Tesla has released its Q2 2018 Financial Results (PDF), which showed a company that is doing much more than just making EVs.

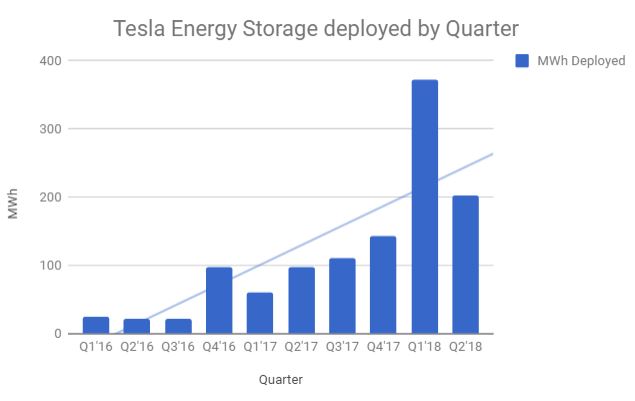

During the call Elon Musk said that in the long term he expects the company’s energy business to catch up with its auto business in size, with Chief Technology Officer and co-Founder Jamie Straubel noting that the company expects 300-400% of “mad growth” (Musk’s description of it) in energy storage in 2019. The huge PG&E project was stated as being 1 GWh, confirming Electrek’s Fred Lambert, meaning that this is a 6-hour duration battery (the first big utility 6-hour battery?).

And as we all expected due to the fact that this energy storage and solar power company also sells electric cars, the Model 3 ramp up to 5,000 units took away from energy storage resources.

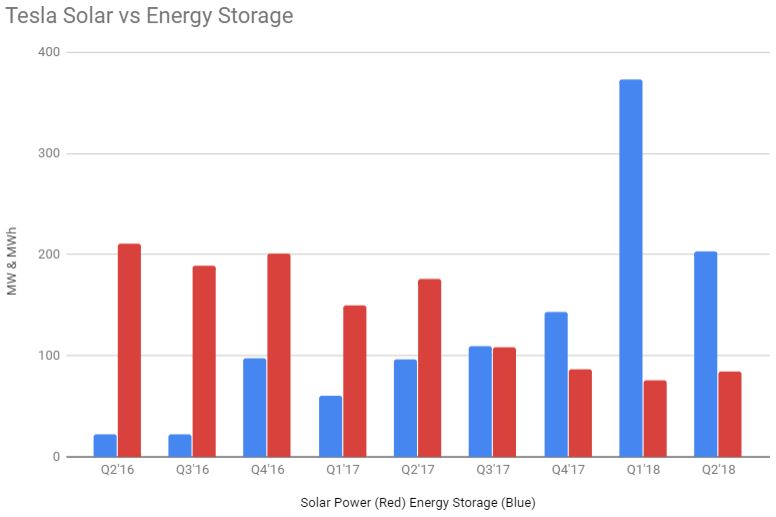

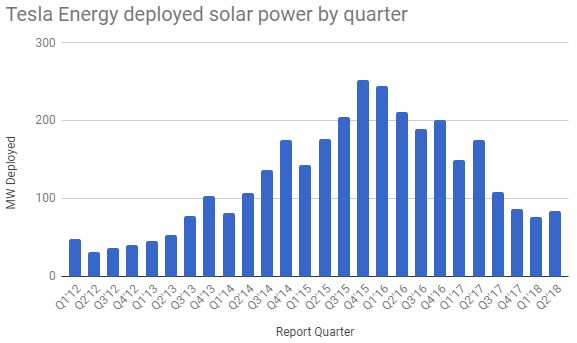

As buyers very well know, Tesla energy products are currently in greater demand than Tesla can supply. Energy storage is showing an aggressive upwards curve – but it’s sold out, and while solar power might have hit his bottom – around 80 MW the last three quarters – Tesla is predicting a climb in mid-2019 and later. Though there is light, as Musk noted that ‘several hundred’ Solar Roofs have been deployed, are being installed or scheduled for install, and international expansion was underway.

Solar Power

It is probable that the Solar Roof will not make a positive contribution to its Energy Generation and Storage division revenues until Q2 of 2019, at the earliest.

We plan to ramp production more toward the end of 2018 and are working hard to simplify the production and installation process before deploying significant capital into factory automation.

If the ‘significant capital deployment’ will be to finalize the order to purchase hardware to manufacture solar panels, then there will be a lag between that purchase and the machine deployment, then refinement of the manufacturing line, production of the solar shingles en masse, and then of course moving from factory to installed.

The slow movement on the Solar Roof was attributed to validating the 50 year potential lifetime of the product.

It takes a while to confirm that the Solar Roof is going to last for 30 years and all the details work out, and we’re working with first responders to make sure it’s safe in the event of a fire and that kind of thing. So it’s quite a long validation program for a roof which has got to last for 30, 40, 50 years

The company installed 84 MW of solar power in the quarter, an 11% increase over Q1 2018. This value is down 52% from Q2 2017’s value of 176 MW, and for the past four quarters – 356 MW deployed – versus the prior four quarters – 716 MW. Tesla projected that “solar deployments should remain stable in the second half of this year”. If the pace of the past three months holds through the end of 2018, Tesla will end the year with 329 MW of solar power deployed, their lowest four quarter total since 2014.

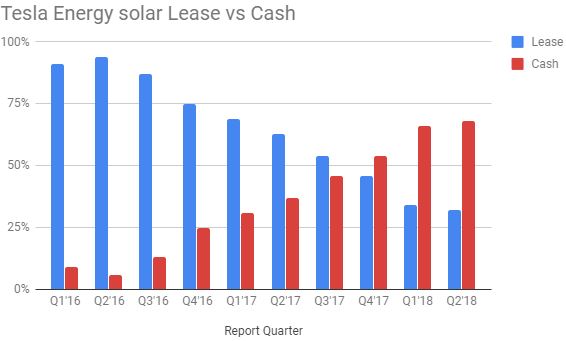

The company has continued its shift from solar leases toward solar cash purchases. In the past quarter, 68% of solar sales were cash purchases – 2% higher than last quarter, flipping Q2 2017’s 63% of solar installations being leases. Tesla noted that the profitability of its Energy Generation and Storage division increased because of a tilt toward solar in the overall ratio.

The company noted that over 80 Tesla stores in the USA now offer solar+storage products, and that this offering will expand overseas in Q3 2018.

Energy Storage

Tesla’s energy storage deployments are at a different point in their storyline. The company broke through 1 GWh of cumulative deployments in the early part of the quarter. It finished the quarter with 203 MW deployed, and a cumulative total of 1,153 MWh. The Q2 total was 106% greater than Q2’17, but down from the 373 MWh total of Q1’18. Tesla noted that the uneven pace of deployment of large projects resulted in the fluctuation in revenue from quarter to quarter, particularly as regards its 129 MWh Australian project.

pv magazine has reported on other large ‘clumpy’ Tesla energy storage deployments.

It was noted that energy storage products have taken a secondary position to Tesla’s all important Model 3 ramp as a Powerwall cell line was was partially shut down to feed the voracious demand for the car.

We’re kind of cell starved for Powerwall right now, so we actually had to artificially limit the number of Powerwalls because we don’t have enough cells.

This is especially important as the energy storage market has dealt with slow moving product. Even the very successful Green Mountain Power project, which helped save $500,000 in demand charges for the utility’s customers, is waiting on upwards near 1,500 Powerwalls to complete deployment.

And not only did Tesla complete the quarter with over 1 GWh of cumulative deployments, it also expects to deployed its next 1 GWh in 9 to 12 months. During the first half of the year, the company has deployed 450% more energy storage than last year – and it is sticking to its 300% growth in 2018 over 2017, suggesting at least 650 MWh for Q3+Q4 to come.

Considering Straubel’s 300-400% 2019 growth projection, Tesla could deliver between 3.6-4.8 GWh of storage worth greater than $10 billion.

Finances

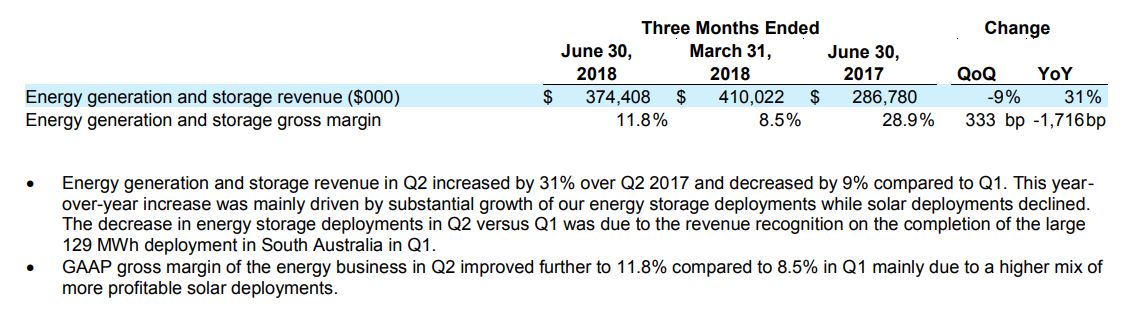

Energy Generation and Storage revenue topped $374 million in the quarter, and this represented only around 10% of Tesla’s overall revenue, a bump down from the all time high of 13% of company revenue in Q1. During the first half of the year, total revenue was $784 million – up 57% from the first half of 2017.

The Energy Generation and Storage division has held a 10-13% share of overall company revenues since Q2’17.

Profit margins in the department are tight, showing an increase from 8.5% in Q1 to 11.8% in Q2. This is mostly due to energy storage products having tighter margins relative to solar power sales, and with the dip in energy storage recognized in the quarter, the ratio toward more profitable solar pumped the number. Expect this margin value to go down through the end of the year as energy storage continues its aggressive ramp, while solar power deployments stay flat. And then costs will go up with the cash deployment for the Buffalo Gigafactory’s automation build out.

Energy storage is hot, solar power is going through a teething phase, and the evolution is aggressive.

Correction: This article was corrected on August 8 at 2:22 PM EST. An earlier version of the headline for this stated that Tesla had installed “several hundred” solar roofs, however subsequent coverage by Reuters has revealed that many of these roofs were either in the process of construction or only in the planning stage. As such, we have removed this wording from the headline.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.