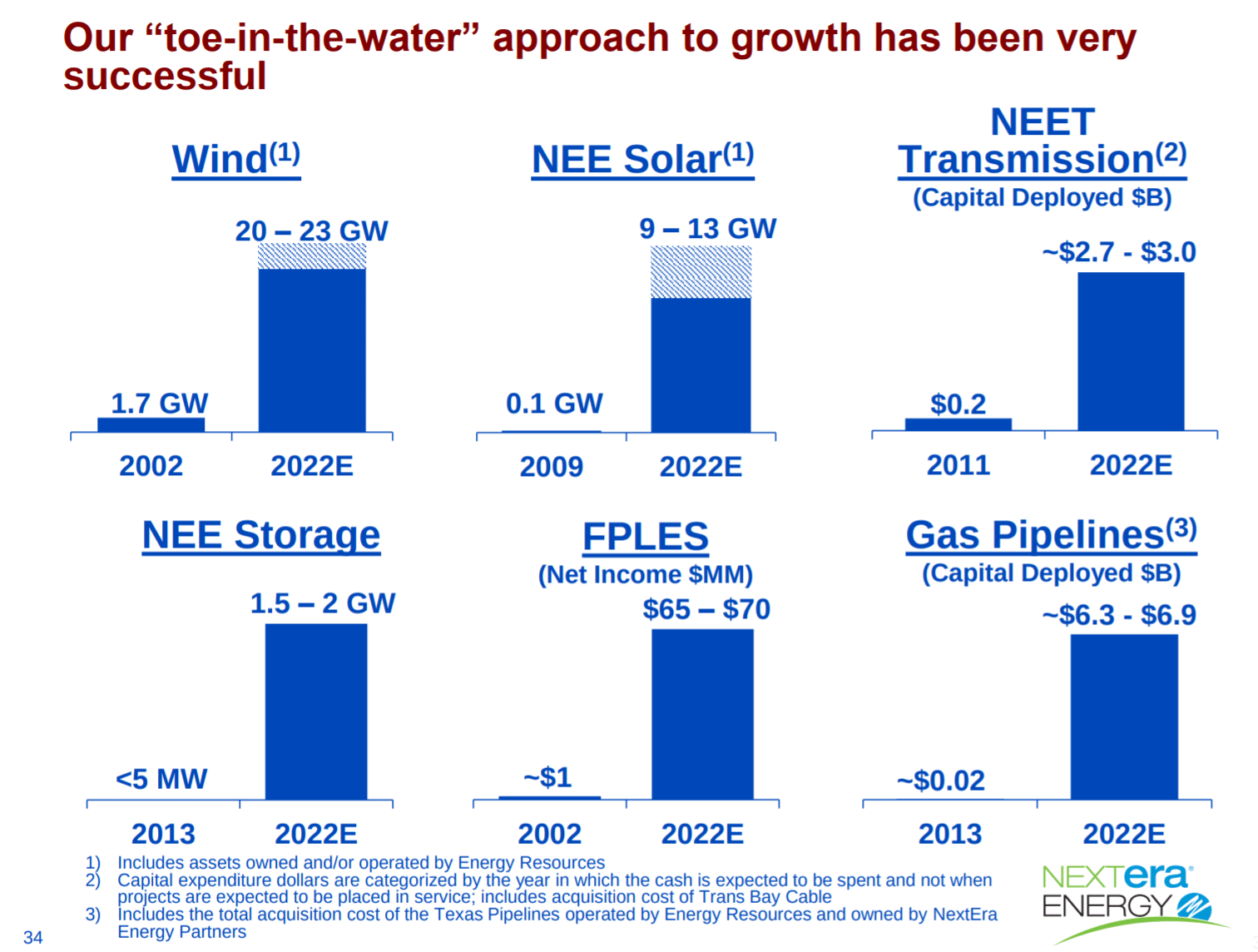

NextEra also reports that its “toe in the water” approach to growth has been successful (below slide). The slide notes that by 2022, the power giant hopes to have between 20-23 GW of wind, 9-13 GW of solar power and 1.5-2 GW of energy storage deployed. In a later slide, the company notes wind, solar and storage cumulatively growing from ~18 GW in 2018.

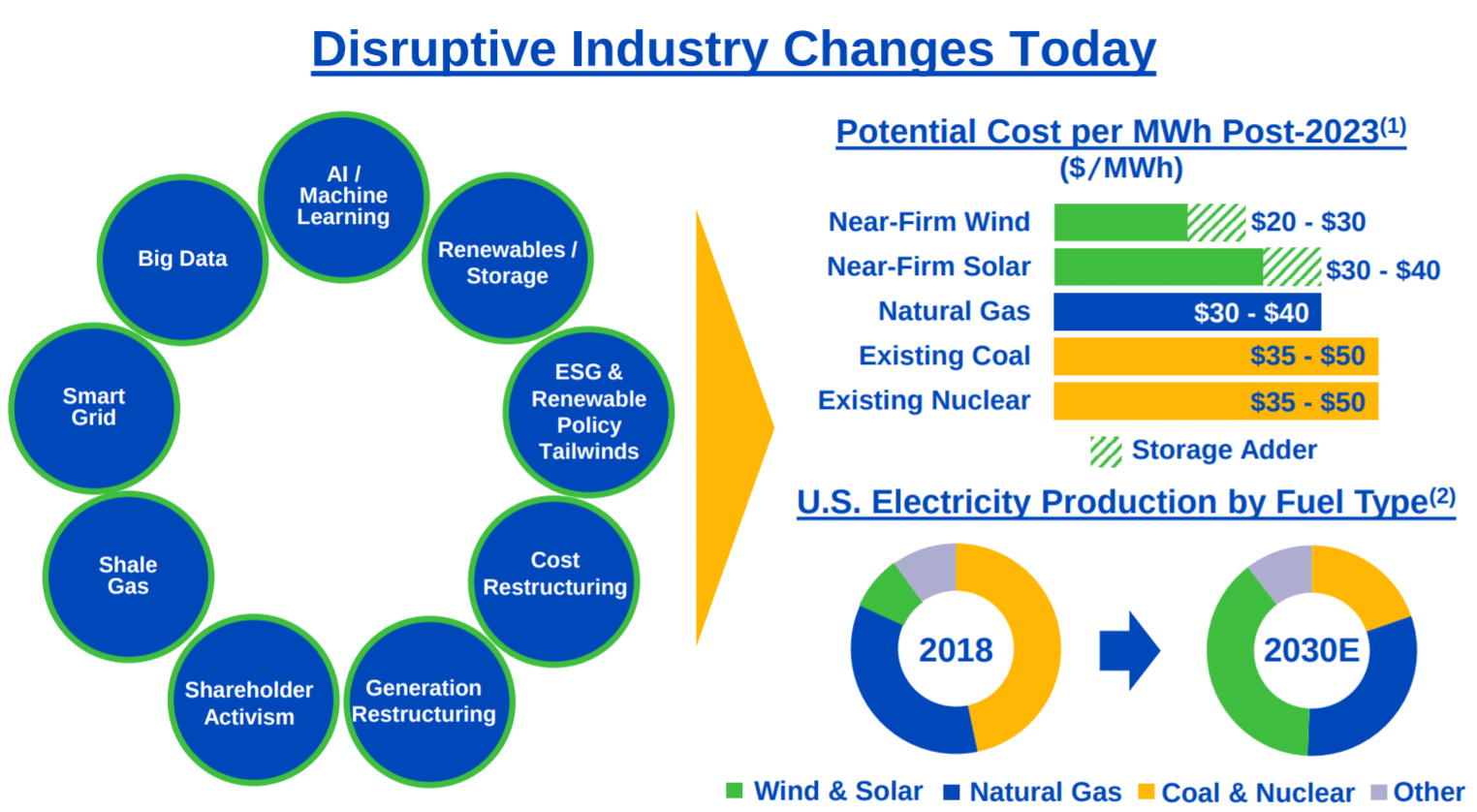

Later slides clearly state that this “toe in the water” growth pattern will continue. On the call, the company states that “we expect these disruptive factors (some noted in below image) will further expand and accelerate over the coming years.” The accelerate terminology was followed up by the company noting that wind and solar power growth have been consistently underestimated – and then NextEra references EIA growth estimates.

Following that, NextEra provides us all something beautiful and unique: the future pricing projections, post all tax benefits from the federal government, of new FIRM (including storage adders) solar and wind versus other sources of electricity. Of course, the industry already has numbers like this from the researchers at Lazard–however, these estimates are coming from owner-operators who don’t care about selling research, they care about delivering cash to investors.

So repeat it aloud, NextEra thinks “near-firm” new wind and some solar will be the cheapest electricity source even without federal tax benefits, with gas pricing comparing to solar+storage depending on market probably.

The group also projects that coal and nuclear will fall from 50% of the market in the United States to sharing that 50% with gas while solar+wind+storage come to take over huge swaths of the market by 2030. Later, on slide 47 the group references NREL projections of ~15% CAGR in MWh generation between 2018 and 2030 for US renewables from ~100 GW to 500 GW by 2030. Expect pv magazine USA to reference these values in the future.

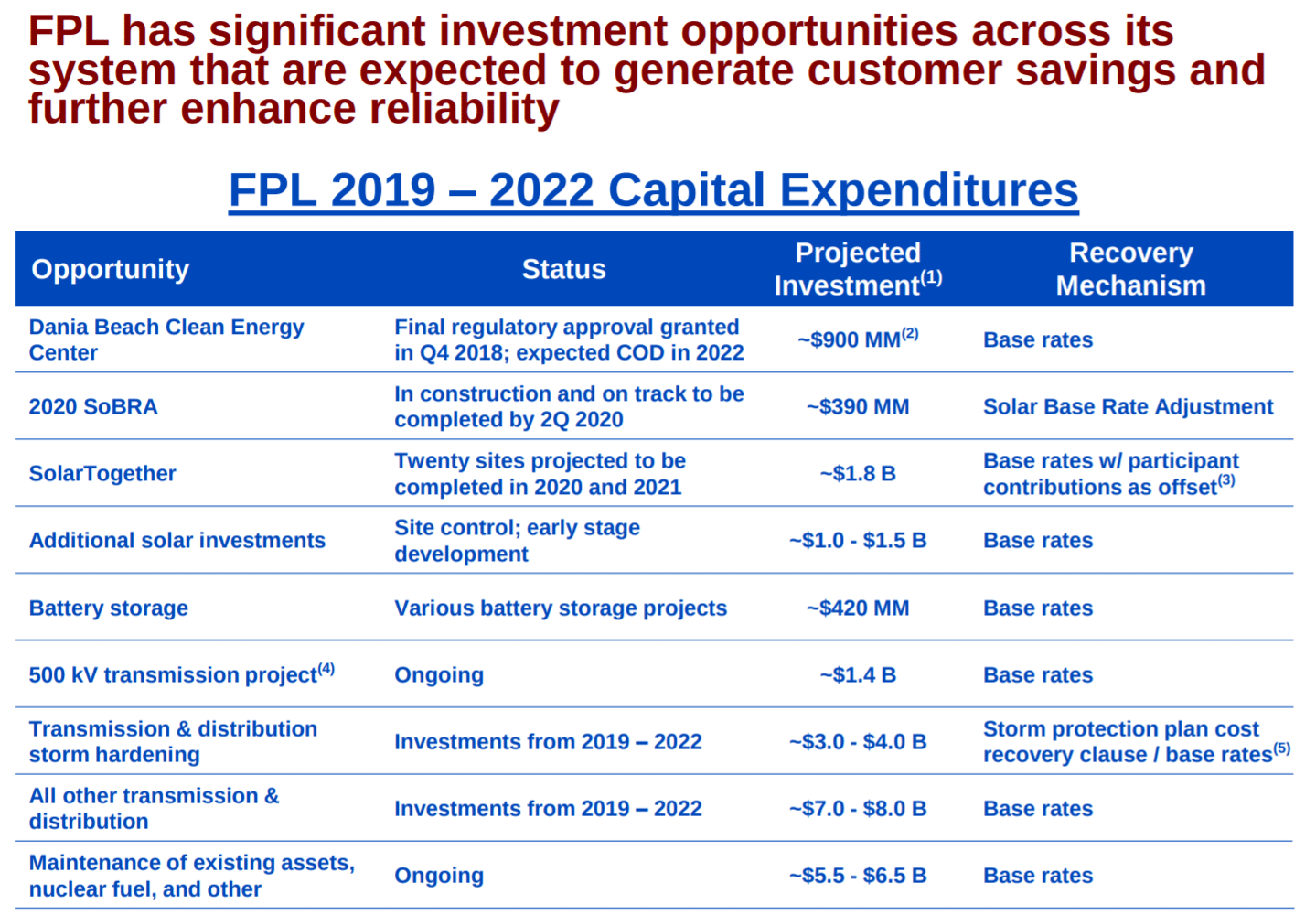

NextEra as a parent company owns two utilities – Florida Power & Light (where everything started for this team) and Gulf Power. In the subsections associated with their work, both noted future capital expenditures that included much clean energy and that they expect to rate base most of it (and expect it to work as it has much precedence in the state).

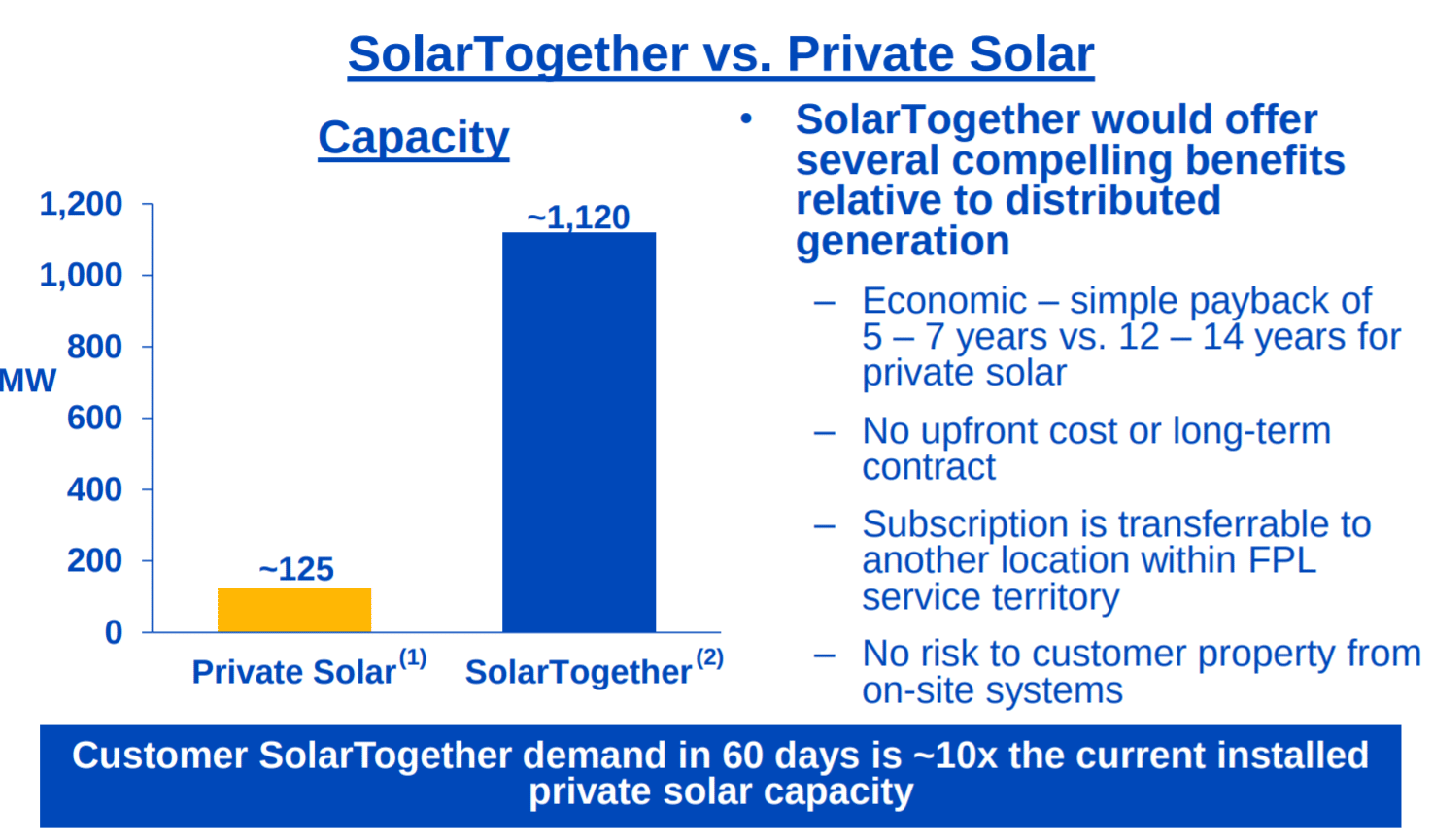

The new community solar program, SolarTogether, had a few slides – and an interesting line in it:

SolarTogether is projected to generate $139 million in total net lifetime savings, with non-participating customers receiving 20%.

The program is structured where customers in the voluntary program would subscribe to a portion of solar power capacity for a fixed $/kW subscription cost, and in return, they would receive credits that are expected to reduce their monthly bills over time. The program is ~1,500 MW initial program size, with 20 sites to be placed in-service in 2020 and early-2021 with a total expected capital investment of ~$1.8 billion. And the biggest surprise is the customer uptake of the program – below slide – which shows 1.1 GW of pre-registered capacity within 60 days(!).

The slide also notes, “economic – simple payback of 5 – 7 years vs. 12 – 14 years for private solar” – which suggests an ownership structure.

As the document has further data that pv magazine USA wishes to cover, and it is far greater in scope than a Friday morning allows for, please look forward to additional articles on this presentation.

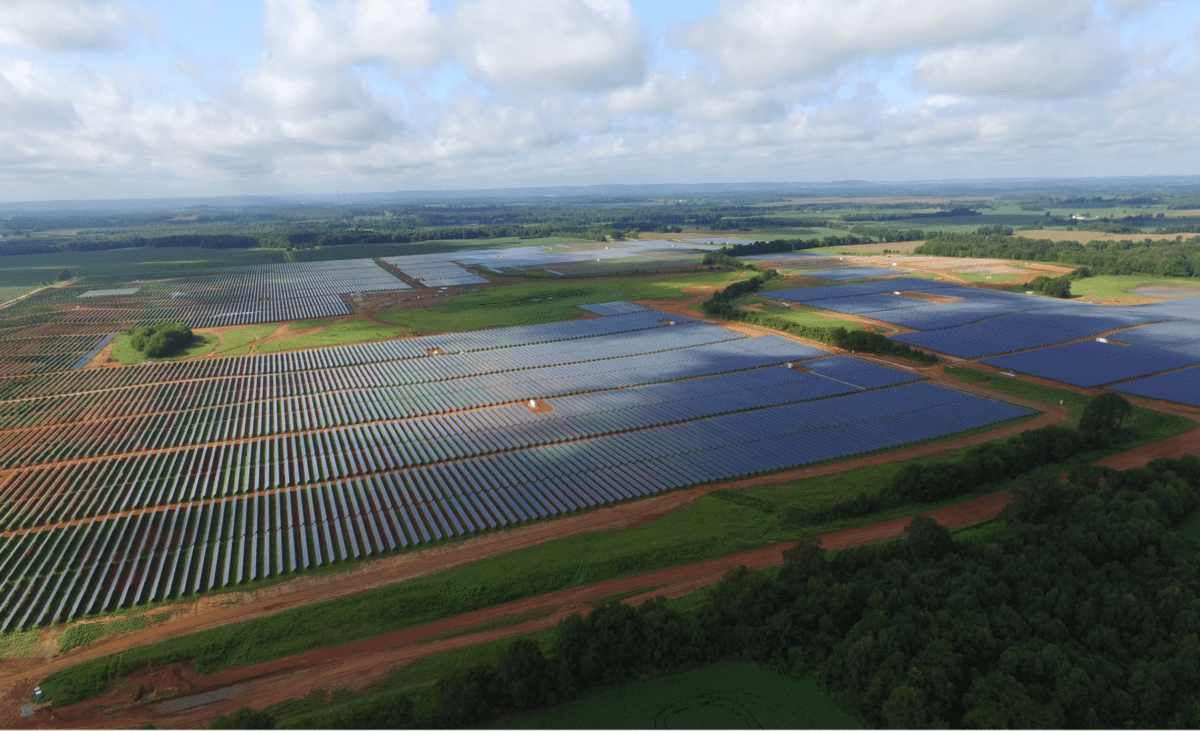

As a bonus for making it to the end of the article, some pretty images:

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Keep up the good work and save environment