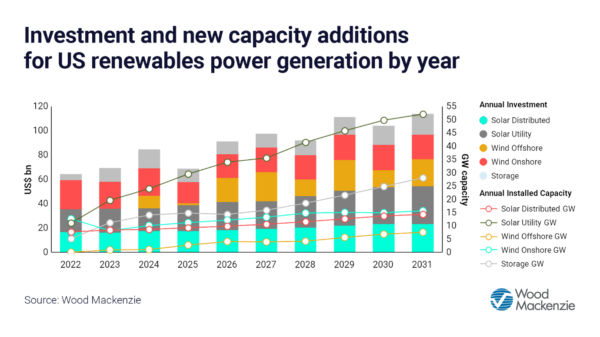

Investments in the U.S. renewable energy market are expected to hit $114 billion by 2031, a 78% increase from $64 billion in total investments at year end 2021, buoyed by decarbonization momentum from the landmark Inflation Reduction Act.

In a new report titled “Boom Time: what the Inflation Reduction Act means for U.S. renewables manufacturers,” Wood Mackenzie provides an initial assessment of how the IRA will greatly support the expansion of U.S. renewable energy equipment manufacturing capacity.

“The IRA will completely reshape the renewables supply chain in the U.S., incentivizing the reopening of shuttered facilities as well as provide opportunities to build entire equipment supply chains from scratch,” said Daniel Liu, head of asset commercial performance at Wood Mackenzie.

Two key provisions of the IRA are likely to be game changing for equipment manufacturers. The first, the advanced manufacturing production credits (AMPC), for US-made renewable equipment. The second provision is the incentivization of developers of U.S. renewable energy projects to purchase domestically sourced equipment with an additional tax credit if they meet domestic content requirement or DCR thresholds. To qualify, 40% of all equipment must be American made for projects installed before 2025, and 20% American-made for offshore wind projects. This requirement rises to 55% beginning in 2027 for the offshore wind market, the report notes.

“It’s high stakes for U.S. equipment sales, as the IRA provides incentives that cut the manufacturing cost of solar panels, storage equipment and wind towers in the U.S. by anywhere from 4% to 30%,” Liu said. “This, along with tariffs on some imports, potentially puts domestic manufacturing on a cost-competitive footing with imported equipment.”

Utility solar remains foggy

The U.S. currently has just a small domestic capacity to support manufacturing of utility-scale solar panels, juxtaposed against substantial forecasted growth in solar additions. Meeting U.S. solar market expansion activity as forecast by various agencies, including Wood Mackenzie, proves that the U.S. supply of solar panels to the utility market remains a foggy proposition, Liu states.

PV panel manufacturers face considerable challenges when it comes to developing a self-sufficient domestic manufacturing capability, with costs between 16% and 33% higher than imported PV equipment, though the AMPC credit could start to close this gap.

Tax code digestion

The Internal Revenue Service (IRS) will provide eligibility requirement guidance on how to access support in the form of tax credits, which will be a critical factor for investment decisions by the manufacturing community.

“The decision to invest in equipment manufacturing capacity expansion depends on the interplay of three factors. First, the cost of manufacturing equipment in the U.S. compared with imports, taking into account the benefits the AMPC provides,” Liu said. “Second, the expected supply/demand imbalance for renewables equipment, and finally, specific guidance from the IRS on what constitutes ‘domestically produced equipment’,” he added.

Wind market benefits from AMPC

The AMPC credit from the IRA will help original equipment manufacturers (OEMs) reverse declining equipment sales margins in the short term and incentivize investment in manufacturing capacity for the U.S. onshore wind power market.

The U.S. has enough manufacturing capacity to supply most domestic demand for turbine equipment through 2031, though the industry faces a near-term shortage of American-made equipment. This creates an opportune pricing environment for manufacturers, as not all developers will be able to meet DCR thresholds within the Act.

Developers should be able to meet pre-2025 DCR thresholds with American-made turbine components, such as domestic foundations, towers, and balance-of-plant equipment. Turbine blades will help developers reach the 55% threshold after 2026.

Despite the nascency of the U.S. offshore wind market, the country is one of the most attractive markets for offshore wind suppliers due to its ambitious targets, lack of existing supply chain, and focus on local content in tenders and its consolidated client base.

“We expect manufacturers to capture the full value of the AMPC given the limited capacity of U.S. manufacturing, the natural cost advantages versus imports and the need to invest in domestic manufacturing capacity,” Liu said.

Silver lining

Despite the IRA’s potential to be a major driver for U.S. manufacturing capacity expansion, the industry’s path forward is not so clear-cut. Additional factors that will have a significant impact on renewables capacity expansion include:

- Ongoing negotiations between the European Union (EU) and the U.S. over perceived trade barriers created by the Act. EU leaders believe the Act violates World Trade Organization rules, but negotiations are underway to prevent a trans-Atlantic trade dispute.

- Whether manufacturers can reduce their cost base to competitive levels before the AMPC expires in 2032.

- The response from overseas manufacturers, who will strive to protect their existing cost advantages.

- Internal Revenue Service (IRS) and Treasury Department interpretation of the key provisions of the Act.

Also read “The role of solar in the Inflation Reduction Act“.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.