Despite the best efforts of developers and contractors to secure modules before the Section 201 tariffs hit, Q3 appears to be the quarter where the inevitable impacts of the 30% tariff came home, as documented in Wood Mackenzie and Solar Energy Industries Association’s (SEIA) U.S. Solar Market Insight report.

The capacity of solar installed during this quarter fell 15% year-over-year to 1.7 GWdc. By far the biggest impact was on the utility-scale sector, where installations fell to 678 MW, as the only quarter that this market segment has seen less than 1 GW installed since 2015.

If all of this sounds bad, it is. But it also needs to be put in its proper context. Many projects were not cancelled, but merely pushed out to a later date. Many of these are being completed during the final three months of 2018, with the result that Wood Mackenzie and SEIA expect 3.5 GW of utility-scale installations in the fourth quarter – the highest volume since the massive fourth quarter of 2016.

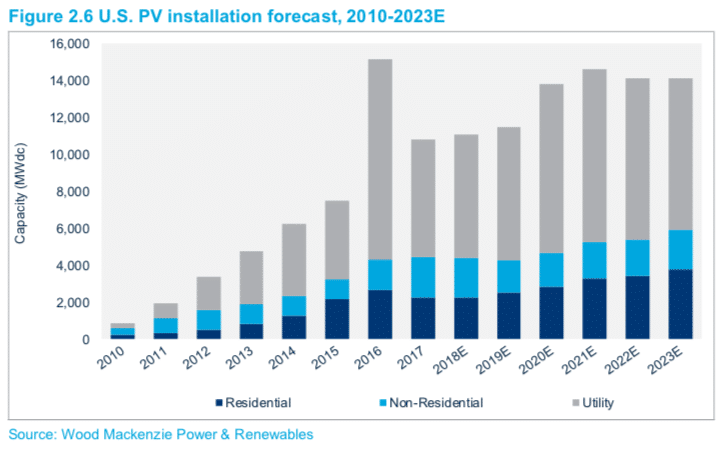

The result is that overall, the organizations forecast that 2018 will end with a market relatively flat in comparison to 2017, with 11.1 GW installed over the course of the year.

Residential stabilizes

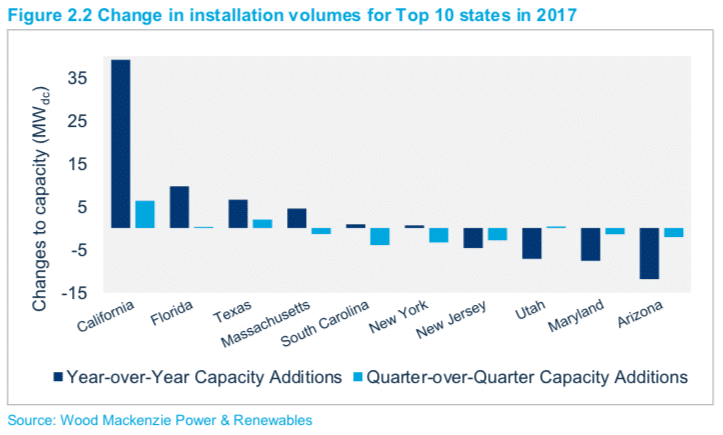

Beyond the twists and turns of the utility-scale sector, there was some good news for the residential solar market. The installed capacity of residential solar was up 11% year-over-year, with a major rebound in California’s solar market.

However, here there are signs of trouble as well. Of the 10 largest markets, six saw flat or declining on a year-over-year basis. In explaining this lack of progress, Wood Mackenzie cites the lingering effects of Tesla/SolarCity and Vivint pulling back from their previous aggressive deployment strategies.

As for the “non-residential” segment, this is less clear. This is in part because Wood Mackenzie and SEIA use this as an “other” category, lumping in commercial, industrial, government and non-profit installations with community solar. This Frankenstein segment is up 6% year-over-year, in part due to progress with community solar in Minnesota and Massachusetts.

Big pipelines

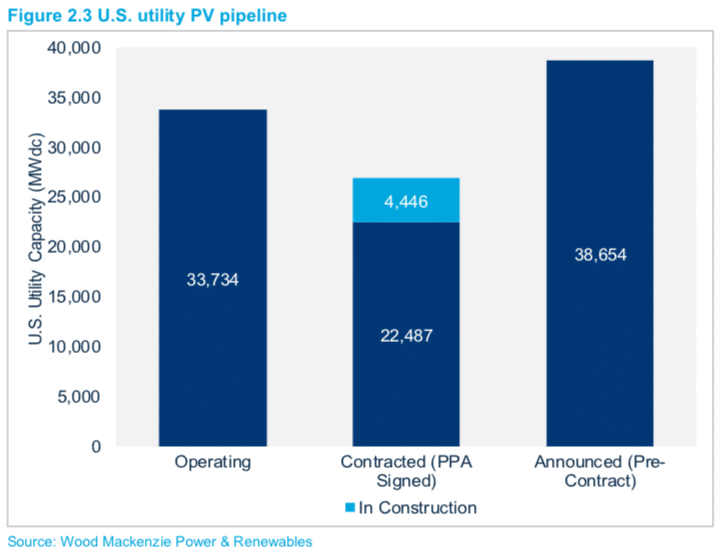

But looking at installations only tells a part of the story. Wood Mackenzie notes that contracts for 2.7 GWdc of utility-scale solar projects were signed during the third quarter, meaning that new contracts outpaced installation volumes four to one.

This in turn is pushing pipelines to get even larger. At the end of the quarter there was 4.4 GWdc of solar under construction, with another 22.5 GW holding power contacts. Adding to this is another 38.7 GW of projects which have been announced but do not yet have contracts – more than is currently online in the nation.

This in turn is pushing pipelines to get even larger. At the end of the quarter there was 4.4 GWdc of solar under construction, with another 22.5 GW holding power contacts. Adding to this is another 38.7 GW of projects which have been announced but do not yet have contracts – more than is currently online in the nation.

Despite this Wood Mackenzie is expecting only modest market growth in 2019, but for the market to pick up again in 2020 and 2021 as more projects come online.

Much of this has to do with the timing of the step-down of the Investment Tax Credit (ITC). In order to claim the 30% credit, projects must start construction during 2019 and must meet the requirements of continuous construction, but can delay going online until the end of 2023. Wood Mackenzie suggests that this approach is being pursued by many developers.

“After examining the risks of advanced procurement, many project developers now seem more open to anchoring projects in 2019 to claim the 30% ITC and bringing them online in 2021 or later,” notes the report’s executive summary.

Despite this phenomenon of advanced procurement, in comparing this to interconnection queue volumes and the general momentum of the market, pv magazine USA finds Wood Mackenzie to be somewhat conservative in its estimates of 2019 and 2020 deployments. But regardless of whether or not this turns out to be an accurate assessment, we are preparing for robust market growth, and the next five years are expected to be very good for the solar industry.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Power tools factories have been negatively impacted too.