2018 was a rough year for the U.S. solar industry. The Trump Administration’s Section 201 tariffs wreaked havoc on utility-scale solar project development, including during the period of uncertainty before tariff levels were set, leading to a mid-year slump.

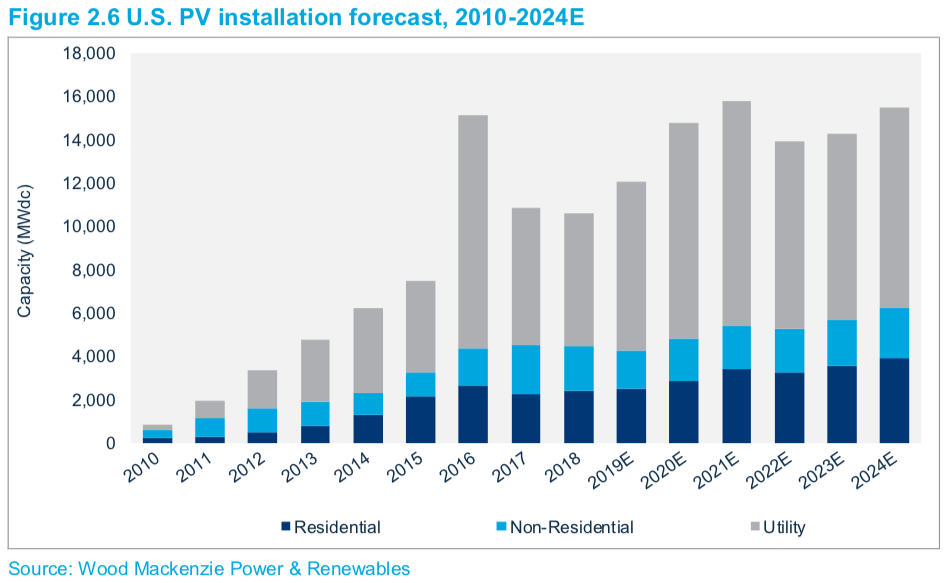

But solar is roaring back, as revealed in the figures in the latest U.S. Solar Market Insight report, a joint publication of Wood Mackenzie Power & Renewables and the Solar Energy Industries Association (SEIA). This report shows 4.2 GWdc of solar installed in Q4 2018 and 10.6 GWdc over the full year, only a 2% fall from 2017 levels.

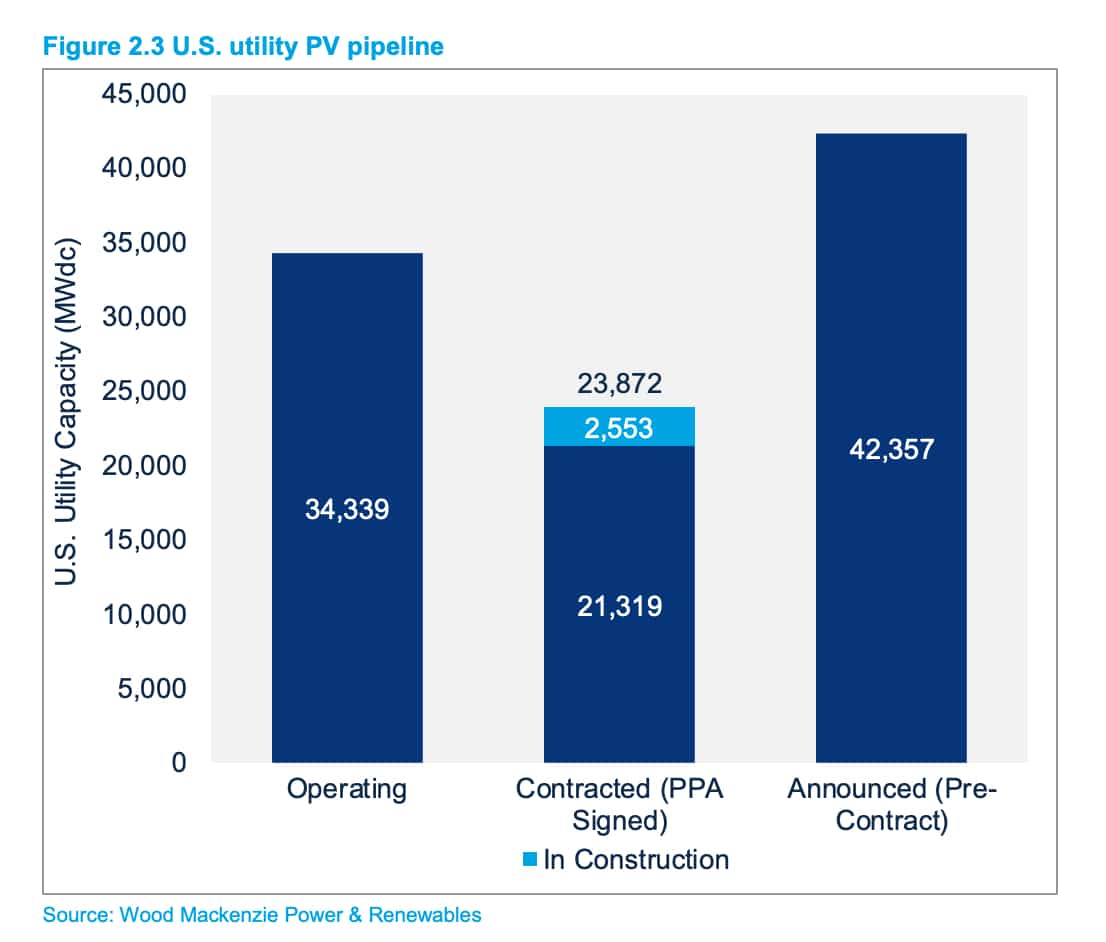

And the best is yet to come. The United States finished 2018 with nearly 24 GWdc of utility-scale projects under power contracts, a volume only ever exceeded three months ago. Furthermore, 2.6 GWdc of those contracted projects are already under construction.

When looking beyond projects which have contracts secured, Wood Mackenzie identified more than 42 GWdc of projects that have been announced and are in their respective interconnection queues nationally.

This is much less than pv magazine has found. In looking in the interconnection queues of six grid operators at year’s end, we reported 139 GWac of solar projects. Add in the 25 GWac of projects in the Southwest Power Pool queue, and it brings you to 164 GWac – and this doesn’t even count the Mountain West or the South, which do not have wholesale power markets overseen by third-party grid operators.

It is likely that Wood Mackenzie and SEIA are only looking at a subset of projects, and it is not clear what the criteria are. In either case not all of these projects will get built, given the highly speculative nature of project development, but what is clear is that solar project development activity has reached levels never seen before.

Residential rebound

Both utility-scale solar and Wood Mackenzie’s “non-residential” category – which includes commercial, industrial, government, non-profit and other distributed solar installations – declined in 2018 versus 2017 numbers. In some states the fall in the non-residential segment was driven by state policy changes, with the wait for the roll-out of the Solar Massachusetts Renewable Target (SMART) program leading to a 64% year-over-year decline in Massachusetts’ market.

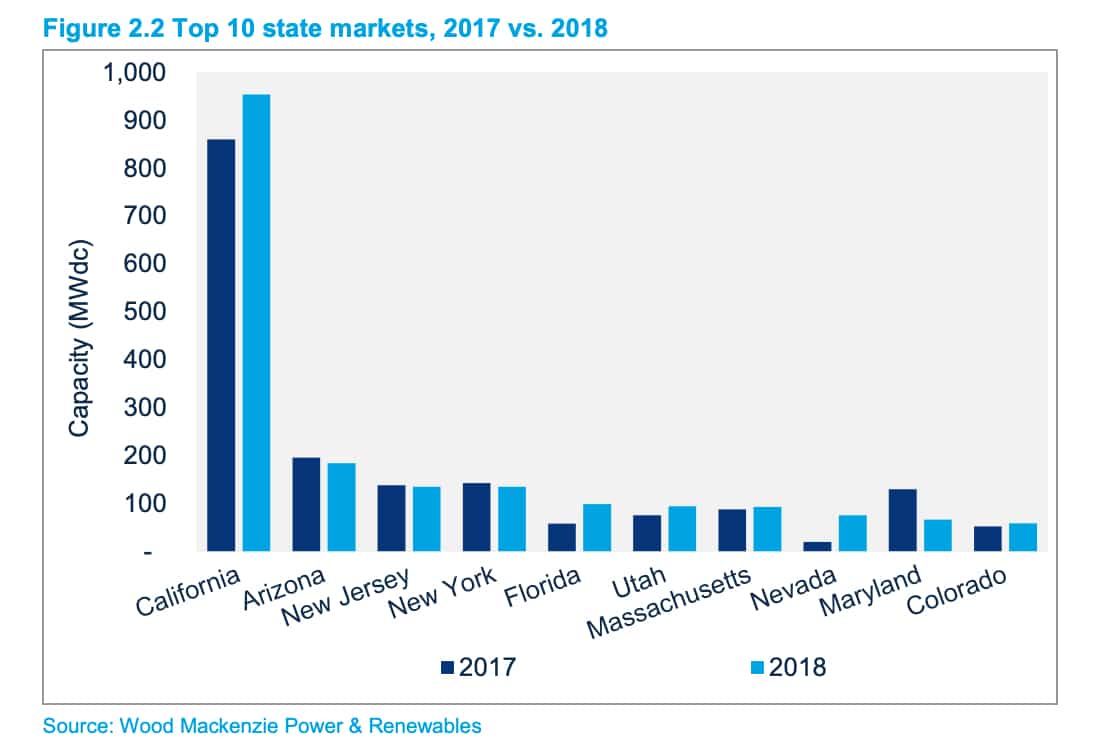

But while these two categories fell, residential installations bounced back, growing 7% over 2017 levels. The 2.4 GWdc of installations during the year did not bring residential solar back to 2016 levels, but did show resilience in this segment. While Arizona, New Jersey and New York were sluggish, California installations came back to nearly 1 GW, while Florida rose to the 5th-largest residential market.

And this recovery does not mean that it is easy sailing for residential solar installers, particularly as regards customer acquisition. “As major state markets continue to grow past early-adopter consumers, higher costs of customer acquisition will challenge the industry to innovate,” warns the report’s executive summary.

Gas dominates new capacity

For the first time since 2013, solar and wind were not the majority of new capacity installed over the course of the year. Solar Market Insight estimates that solar accounted for 29% of new U.S. electricity generating capacity additions in 2018, with wind adding another 16%.

Instead, 2018 was a record year for natural gas build-out. FERC’s Energy Infrastructure Update estimated that 20 GW of gas came online, and the U.S. Department of Energy’s Energy Information Agency (EIA) put that number at 19.3 GWac of new capacity, versus 4.7 GWac of gas retirements.

Many of these new gas plants were located on the East Coast, Midwest and South, with gas largely replacing an estimated 12.9 GWac of retiring coal plants during the year.

The Lone Star rises

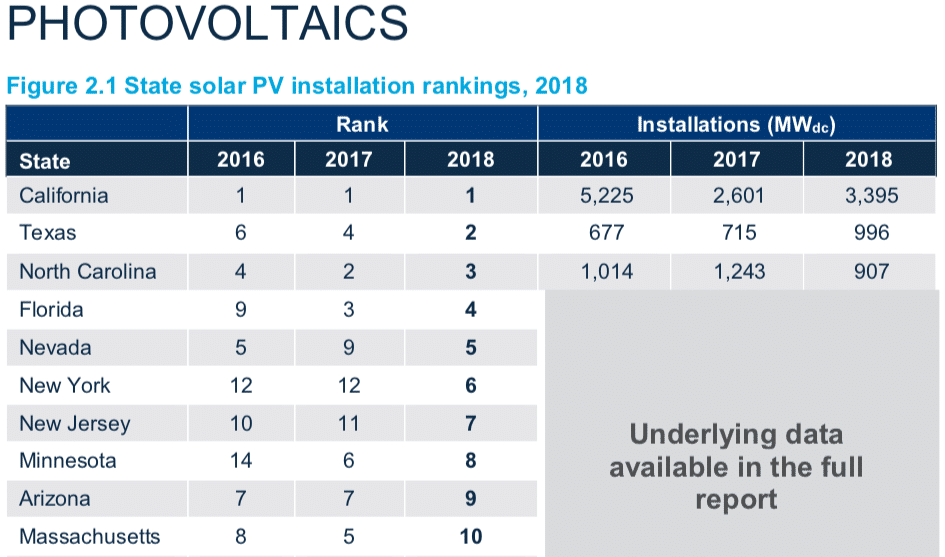

Finally, it’s time to look at one of our favorite features in every edition of this report: state installed capacity rankings. Outside of California, this year’s big winner was Texas. The Lone Star State vaulted from having the fourth-largest market in 2017 to second-place in 2018, adding nearly 1 GWdc. Texas passed North Carolina, which fell one spot to #3, with Florida, Nevada, New York, New Jersey, Minnesota, Arizona and Massachusetts rounding out the top-10.

We’re expecting a lot more from Texas in 2019, as the state’s grid operator has already approved more than 5 GW of projects, nearly all of which are expected to come online over the next three years.

Wood Mackenzie is optimistic about this period on the national scale, expecting that 2019 installations will come in around 12 GWdc, and that the market will rise to nearly 16 GW in 2021, during the most favorable portions of the declining Investment Tax Credit.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Actually, as of the ERCOT February report Texas has 6.163GW of solar with interconnection agreements – an increase of 1GW since the January report. Planned completion:

2019: 2026.40MW

2020: 3184.16MW

2021: 953.30MW

Both 2020 and 2021 grew by more than 500MW from the month earlier report.

FERC proposal pipeline data is showing similar growth for solar:

Dec 2018: current cap=35.82GW, add=70.904GW

Jan 2019: current cap=37.10GW, add=77.069GW

Over 6GW of new proposals in a month.

Michigan legislators, MPSC, and DTE utility have joined forces to change the net metering program.

My question, can someone please bullet point all the specifics of the changes for the net metering change…. such as they lowered the “dollar value” of the residual/extra kWh produced. Does this mean that one kilowatt hour of banked energy will only cover about one-half of a kilowatt when I need to draw it back for my use? Under the original net metering DTE credited excess with retail value.