Over the past year, pv magazine staff has consulted with dozens of market participants who have spoken of projects being put on hold or abandoned due to at first the threat and later the reality of the 30% Section 201 tariffs implemented in February.

And while analysts still expect impacts on large-scale solar from the import duties, these have not yet shown in national solar market figures issued by GTM Research and the Solar Energy Industries Association (SEIA). The latest version of the two organizations’ U.S. Solar Market Insight report instead finds that during Q1 2018 the United States installed 2.5 GW-DC of solar PV, a 13% year-over-year increase.

The growth was led by the utility-scale sector, which saw 1.4 MW-DC of solar deployed. This is the sector which is likely to be most impacted by the Section 201 tariffs.

“Despite the cell and module tariffs put in place, we will continue to see growth in the utility solar market, albeit at a slower rate than what would be seen without the Section 201 tariffs,” states GTM Research in the report.

Likewise, the report’s “non-residential” segment saw a 23% year-over-year increase in capacity installed during Q1. This includes more than 100 MW of community solar installed in Minnesota, as GTM Research and SEIA lump community solar in with commercial, industrial, non-profit and government installations in this sector.

Residential market woes

The residential segment, however, saw flat growth. This is of particular concern given that residential installations fell 15% last year, meaning that slowness in the segment is ongoing. GTM Research blames the “lingering effects of a national installer pullback,” but the sector is also seeing policy headwinds.

There are geographical dimensions here. Offsetting recovery in California’s residential market, seven of the top 10 state markets declined year-over-year, with New York and New Jersey seeing residential market contraction each quarter for more than a year.

It is important to note that the growth seen in the national residential market is mostly coming from new states opening up. GTM Research and SEIA name Florida and Nevada as booming markets, and the organizations note that they expect Florida’s solar market to continue to grow now that state regulators have confirmed that solar leases are not an infringement on the rights of utilities.

Looking forward, California’s new mandate for residential solar to be installed on all new homes is also expected to give a boost to this market segment, with uptake beginning strongly in 2020.

Going South

A lesser-noted trend in the U.S. Solar Market Insight report is the growth of markets in southern states. Florida rose to the 2nd-largest solar market overall in Q1, with 482 MW installed. Arkansas made a surprise showing as the 4th-largest market due to the completion of a very large project.

North Carolina, which was the second-largest market in 2017, and Texas round out the top 10 state markets for Q1. This supports a trend that we at pv magazine have been observing for years: solar markets expanding from the Southwest and Northeast to the U.S. South. However, given that all of these markets are driven primarily by large utility-scale projects, the details will be uneven from quarter to quarter.

Texas and Florida represent particularly promising markets, as they are the 2nd- and 3rd-largest U.S. states by population. Both are expected to be top-five markets over the next five years.

Growth ahead

Despite the Section 201 tariffs, the momentum of the U.S. market appears unstoppable. GTM Research expects the impact of the tariffs to be put off by a few quarters, due to advanced procurement of modules, noting that 2/3 of the utility-scale solar projects which are scheduled for construction by the end of the year consist of either projects in construction that have secured tariff-free modules, and/or those driven by state-level renewable energy mandates.

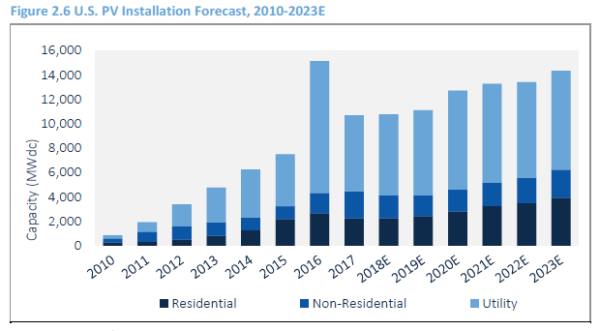

As such, the organization is marginally increasing its 2018 forecast for utility-scale solar from 6.47 GW to 6.6 GW. Across all segments, the company is predicting relatively flat growth year-over-year.

By the time the tariffs bite there will be other factors at play. Not the least of these is the anticipated collapse in global PV module prices, which is expected as a result of a pending global oversupply due to the pull-back in China’s solar policies. BNEF has predicted a 34% decline in module prices over the course of 2018, with GTM Research offering a similar range.

GTM Research expects this to drive 5% growth in the utility-scale segment in 2019, as part of marginal growth in the overall market. The organization expects more rapid growth to resume in 2020 and beyond, with the utility-scale sector remaining dominant.

This segment is increasingly reliant on factors other than state-level mandates. GTM Research estimates that 3/4 of the current utility-scale pipeline is driven by a combination of voluntary utility procurement, PURPA, corporate procurement and community choice aggregators.

We at pv magazine are increasingly seeing this as well, with utilities in non-traditional state markets expressing interest in large solar projects, and with new record low price power contracts being signed.

Market analysts are conservative by nature and, in the past, have repeatedly under-estimated the growth trajectory of solar. If anything, we expect more dramatic growth, driven fundamentally by ongoing price declines and sheer momentum.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.