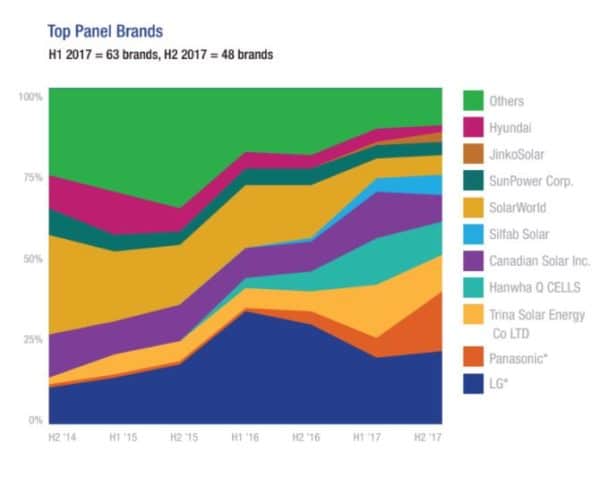

EnergySage says that in 2017, 74% of customers shopping for solar on their online solar marketplace were considering energy storage. The company’s Solar Marketplace Intel Report also offers evidence that customers will pay the extra costs for storage – as residential solar panel purchases have moved upmarket toward SunPower, LG, Panasonic and other premium brands. When extrapolated – these interests represent a 1-2TWh, or larger, market opportunity.

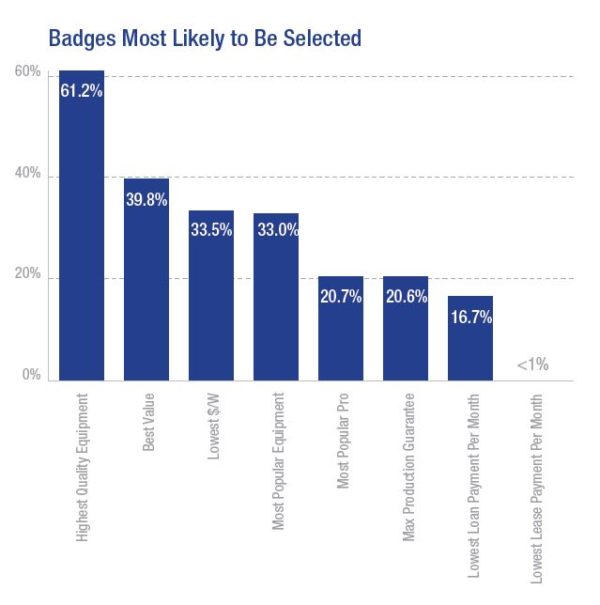

The report published a new metric, Badges – “an additional layer of information that educate shoppers about the various attributes of one quote versus another.” High quality equipment stood out by far, and only one of the top seven items – lowest $/W – suggested shoppers were focused on bargains.

The report also showed that system prices continued fall on a price per watt basis. However, total system size increased – which actually meant a net increase in total system cost (8kW at $3.36/W at the end 2016, versus 8.7kW at $3.13 at end of 2017).

Installers in Florida, Arizona and Maryland brought average costs below $3.00/W on the EnergySage marketplace, and there were some counties where average costs fell as low as $2.00/W.

That overall prices are falling while equipment from premium players like LG and Panasonic are making inroads in the solar panel market is likely a testament to the ability of those two companies to deliver higher efficiencies at respectable prices.

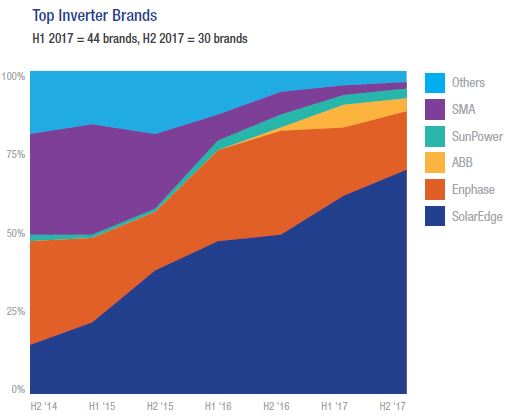

Another chart shows that SolarEdge has become the dominant brand in residential installations. That the size and complexity – think multiple surfaces, at multiple angles facing multiple directions – of installations has increased may be directly due to module-level electronics from SolarEdge and Enphase.

Customers will pay a small premium for the piece of mind of panel level data, and installers are selling as many watts per roof as possible: hardware nirvana.

This report gives some insight into potential broader market opportunities.

Sometime in less than a year the United States is going to cross 2 million installed residential solar power systems, and one day a full third of the roughly 120 million homes in the United States may have a solar power system.

If 74% of 40 million homes install 30 to 60 kWh of energy storage – one to two days worth of home electricity – we could reach between 880-1,776 GWh of electricity storage. Per recent research, that would be 16-33% of the energy storage needed to allow for 80% solar+wind running the whole of the United States. A similar number of electric cars would put us at 90% of the requirement – this is before we consider utility or commercial installations of energy storage.

With the 30% ITC still in place, and the IRS recently ruling that a retrofitted energy storage system is able to make use of the tax benefits, one might also expect that the 2 million home PV systems and multiple tens of GW of commercial & industrial, and utility scale solar installations to have a significant market potential.

In comments to pv magazine, partners Gregory F. Jenner and Morten A. Lund, from Stoel Rivers LLP, expressed that the finance side of the equation might make things a bit more complex.

Jenner in reference to assumptions on the IRS’ interpretations of the solar credit versus business ITC:

We believe that the recent IRS ruling is encouraging but that caution is called for. It is not clear that the IRS would reach the same conclusion for the energy investment tax credit available to business. The recently-issued ruling applies specifically to the residential solar credit, which is different than the energy ITC. Although many of the principles articulated by the IRS could translate to the energy ITC, it also is possible that the IRS would reach a different answer. It is important to note that the IRS is presently reviewing their regulations concerning storage and will likely not issue rulings under the energy ITC until that review is complete.

Lund had to say of the complexity of restructuring already financed projects:

Residential solar is financed on strictly uniform documentation and structure (these are volume transactions), and banks generally will not allow any modification of the systems. Other than physical risk concerns, the incremental transaction cost would be substantial. A solar PPA is a relatively simple document – a solar+storage PPA is potentially very complex (in drafting and implementation). It is not as simple as just adding “battery” to the project description. Operation and maintenance also changes, and there would be additional new parties to an already complex financing, … It might happen, but I highly doubt it. Residential solar+storage will be financed as it is now—as a single up-front unit.

And while it is tough to project actual energy storage installations from a survey, as signaling an interest doesn’t equate to spending hard earned money, EnergySage customers have paid for solar power, and they’re showing a tendency toward buying premium equipment and high quality hardware. Additionally, utility scale developers are absolutely rushing the energy storage market. All of this indicates a very strong marketplace for selling large quantities of energy storage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.