Last April the Internal Revenue Service (IRS) released final guidance for the transfer of clean energy tax credits, a provision within the Inflation Reduction Act (IRA) and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) act that allow tax credit owners to sell their credits to other entities with a tax appetite.

Under a tax credit transfer transaction, renewable energy developers and owners are able to sell tax credits for cash. While there’s uncertainty as to how the current administration will change U.S. energy policy, changing or rescinding the tax credits would require action by Congress.

The recent report from Crux, 2024 Transferable Tax Credit Market Intelligence Report, states that transferable tax credits will catalyze $2 trillion in capital investments and $3.8 trillion in U.S. economic activity, leveraging $4 of private capital for every dollar of tax credits.

Crux is a sustainable finance technology company that assists with financing clean energy and decarbonization projects, starting with transferable tax credits. The company currently has a database that includes $25 billion in transferable tax credits.

The 2024 Crux report said the market for tax credit transfers in 2024 far exceeded its own forecast. Total deal volume in 2024 more than tripled the 2023 transaction volume, bringing it to $30 billion. It estimates that 2024 tax credit sales made up $24 billion, and the market in 2025 or later will contribute another $6 billion in deal volume.

Solar takeaways

ITC: Solar investment tax credits (ITCs) represented nearly half of all tax credits in the first half of 2024, and then declined to 17% as there were fewer large deals. Crux estimates that $5.75 billion in solar ITC deals were transacted for 2024 credits

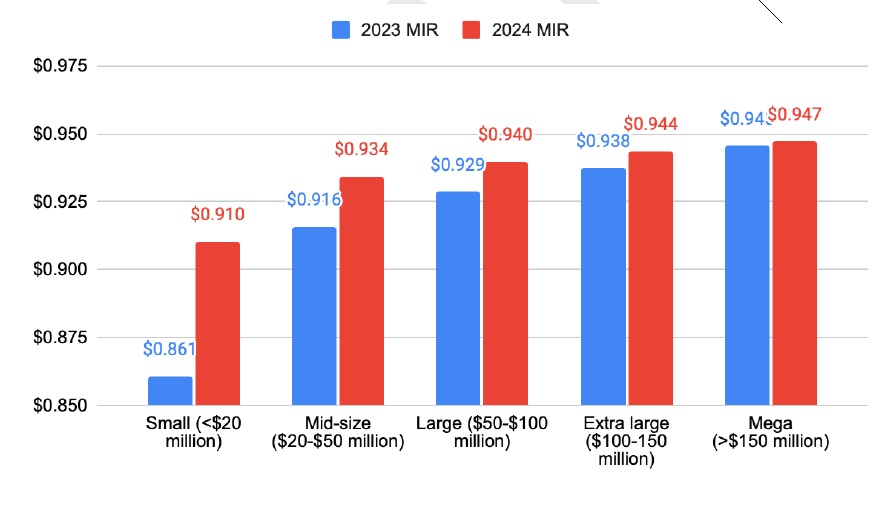

Pricing: Tax credit deal pricing remained strong throughout the year, with average pricing on small solar ITC deals increasing form around 86 cents to 91 cents. Large deals transacted at 94 cents to 95 cents, with a few getting 96 cents, based on credit rating of the sponsor.

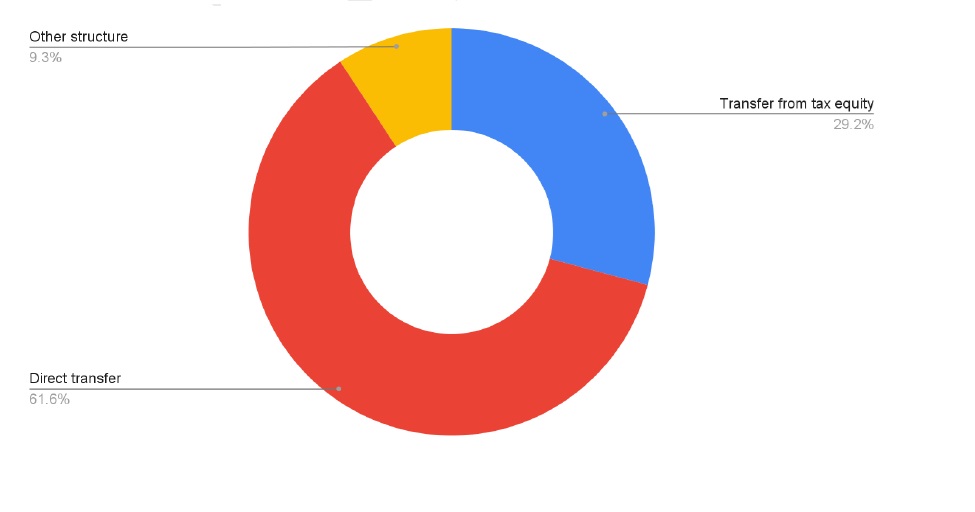

Flexibility: Investment in energy and manufacturing tax credits reflect the flexibility of the market, with more than 90% of production tax credit (PTC) deals made as direct transfers and 57% of ITC deals were sold out of tax equity partnerships.

Solar PTC sales remain a small part of the market, just 3% in 2024. Developers and sponsors generally can choose between three primary structuring options for monetizing tax credits: tax equity, minority or preferred equity investment, and direct transfers.

Future commitment: By the fourth quarter of 2024, more than 30% of closed deals included a commitment to purchase tax credits in the future. In 2023 very few deals included forward commitments. As much as $8 billion in solar ITC deals in 2024 included forward commitments.

Prevailing wage: About 72% of solar ITCs in the market met Prevailing Wage and Apprenticeship (PWA) requirements. The goal of the prevailing wage and registered apprenticeship (PWA) provisions in the IRA are to ensure that those working in the clean energy industry receive fair pay, and also to encourage apprenticeship programs that will build a skilled workforce. Guidelines for PWA were released at the end of 2024.

Pivotal role

Crux expects the tax credit market to play a pivotal role in meeting the increasing demand for affordable, reliable and sustainable energy. Crux says that projections suggest that transferable tax credits will catalyze $2 trillion in capital investments and $3.8 trillion in U.S. economic activity.

The report authors conclude that, “The market’s influence on energy infrastructure and manufacturing development cannot be overstated. These investments are not only addressing immediate energy needs but are also laying the foundation for long-term economic and environmental resilience.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.