The state of the U.S. solar industry is strong, despite the uncertainty surrounding it thanks to the Section 201 trade case currently under adjudication by the U.S. International Trade Commission – at least if one investment group’s actions are an indication.

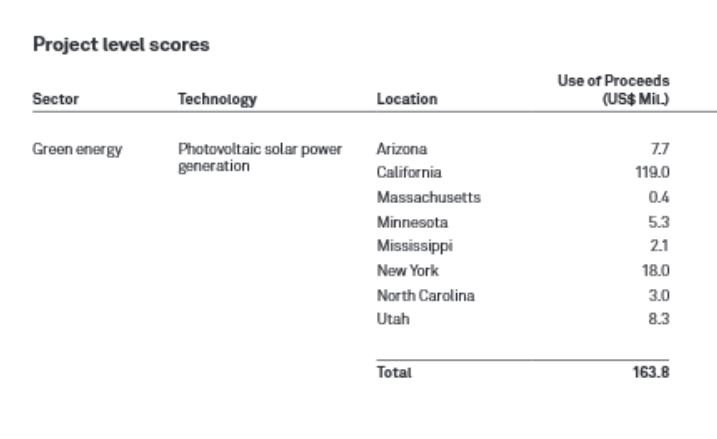

Hannon Armstrong, an investment firm specializing in sustainable infrastructure (including solar energy), bets on projects and industries that have environmental benefits and long-term cashflows, which is why its decision to issue $164 million in green bonds specifically tied to 57 U.S. solar projects totaling 1.2 GW of capacity sends a strong signal about what it sees as the overall strength of the industry. California is home to the bulk of the projects (73%), with the rest being spread over seven states.

As befitting its status as the state with the most projects, California will receive $119 million from the bond issuance, with New York coming in second with $18 million and Utah ranking third at $8.3 million.

S&P

The firm owns the lease rights to the projects under long-term power-purchase agreements (PPAs).

In February, Hannon Armstrong invested $144 million to purchase more than 4,000 acres of land located under more than 20 individual solar projects with investment grade off-takers. At the time, the company estimated that these projects had an aggregate capacity of more than 690 MW-DC.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.