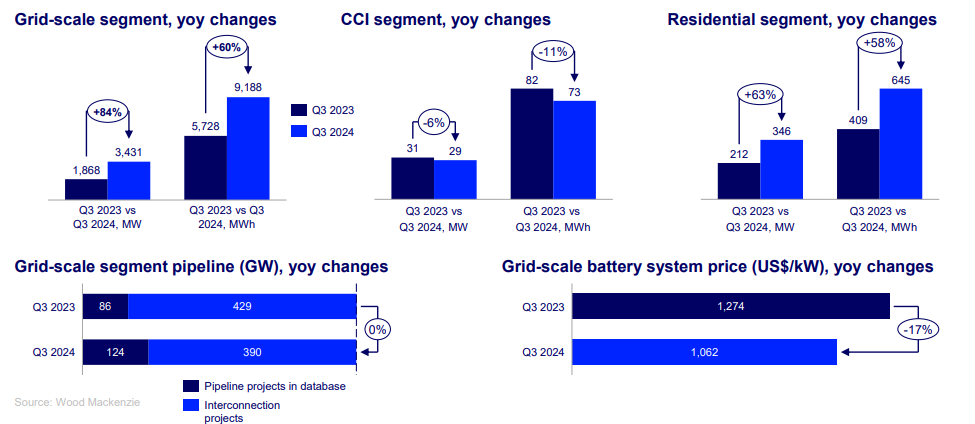

Energy-storage installations were the highest on Q3 record, found a new report by the American Clean Power Association (ACP) and Wood Mackenzie Power & Renewables. The totals of 3,806 MW and 9,931 MWh deployed were an 80% and a 58% increase from the previous year, respectively.

The grid-scale segment’s total of 3,431 MW and 9,188 MWh deployed also set a record for third quarter installations, the ACP and Wood Mackenzie said.

Storage installation increases 80% from previous year

The 3.8 GW of storage installed in Q3 was an 80% increase from Q3 2023. Additionally, 3,431 MW and 9,188 MWh were deployed in the grid-scale segment, the largest capacity installed during Q3 on record. Texas and California were responsible for 93% of the total capacity.

Residential storage installations increase 63% from previous quarter

The 346 MW of residential storage installed in Q3 broke a record for third-quarter installations, which increased 63% from the previous quarter. Despite residential battery-supply shortages, this growth was led by California, Arizona and North Carolina, each of which installed 56%, 73% and 100% more residential storage than the previous quarter, respectively.

The community, commercial and industrial (CCI) market remained steady, with a slight 4% decrease to 29 MW from the prior year. With only 10 MW installed in Q4, California failed to surpass the previous quarter’s 14.4 MW.

Grid-scale capacity projected to increase 25% year over year

Texas and California’s grid-scale Q3 energy storage deployments were “robust,” the ACP and Wood Mackenzie said. Texas tripled its installations from the previous year to nearly 1.7 GW added. California produced the highest GWh of installations in the United States, with nearly 6 GWh added to the grid.

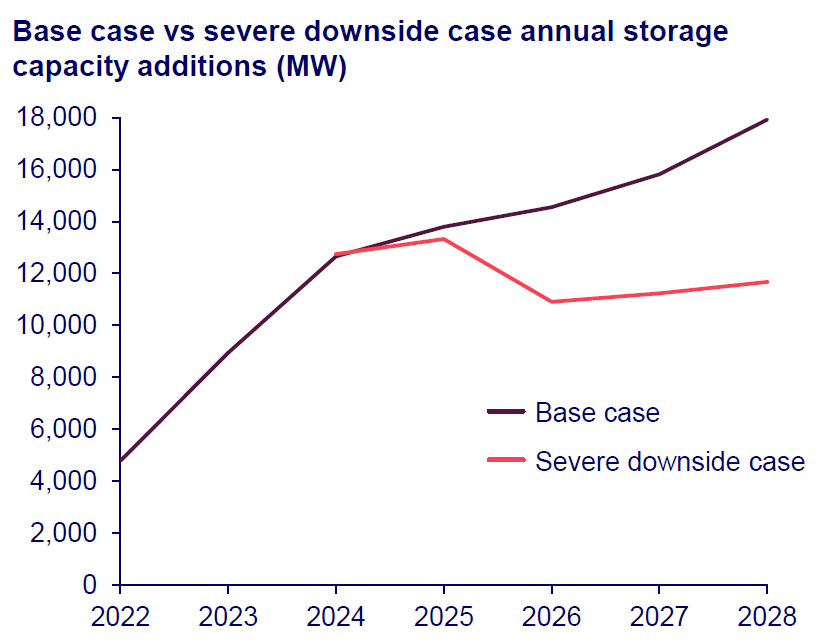

Wood Mackenzie anticipates grid-scale capacity to increase 25% year over year, with 10.4 GW and 30.6 GWh deployed by the end of 2024, reaching a total cumulative installed volume of 63.7 GW and 222 GWh across a five-year outlook.

“We have seen consistent growth in the market this year, especially in the grid-scale segment,” Nina Rangel, a senior research analyst at Wood Mackenzie, said. “Overall, storage installations will grow 30% in 2024, signaling the industry’s strongest year yet,” she said.

However, “it will be difficult to keep this pace,” Rangal said. “Between 2025 and 2028, we are projecting an annual average growth rate of 10%, as early-stage development constraints continue.”

A projected 12 GW of distributed storage will be deployed within the next five years

From 2024 to 2028, Wood Mackenzie projects the residential segment to install 10 GW of storage and the CCI segment to install 2.1 GW of storage.

According to Wood Mackenzie, “near-term growth in the residential segment is expected but may be slightly tempered due to supply chain shortages.”

Trump administration presents risk for storage project development but also potential opportunities for domestic manufacturing

Trump’s victory in the November election increases the uncertainty of the residential and CCI forecasts, Wood Mackenzie said. “Potential increases in battery costs could hit the CCI market particularly hard as many of these projects are already on the margin,” the report said.

According to Allison Weis, global head of storage for Wood Mackenzie, “While there might be potential opportunities in a new pricing environment for domestic manufacturers in terms of competition, any major shifts in tax incentives or increased tariffs could outweigh benefits and have an impact on new project development.”

Wood Mackenzie mapped out what it called an “an extreme downside scenario” prior to the election, which included:

- The investment tax credit and the production tax credit phased out in 2029 rather than 2032, and the removal of the greenhouse gas emissions.

- The elimination of bonus adders, transferability and direct pay.

- An increase in the cost of storage imports due to protectionist measures.

- Manufacturing tax credits to begin being phased out in 2028 instead of 2030.

Wood Mackenzie said this scenario would result in 20% less U.S. storage over the next five years.

Because a majority of ESS battery supply components come from countries that are potentially at risk for increased tariffs, these tariffs and any repeal of domestic manufacturing incentives would create significant price increases, Wood Mackenzie said.

“Energy storage is crucial for energy security and to help outpace rising demand,” Noah Roberts, ACP’s vice president of energy storage, said. “The rapid energy storage deployment we’re seeing in the United States not only enhances reliability and affordability but also drives economic expansion,” he said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.