Having more demand for your product than you can deliver is usually a good problem to have. And that is where Enphase is finding itself as it moves into the second quarter of 2019.

The company is a remarkable turnaround story; after being eclipsed in the California residential market by SolarEdge’s power electronics, Enphase switched CEOs, laid off workers, cut product lines and slashed costs to below the cost of production in what looked at the time like a desperate bid to win back its place in the sun.

And while this writer thought at the time that this was crazy, it worked. Enphase has returned to profitability for not one but two consecutive quarters, reporting a 7% operating margin during Q1 and a net income of $2.8 million.

The company was also able to bring in $17 million in cash, despite paying off its loan to Tennenbaum Capital Partners to the tune of $45 million – leaving the company with a tidy $78 million in cash.

Revenues are rising as well, with the $100 million that Enphase brought in during the quarter a 43% increase over a year ago, but also 9% better than the fourth quarter of 2018 – despite the fourth quarter being the biggest quarter for residential solar installations.

And while CEO Badri Kothandaraman was cagey about giving figures on the call, in a relatively flat U.S. residential market this means increased market share. We aren’t able to derive exact recent figures, but one indicator is that Enphase was winning back market share from SolarEdge on the EnergySage marketplace in the second half of 2018. Additionally the 306 MWdc of microinverters it shipped during Q1 represents a 50% higher volume than Q3 of last year, with shipments rising each quarter.

One factor in its market success may be Enphase’s partnership with SunPower, which through its installer network has gained the second-largest share of the U.S. residential solar market, behind only Sunrun.

Component shortages and tariffs

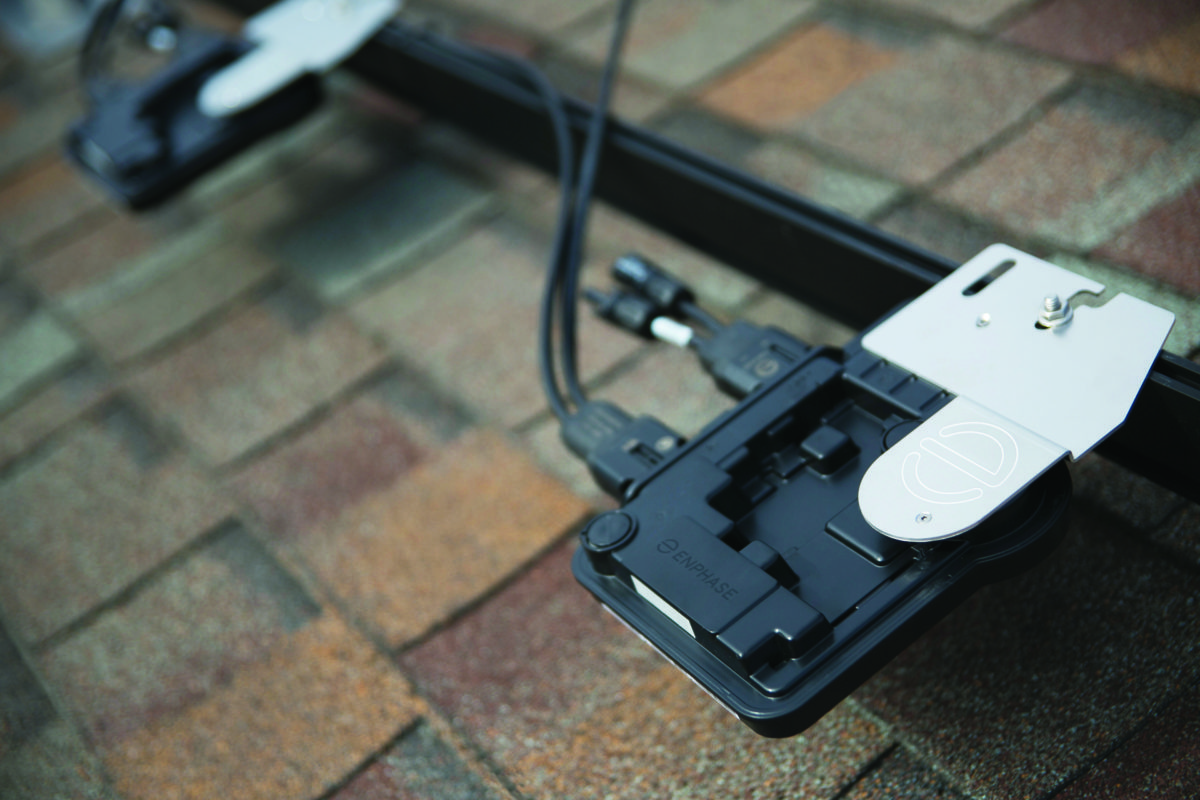

But while Enphase has turned its ship around both in terms of profitability and market share, the company still has persistent challenges. On the company’s results call, CEO Kothandaraman revealed that despite the unusual step of investing in internal capacity online to make certain components, component shortages were the biggest challenge Enphase faced during Q1.

The company is also taking steps to obtain components from more external suppliers, and Kothandaraman stated that Enphase has sIgned low-term contracts for high-voltage transistors, with some expected to come as early as this quarter, and more in the second half of the year.

Component shortages as a limiting factor are likely one reason that the company is sold out through the end of the second quarter. But it is not the only challenge that Enphase is facing. Enphase’s products are manufactured by Flex in China, and since September have faced 10% tariffs imposed by the Trump Administration under the far-ranging Section 301 case.

Enphase says that it has been sharing the costs of these tariffs with its customers, and this makes its rising market share and return to profitability all the more impressive. However this is soon to be alleviated, as Enphase expects to begin receiving product from a Flex factory in Mexico during this quarter, and transition its manufacturing to this factory.

We’ll see where the company goes from here, as customers are still waiting on the roll-out of the company’s IQ8 product, and during the call Kothandaram talked up the company’s Ensemble system, which integrates energy storage with microinverters and home energy management, for a much higher value-added offering.

There is also Europe, and while Kothandaram noted that component shortages limited European shipments, he clearly sees Europe as the next big growth opportunity for Enphase. And in this highly competitive space, Enphase appears to have its greatest struggles behind it.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

And don’t forget India… It’s coming.

With battery storage becoming more and more practical, AC at the panel will become less and less.

Battery storage is bulky and too expensive for most homeowners. The ROI isn’t there unless a grid tie in is not an option. The transition to battery storage will be long time coming, if ever for the majority of residential PVS users. Batteries require more maintenance expense than distributed Microinverters.

This may be true of many markets, but not California, which is still the largest market; for example Sunrun is reporting very high attachment rates of energy storage with the solar it finances/deploys in Southern California. This is likely due to the shift to time of use (TOU) rates.

As more regions move to TOU, more batteries will be deployed. And just like solar, the change will come faster than anyone predicted.

I have to pay for transmission coming and going, about $1100 per year. ROI in 11 years for two powerwalls.

Americans want Freedom. Solar + energy storage is what they want with utility for back up..

With a Solar Roof and electric vehicles and all electric appliances this is it, here we go.

A new solid state battery is on its way. John Goodenough the man that invented the first lithium battery now just reinvented a glass solid state battery.

No lithium won’t get hot, can’t catch on fire and is not heat sensitive.

It can hold two to four times greater charge capacity for the same space.

It will weigh in at less then half of lithium and is suppose to last four times longer. Unbelievable and he is now 96 yrs old, Wow.

Check him out on you tube John Goodenough glass battery.

Our world is going to start changing over to all electric power from the Sun. Musk wants this battery so bad and cant have it.