The American Council on Renewable Energy (ACORE) has launched a new campaign with the goal of driving $1 trillion worth of private sector investment in renewable energy and grid technologies by 2030.

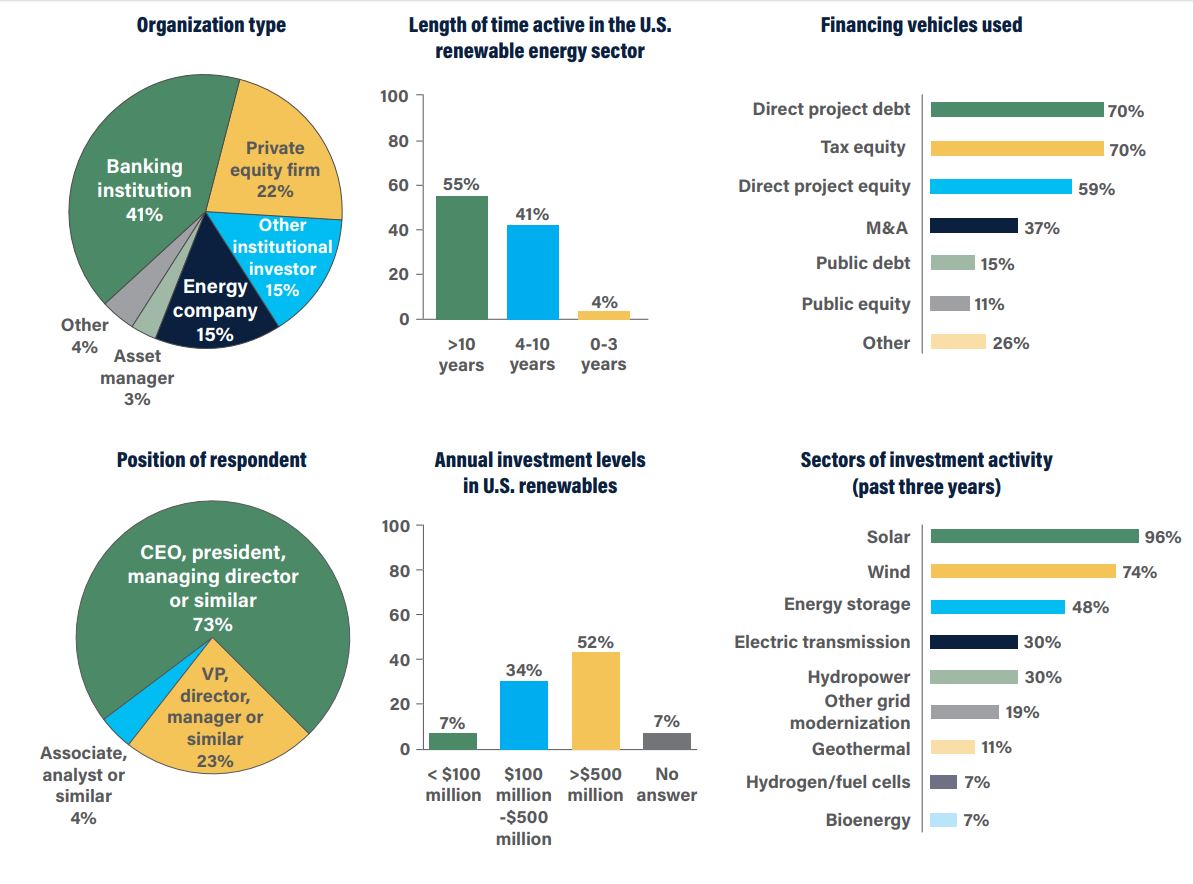

In a report released by the group, The Future of US Renewable Energy Invement; A Survey of Leading Financial Institutions, we see a broad look at the resources deployed – wind, solar, energy storage, grid upgrades, EVs, etc – and how they’ve been financed – project debt, tax equity, direct project equity, etc.

Along with that feedback, these same large investors – 52% of whom had investmented more than $500 million in renewables – gave their opinions on specific challenges to further growth, and policy structure that could help going forward. And its here that ACORE is building their guide to the next decade of $1 trillion of renewable investment in the US.

The main challenges that these investment groups see come from the sunset of the Production Tax Credit and Investment Tax Credit. There is a strong truth to this – as we saw the 2017 solar power installation slump after the record setting 2016 ITC fueled buildout, and we’re already seeing utilities state that they’re pulling new solar and wind installations forward to take advantage of these tax benefits.

Another very eminent challenge noted by the respondents are tariffs and trade disputes. Section 201 and a new round of potential tariffs could have real costs.

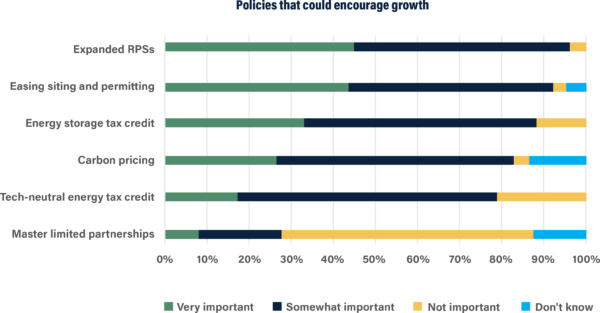

The groups also gave their opinions on what they thought could keep up the growth – and this is where ACORE is focusing. State-level renewable portfolio standards (RPS) were defined as key growth policies, with 95% of respondents denoting these policies as ‘important’ or ‘very important.’ 88% of these respondents saw energy storage as a driver of growth and that something akin to the Federal ITC would drive significant volume. Residential solar power customers have also stated this, with 74% of them being interested in storage.

And while it continues to be promoted by certain environmental groups, a carbon tax was lower on the list of priorities for respondents. Along with this, at ACORE’s Renewable Energy Finance Forum – Wall Street conference today panelists including Invenergy LLC Founder and CEO Michael Polsky noted the dangers with carbon taxes, particularly if set too low, as a misleading solution for decarbonization.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.