Solar power is often referred to as a bespoke investment – solar plants are built to fit into their respective places on the grid, with data collection varying by manufacturer and project, often depending on components the engineer picked. These days, installations are becoming more consistent in their data collection as the industry matures, hardware lifetimes and production projections show higher levels of reliability, and those buying the projects become more sophisticated.

Per a report by Michelle Davis, senior analyst of US distributed solar at Wood Mackenzie Renewables & Power, the investment landscape is evolving:

Davis’ report, US Solar Project Finance and M&A Landscape 2018, aims to communicate “the latest trends impacting tax equity investors, lenders and sponsors.”

The market for tax equity, even in light of multiple tax reforms, has increased significantly since 2016. Additionally, with more competition, investors are widening the types of projects they will invest in. Specifically noted was that whereas the largest players still only focus on $25 million and larger, small projects are now being considered and there are plenty going far below that number.

As has been noted many times here on pv magazine, there is a greater demand for projects than there are projects available to be purchased. One manner that this has shown is that even while the Federal Fund Rate has increased four times over the last year, project financing interest rates have held steady. Dividend Finance has lowered their interest rates over the past year.

Along with this are evolving deal structures. With P50 and P90 ratings showing high confidence in success of solar power construction, and in electricity generation projections, we’re seeing downward pressure on debt service coverage ratios. And with less cash needed to be put down, projects sponsors have more capital available to spread among development.

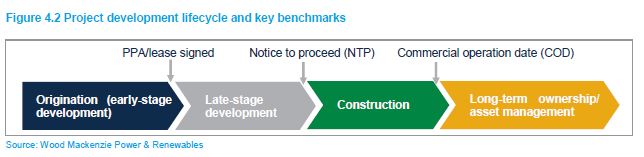

When utility scale projects holding long term power purchase agreements with investment-grade off takers are put out to the market, buyers are now moving forward in the construction process to gain access. Whereas the most conservative buyers were looking to buy at the Commercial Operation Date, many advanced buyers were choosing to get involved at Notice to Proceed. Now some are reporting purchasing projects months before Notice to Proceed, in a much more risky position in the development chain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.