LevelTen’s Q1 PPA Price Index shows general price decreases for both wind and solar power in bids submitted through its online marketplace. The company notes that “across markets, an evenly-weighted index of hub-specific P25 wind and solar prices decreased $0.39/MWh, or 2.3% quarter-over-quarter” for contract terms ranging from 10-25 years.

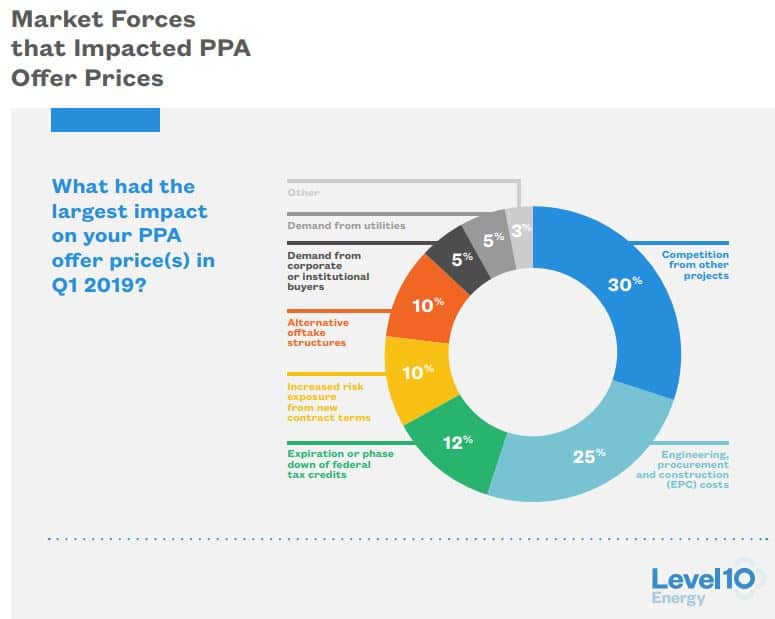

Additionally, the company surveyed 40 utility-scale renewable energy project developers and found that increased competition among developers and changes in engineering, procurement and construction (EPC) costs had the greatest impact on the quarter’s pricing changes.

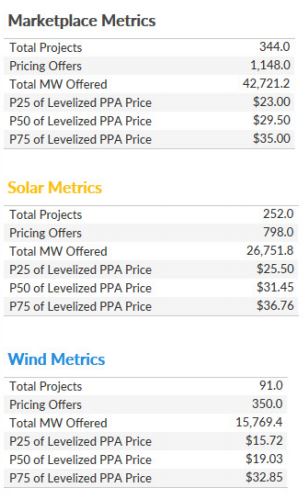

This pricing was based on a total of 344 projects, which submitted 1,148 pricing offers. The total megawatts offered was 42,721.

This pricing was based on a total of 344 projects, which submitted 1,148 pricing offers. The total megawatts offered was 42,721.

Last quarter’s analysis saw 389 projects being bid on, getting 745 pricing offers, with utility scale solar pricing increasing about 1.3%. LevelTen noted that the large increase in offers was partly due to a change that made it easier for developers to submit multiple offers, with varying contract terms, for the same project.

The P25 through P75 analysis showed a variance in pricing between from $36 to $25 per MWh, with these numbers shifting downward 4.4% to 7.2% from the prior quarter.

Of the five major grid operators analyzed, LevelTen found that the P25 prices increased by 4% in MISO, but decreased in all other markets. CAISO saw a 15% fall and prices in ERCOT declined by 6%, with the Texas grid operator’s West Zone falling 9%. The SPP region fell by 1% and PJM saw a 3% decline.

Wind also saw slight decreases in pricing, but the base price for wind was much lower than the solar price to start with, and well below $20 per megawatt-hour for the P25 values.

In addition to pricing information, the group asked why pricing changed (above image) and also how it might shift in the future, with the company receiving 40 responses from U.S. and Canadian developers.

For U.S. developers, the tax credit phase-down was increasing demand for modules, while those who hadn’t yet secured panels were finding upward pressure on costs, and projecting an increase as the year goes on. The lower value of the ITC was thought to potentially push costs up a bit. There was also a sense that increasing demand from utilities who had to follow new state renewable portfolio standard laws, and corporate purchasing was also up—which might put upward pressure on pricing.

The platform itself saw an increase of 17% in the number of active projects, which could drive higher levels of competition and bring down prices. More advanced PPA structures for C&I customers is also removing risk and lowering prices.

In terms of what actually drove pricing, Walden Renewables CEO Henry Weitzner noted:

We are seeing an increasing number of solar projects submitting requests to utilities to connect to the grid, and competition to interconnect and to sell electricity is increasing.

30% of respondents agreed with Weitzner that competition is having the highest impact on their pricing, while 25% cited a “change in engineering, construction and procurement (EPC) costs” as having the largest impact.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.