The Solar Energy Industries Association (SEIA) is pushing for two legal changes: fine tuning and automating the solar power permitting process (via SolarApp – PDF), and getting a hard definition from the IRS as to whether business can get apply toe 30% ITC to energy storage retrofits (via a letter sent to the Treasury Department – PDF).

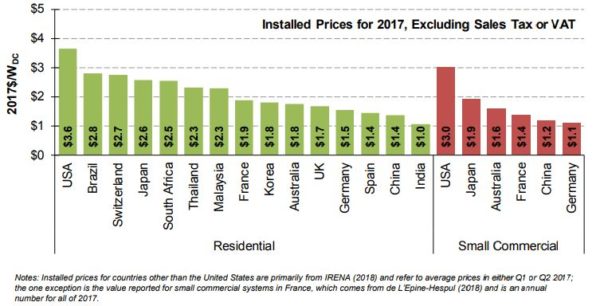

The first, refining the soft costs of the solar installation industry has long been talked about. Per a recent report by Lawrence Berkeley National Lab, the United States has some of the most expensive residential solar power in the world.

This is often noted as being because of the permitting process and other associated ‘soft costs’. In pv magazine’s analysis of potential benefits from California’s solar home mandate there’s significant financial benefit shown from efficient permitting.

SEIA and the Solar Foundation are now proposing Solar Automated Permit Processing (SolarAPP) (PDF) to work these prices down. Specifically, the program proposes:

Standardized certification of installers and equipment, standardized online permitting and interconnection tools, and local implementation of instantaneous permitting for eligible installers on qualifying (i.e., non-complex) solar projects.

It’s suggested that $1 per watt in savings is readily available.

Concurrently, in a letter written (PDF) to Steven T. Mnuchin, Secretary of the Treasury, US Senators Tim Scott (R-SC) and Michael Bennet (D-CO) have requested “clarification on whether energy storage technologies qualify for the investment tax credit (ITC) when added to an existing ITC-eligible technology.”

There is almost 30 GW worth of utility scale solar power within this classification, and probably 10 GW of commercial capacity eligible. And we have already seen 10 MW / 42 MWh worth of movement on the assumption of approval.

A March ruling by the IRS stated that an energy storage retrofit to a residential solar power install was eligible for the 30% residential solar tax credit. At the time, Gregory F. Jenner reminded pv magazine,

Although many of the principles articulated by the IRS could translate to the energy ITC, it also is possible that the IRS would reach a different answer. It is important to note that the IRS is presently reviewing their regulations concerning storage and will likely not issue rulings under the energy ITC until that review is complete.

The residential retrofit approval is noted by the Senators in their letter as a logic for approval. The letter also notes that the IRS has already confirmed the eligibility of energy storage at the time of a solar power installation. Jenner agrees with the logic put forth by SEIA and the Senators.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.