2018 was a difficult year for the global solar industry. The imposition of no less than four sets of solar-related import tariffs in the United States, the “5/31” policy shift in China and duties in India made for one of the most challenging policy environments in recent memory.

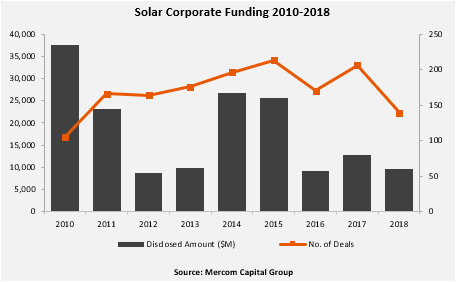

All of this was reflected in solar corporate funding, which fell 24% in 2018 to $9.7 billion, according to the latest report by Mercom Capital. But this fall was not the worst the industry has seen, and Mercom’s 2018 Solar Funding and M&A Report also gives insights into where this capital is going within the industry.

All of this was reflected in solar corporate funding, which fell 24% in 2018 to $9.7 billion, according to the latest report by Mercom Capital. But this fall was not the worst the industry has seen, and Mercom’s 2018 Solar Funding and M&A Report also gives insights into where this capital is going within the industry.

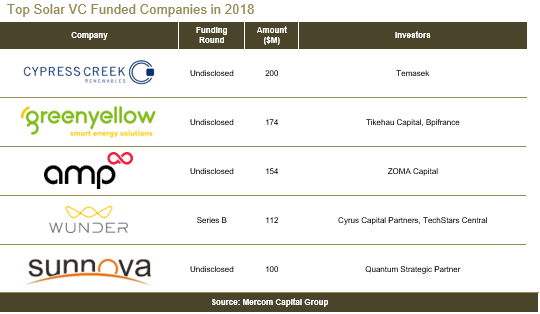

In short, the report documents the movement of capital downstream. Downstream companies walked away with 91% of the total venture capital funding in the industry, with only slivers for solar technology companies and service providers.

In fact the sums of money raised by individual downstream companies – $200 million for Cypress Creek, $174 million for GreenYellow and $154 million for Amp – are each much larger than the total funding for areas like thin film technology, which investors bet on heavily seven years ago, with most seeing their money vaporize.

Projects changing hands

Perhaps reflecting the challenges seen by the U.S. solar market in the wake of Section 201 and other tariffs, securitization stayed at a steady volume of $1.4 billion in 2018, and large-scale funding remained at $14 billion, with European investment banks showing themselves to be the biggest lenders during this period.

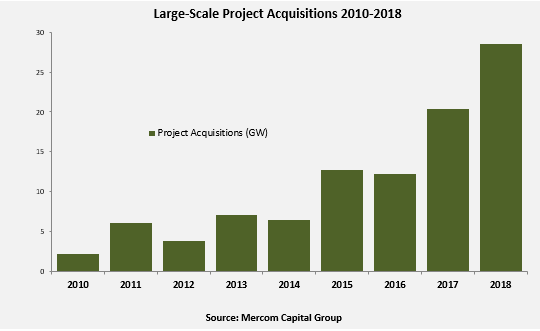

But the real activity was seen in project mergers and acquisitions. The numbers given by Mercom support what we at pv magazine USA have been reporting: that solar projects are becoming accepted even by more conservative investors such as pension funds and insurance companies as a good buy, and that the money chasing these projects exceeds the available projects for sale.

In fact 2018 was a record year for solar projects changing hands, with 82 projects totaling 29 GW being bought and sold.

“About 100 GW of large-scale projects have been acquired since 2010, a reflection of how far solar has come as an asset class,” notes Mercom Capital CEO Raj Prabhu. “Quality solar projects are now a mature, attractive investment opportunity around the world.”

The China exception

But this does not mean that no one is investing in upstream technology. Much of the global solar manufacturing capacity is in China, where investments are inherently less visible.

“So much is state-controlled,” Prabhu told pv magazine. “It is not transparent if it is coming from state-owned banks.”

Also, like everyone else Mercom Capital does not have insight into investments made in private companies that are not disclosed, and Mercom’s report only tracks funding from external sources – not solar companies’ internal spending.

This is notable, given that despite a general trend of low investment in R&D by Chinese PV makers, LONGi is investing more into research and development, both as a portion of its income and in raw dollar terms, than any Western company. This included more than $100 million invested in R&D in the first six months of 2018.

Furthermore, the money for LONGi’s massive expansion of ingot and wafer factories – with plans for 45 GW of wafer capacity by the end of 2020 – is coming from somewhere. The same can be said to a lesser degree of the plans by mono crystalline silicon wafer maker Zhonghuan, as well as the investments in a massive joint venture factory between Zhonghuan, SunPower and Dongfang.

So more than the investment moving entirely downstream, we are really talking about is two distinct environments for solar investment – China, and the rest of the world.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.