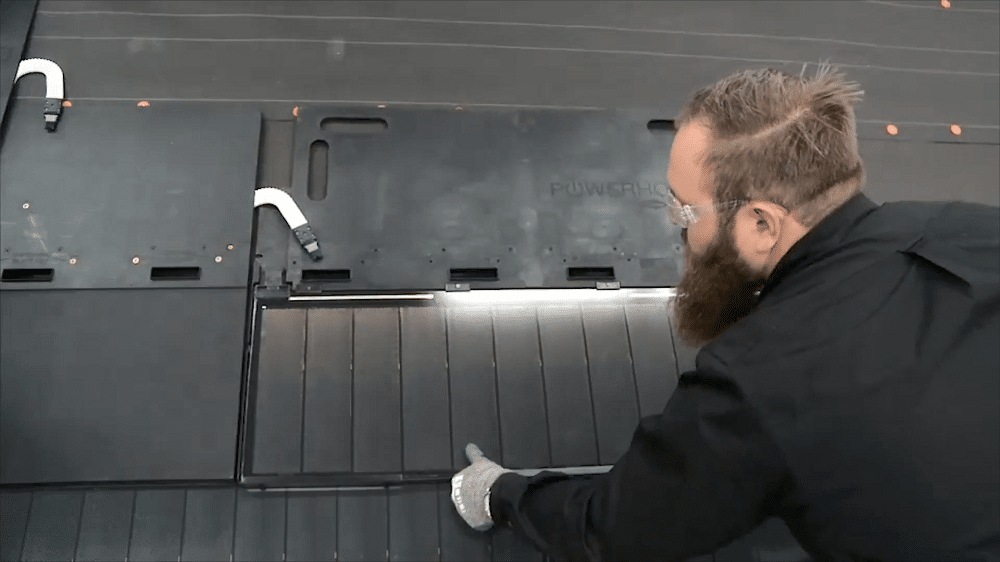

A few months ago, we sang a song to POWERHOUSE – based on the draft specification page of a 17% efficient solar shingle.

At that time, the reminder was that even though we’d seen two prior versions of this seemingly common-sense product not make a market dent, we were ready to make a mistake with it again. Because we’re the hopeful type – and now, it’s being suggested that we’re going to see the first units move to customers in December, only a few weeks away.

On Monday, pv magazine spent time on the phone with members of the POWERHOUSE team at RGS Energy, and last night the company offered up quarterly results. All of this followed the big news of the company receiving Notice of Completion of Production Testing & Authorization from UL for the POWERHOUSE shingle.

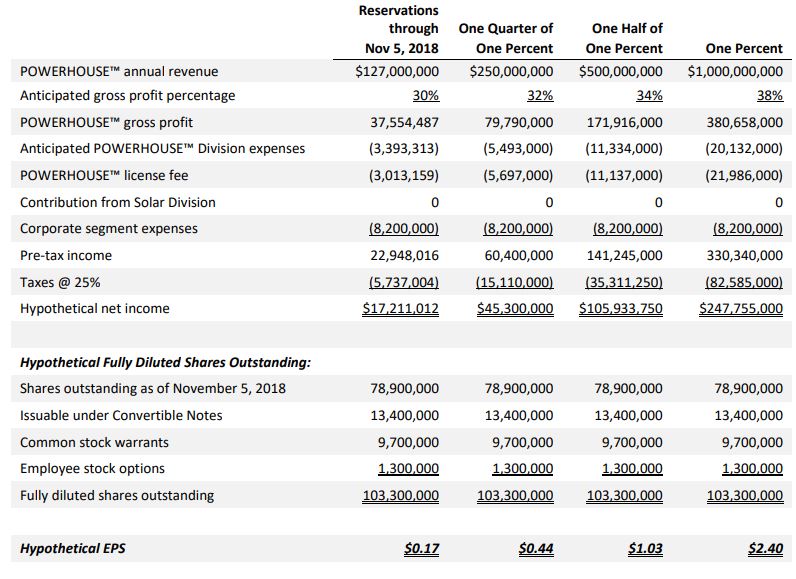

RGS Energy has published “hypothetical earnings” of the POWERHOUSE product. The first row represents “written reservations” through November 5, rows two through four represent aspirations as a percentage of all roof replacements annually in the USA (~5 million):

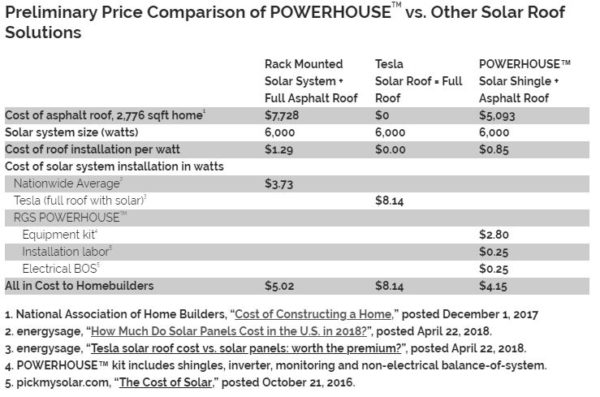

RGS Energy projects revenue from an average POWERHOUSE kit sold to a roofer – 6.3 kW worth – including shingles, inverter, monitoring, non-electrical balance of system components and freight charges to be $19,000. The company expects a 30% gross profit margin on the product, with the overall department making $17 million on $127 million worth of sales. If these $127 million in reservations turn into orders, and the average cost per watt of the kit sticks at $2.80 per watt, then current order queue is approximately 45 MW-DC worth of product, just over 7,100 average sized kits worth.

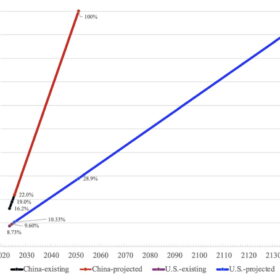

Foremost, there is the market in California to be considered; the state’s new mandate projects that 270 MW of additional solar will be required to keep up with new house construction in the state. Every year. Forever.

We know the world wants building-integrated solar shingle-type products. Some projections suggests Tesla’s Solar Gigafactory – that hasn’t even fully figured out how to make these things yet – probably has a year or two backorder once it starts running. pv magazine itself spoke with manufacturers on the floor at Solar Power International who said specifically that the buzz around the Solar Roof was absolutely driving customer demand.

The earnings call was short and sweet. RGS Energy reaffirmed that the $10 million investment the company got back in April is still enough for them to bring the product to market, and they won’t need further capital at this stage. Chunks of the call were related to stock valuation, how the company hoped for selling pressure to ease, and that projections were strong.

Market questions were addressed as well. The company noted that it had not yet taken cash payments for their product yet as it hadn’t yet been approved, with a jab made at others taking money for a product that doesn’t yet exist. This pv magazine author happily put down $1,000 for a non-existent Tesla Model 3 in late 2016.

The company noted that no home building companies had yet signed any deals, and suspected it would be a longer timeframe (Q2 or more) before those deals came, as the project sales cycle is inherently longer when building out a housing development versus roofers redoing one of the five million re roofs per year in the USA.

We’ve got to be honest with ourselves about this product’s chances. First off, all of those who have stepped to the plate against silicon 60 and 72-cell modules have gone home disappointed – and 2018’s continued aggressive pricing decreases should give anyone pause as they’re warming up. Besides, making pv modules as your business can be complex and difficult for even the largest, most successful companies, with the latest being Canadian Solar retracting a go private deal, noting the inability to secure the funding for the transaction.

So what’s a 40 year old solar installation company out of Denver got against the manufacturing might of China?

For one, the product’s solar cells can be upgraded in the future.

Secondly, they are sourcing the plastic components of the products – the large majority of cost and size – from US companies. Revere Plastic Systems has agreed to dedicate resources required to support up to $138 million in annual Powerhouse orders, so it looks like the company – for now – has an inside track to selling out 2019. That makes this a mostly made in America product.

Third, the company is importing solar cells from Risen Energy, one of the largest solar cell manufacturers globally.

Fourth – those $127 million in orders come from 88 unique roofing companies.

And fifth is that we’ve got demand, and we’re about to build a real product.

For now though, we watch.

Disclosure: The author owns shares in RGS Energy

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Will RGSE also be selling PowerHouse to the DIYer?

A company representative told me they weren’t planning on selling it to DIYers, and that anyone who purchased had to go through company training.

Thanks, that is pretty much what I figured since the installation is probably a little tricky.

Great article, easy reading for us solar novices. Looking forward to seeing if these tiles perform as advertised.

Thanks Randy

When updated spec pages come out I’ll let you know.

Are any of those 88 roofing companies in the San Francisco Bay Area? I am going to replace my roof in the next 5 years and want to look into solar shingles. Thanks