Battery storage is a hot topic right now – both among energy wonks and investors. While a pairing of batteries and renewable energy is starting to compete with natural gas plants in advanced markets such as California, investors are also beginning to bet big on battery companies.

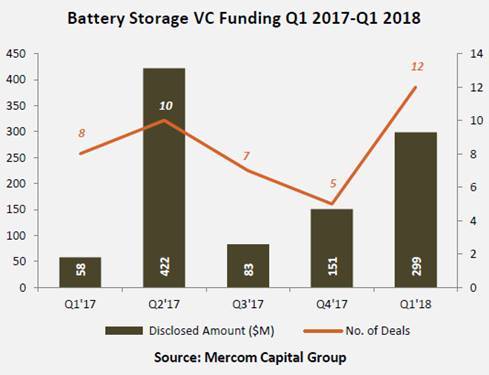

As the latest evidence of the second trend, today Mercom Capital released its quarterly report on battery, smart grid and efficiency funding, which found that venture capital investments in battery companies rose 5-fold year-over-year to $299 million during the first quarter of 2018.

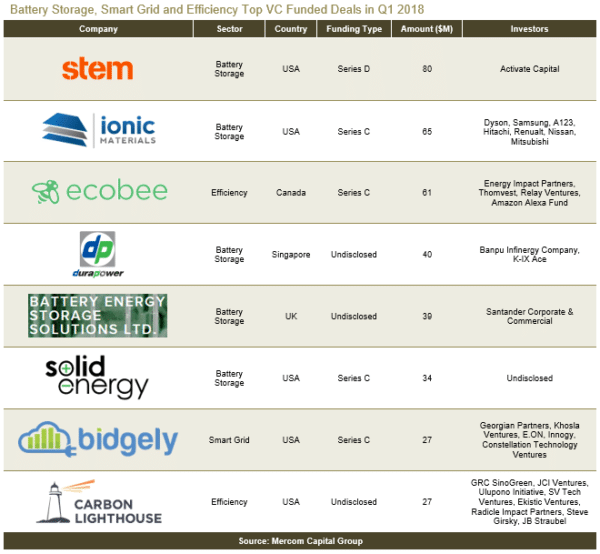

This $299 million represents 12 rounds of venture capital (VC) funding for battery storage companies. The leader among these was energy storage provider Stem, which walked away with $80 million from three investors led by Activate Capital in its D round.

However, lithium-ion battery company Ionic Materials was not far behind, raising $65 million from a consortium of seven investors led by Dyson. Singapore’s DuraPower came in third, raising $40 million from two investors.

“It’s a good start (to 2018), way better than expected,” notes Mercom Capital CEO Raj Prabhu. Prabhu says that while he does not see a particular event driving the activity into Q1, but rather that the quarter is part of a general upward trend in investment in battery storage companies.

And while it is likely not the sole factor, Prabhu recalls that in the conversations his firm has had with battery companies, many are citing the shift to time-of-use rates in California as driving increased interest in solar plus storage.

More than lithium-ion

All of the corporate funding reported by Mercom this quarter was through VC firms. Prabhu says that there are not many battery storage companies that have yet gone public, and that activity on the debt and equity side is “minimal” at this time.

However, this could change. “If activity picks up, they are going to go to the capital markets to raise more money,” predicts Prabhu.

Prabhu notes a mixture of battery integrators and technology companies raised the bulk of the funding during Q1. Battery systems companies walked away with the largest sum of money at $91 million, with $87 million raised by lithium-ion battery makers.

However, $65 million was also invested in companies making solid state batteries. Prabhu says that despite lithium-ion representing the lion’s share of deployments, other battery technologies are still raising substantial sums. “The investors are not ruling out other technologies,” states Prabhu. “They’re not sitting back saying that lithium-ion is the winner.”

Prabhu cites both scalability and safety issues are reasons why investors are looking at chemistries beyond lithium-ion, also noting that there may be better technologies for many large-scale battery storage applications.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.