Renewable energy power purchase agreements (PPA) are increasing in price amid policy headwinds, said a Q3 report from PPA marketplace operator LevelTen Energy.

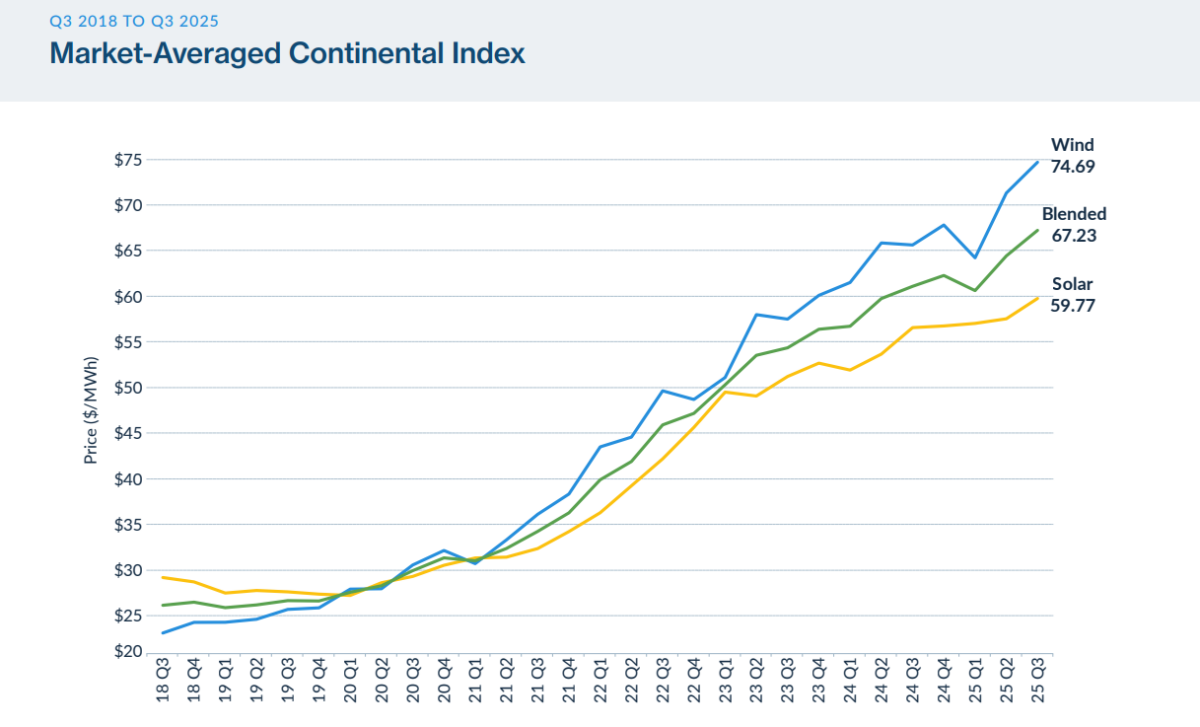

In Q3 2025, North American solar PPA prices increased 4% quarter-over-quarter, while wind PPA prices increased 5%. On LevelTen’s platform, P25 (25th percentile) prices averaged $59.77 per MWh for solar PPAs and $74.69 per MWh for wind PPAs. The report contains data from AESO, CAISO, ERCOT, ISO-NE, MISO, PJM and SPP power markets.

LevelTen said the rising prices are unsurprising due to broader policy headwinds in the United States.

“The OBBBA has spurred a frenzy of development and procurement activity, as developers look to safe harbor projects by hitting key new development milestones, and as buyers compete for a finite amount of tax-credit-eligible project capacity,” said the report.

LevelTen said its project developer contacts have expressed optimism in their ability to build a “bridge” of projects with tax credit access beyond the 2028 tax credit “cliff” imposed by the OBBBA.

Nonetheless, LevelTen said “PPA buyers should avoid complacency and procure with haste.”

It said that even for projects that have a high likelihood of securing tax credits, an array of other headwinds, including tougher review and permitting processes from federal entities, mounting tariff costs, pending Foreign Entity of Concern (FEOC) rules, and a new AD/CVD investigation into solar component producers, could stand to push PPA prices even higher for months and years to come.

LevelTen said while the increased competition to secure tax credit eligible project PPAs will push prices higher, the most immediate impact to pricing has been the rollout of tariffs.

“Section 232 tariffs have been applied across a huge array of trading partners in recent months. While various pauses and ongoing trade negotiations have delayed their effects to varying degrees, their impacts on PPA prices are now coming through more fully,” said the report.

Section 232 tariffs now include 50% levies on aluminum, steel and copper, all important inputs for solar and wind projects as well as grid infrastructure. The 50% duty is layered on top of existing country-specific tariffs, often leading to “profound rises in prices” for essential components for renewable energy projects, said LevelTen.

What’s more, an ongoing investigation by the Trump Administration into polysilicon imports stands to add future costs for solar projects, as well as a recent AD/CVD investigation into solar component producers in Indonesia, India, and Laos, said LevelTen.

“All in, rising solar prices are unsurprising to see, with developers asking PPA buyers to help share the CapEx increases and development risks that result from these trade policies,” said the report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.