The U.S. residential solar industry is changing. Concurrent with a degree of contraction in the largest markets, two of the three largest residential solar companies have shrunk deployments year-over-year, while moving towards direct sales instead of third-party solar arrangements.

Along with Tesla/SolarCity, Vivint Solar is the other company leading this change. While the circumstances are different – SolarCity was acquired by Tesla after losses began to mount, while Vivint has had to recover from the botched acquisition attempt by SunEdison, the path is remarkably similar.

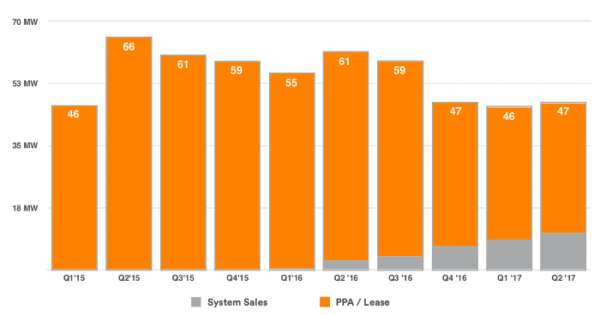

Today Vivint is a smaller company. During Q2 Vivint installed 23% less solar year-over-year at only 47 MW, the third consecutive quarter of sub-50 MW deployment.

However, of this 47 MW, 22% was direct sales and not solar leases and power purchase agreements, and this is changing the quarterly financial results of the company. Notably, Vivint more than doubled revenues year-over-year to $73 million during Q2 while reducing quarterly losses to $37 million.

“We have traded some volume for better economics,” noted Vivint Chief Financial Officer Dana Russell on the company’s results call.

Losses are typical for third-party solar companies, which build long-term value while consuming capital quarter-to-quarter. As such Vivint built up the volume of its long-term lease and PPA revenue, and reported a net retained value of $690 million at the end of the quarter, a figure that takes debt tied to such deployments into account.

As Vivint has contracted its deployment volume, it is focusing on specific geographies, identifying California, New Jersey and Massachusetts as “high margin markets”, and noting that other markets are “not feasible today”. Vivint Solar reports that its deployments in California have increased, which is in contrast to the larger California market, which saw significant contraction during Q1 and possibly flat growth year-over-year during Q2.

Vivint has not made significant progress with cost reduction, and its deployed cost of $2.88 per watt is not very different from a year ago. While the company’s installation costs have fallen significantly, sales and marketing costs increased to $0.69 per watt. Vivint Solar CEO David Bywater has described the recruiting and training of new salespersons, including a switch to selling leases as a “heavy lift”.

Like its fellow large residential companies SolarCity and Sunrun, Vivint is actively moving into the “solar plus” space, through its collaboration with Vivint Smart Home. The company reports that Smart Home drove 5% of its solar sales during Q2, and additionally Vivint has begun offering home energy storage through a partnership with Mercedes Benz Energy.

Vivint expects to begin growing, and the 55 MW booked during Q2 is expected to support 46 to 52 MW of deployment during Q3. However, the company is still maintaining its conservative outlook. “We will continue to pursue fiscal responsibility rather than chasing growth in less profitable markets,” stated Bywater.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.