In early 2017, SUSI Partners launched what it called the “world’s first dedicated energy storage infrastructure fund”, and by the end of May 2018 the group had raised €252 million (US$283 million) from institutional investors in Germany, the Netherlands, Austria, Sweden and Switzerland. The fund seeks returns from 8-10% in ten years when accounting for degradation, with a minimum project size of 10 MWh. Overall, 75% of the projects the fund acquires must come with long-term capacity agreements.

As the latest, the dedicated Energy Storage Fund has acquired a 50% stake in a portfolio of behind-the-meter battery storage systems from Macquarie’s Green Investment Group. The lithium-ion projects are located in the Western LA basin in California and have a total capacity of 63MW/340MWh across 90 projects. All projects are “substantially contracted for 10 years” and are spread across multiple high-load commercial and industrial host sites.

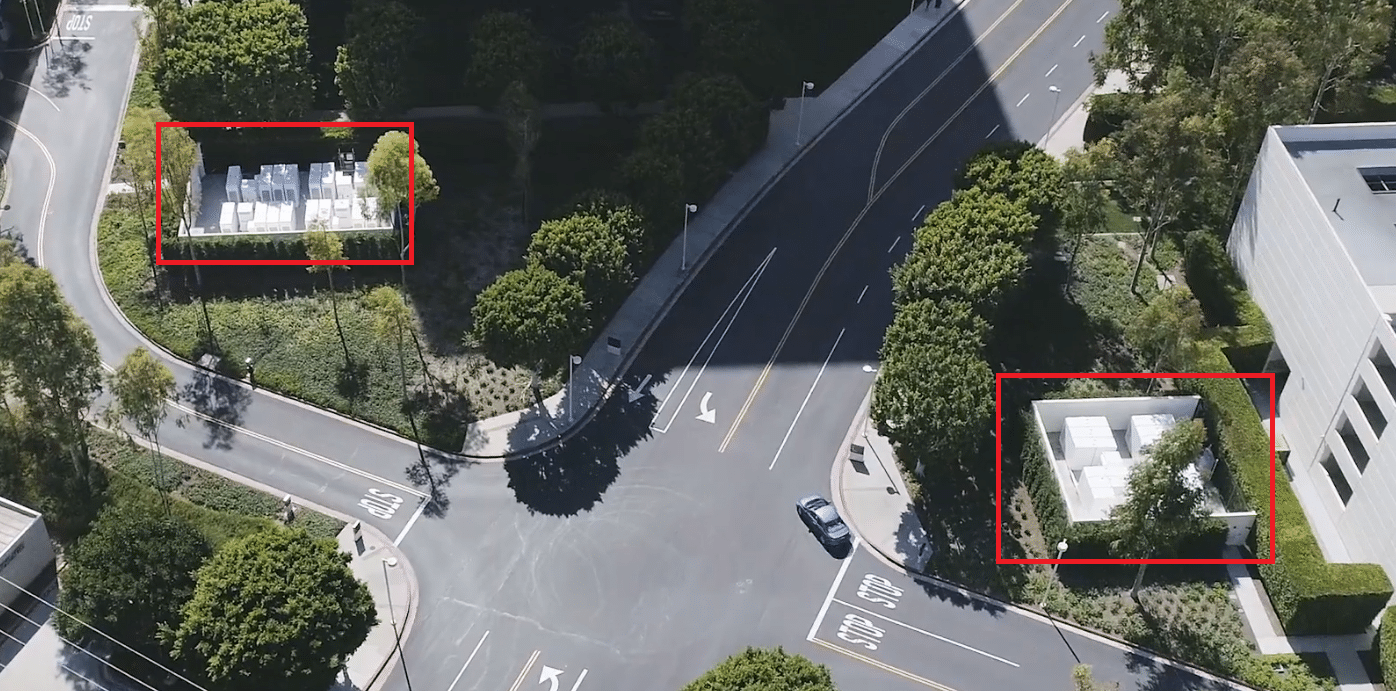

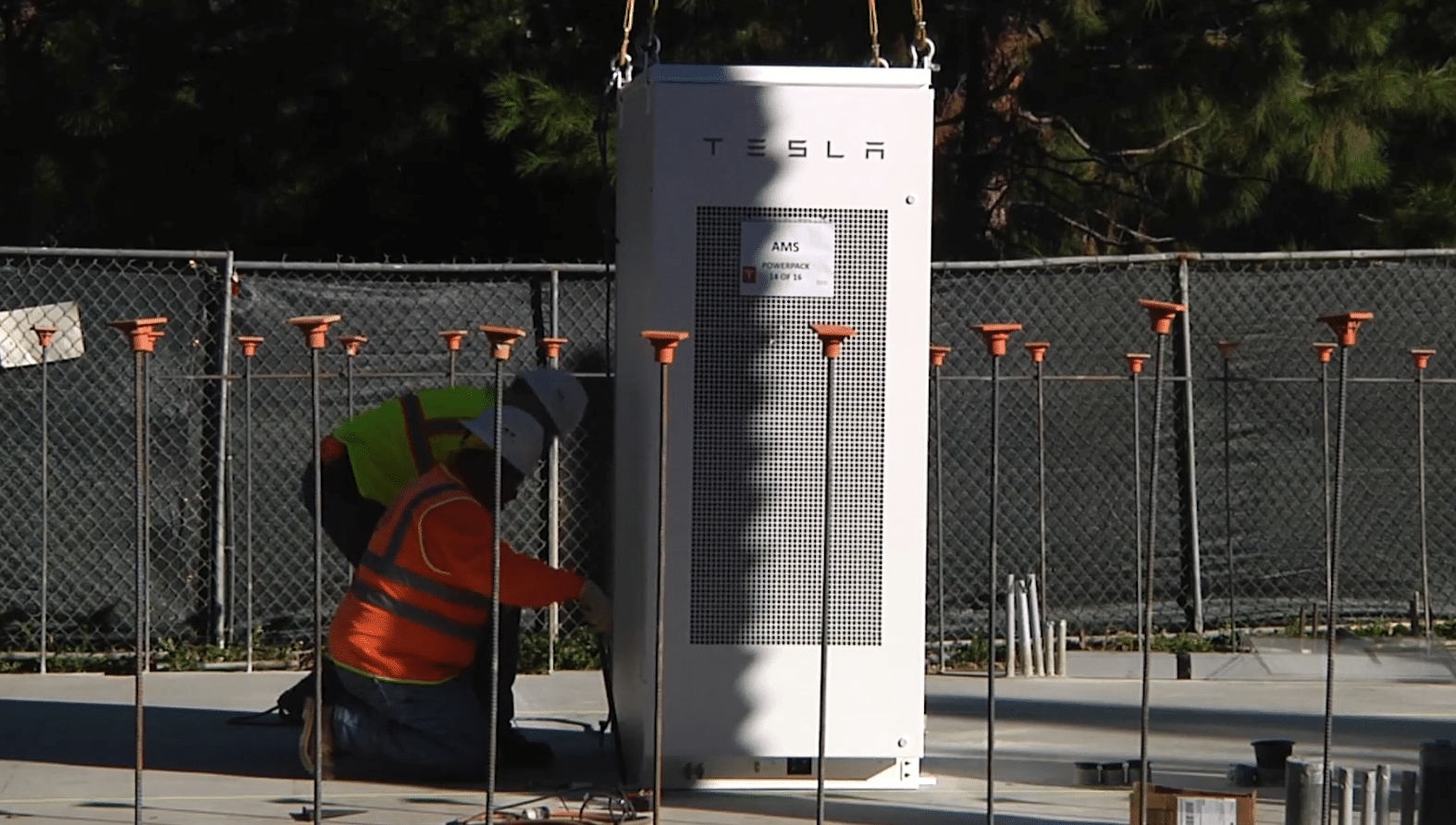

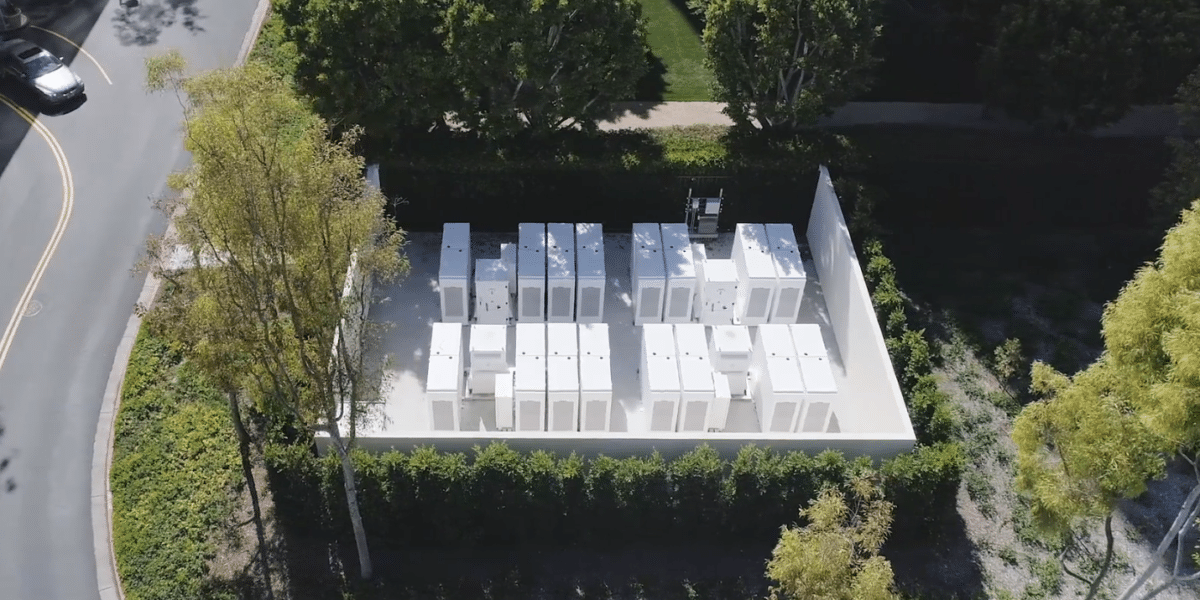

A part of the broader portfolio is what is being described as the world’s largest virtual power plant (VPP) using battery storage to control and reduce peak demand at large commercial and industrial customer facilities. The 11 MW / 60 MWh VPP became operational in 2018, and delivered more than 2 GWh of capacity services, saving greater than $1 million for the customers. A subcomponent of that VPP is a 21 building collection by the Irvine Company (pdf). The above image shows off two of the storage solutions.

No pricing on the investment was given.

At the time of the fund hitting €252 million in May 2018, SUSI noted it had already completed two investments, allocating approximately €90 million (US$101 million) of the fund. One of these was for lithium-ion systems, the other flywheels, and both projects had long-term visible cash flows.

Preceding this, in November 2017 SUSI signed a $120 million (US$90 million) facility with NRStor C&I to develop a 300 MW portfolio of behind the meter energy storage projects.

And in January of this year, the energy storage fund signed a €100 million (US$112 million) deal with ABB for development and execution of small-scale microgrid and power grid connected energy storage projects through qualified engineering, procurement and construction (EPC) partners.

Macquarie has been very busy in recent weeks, having received financing to build 97 MWh of the portfolio last week from a consortium of banks. As well, they bought a portfolio of 6 GW of solar + storage projects from Enel.

- AMS Energy Storage System at the Irvine Company Office Properties

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The statement “…seeks returns from 8-10% in ten years when accounting for degradation…” seems confusingly low as an investment goal. Should the statement read: “…seeks 8-10% annual returns over the expected 10 year life of the equipment…”? This might also assume setting aside funds to replace batteries, etc at end of life which would make the investment more attractive from a term standpoint. I have no idea what the underlying facts are but 8-10% over ten years is under 1% annual return.

Thanks for posts like these. Getting the attention of new investors is critical to making these things happen on a larger scale and faster as well.

“8-10% annual returns” means each year, that level return. Regarding degradation – the 10 MW number was coupled with a notation that 11.5 MW is often the size of systems installed, because the fund wanted that 10 MW number, and the 8-10% return projected in year ten.