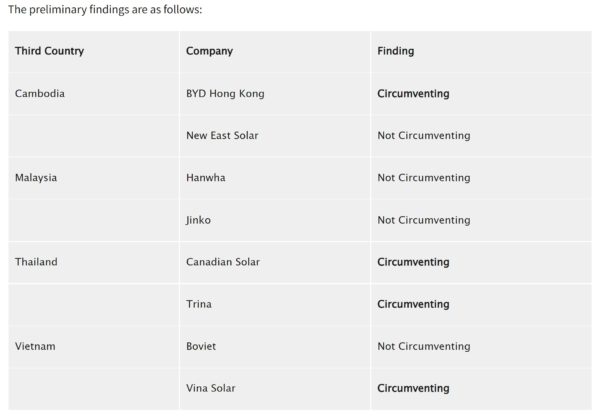

On Thursday, December 2, the U.S. Department of Commerce released their preliminary opinion (long version) that certain Chinese solar cell and module companies used Cambodia, Malaysia, Thailand, and Vietnam to assemble solar modules, thus allowing their products to be imported to the United States without paying import tariffs.

The ruling is nuanced. Though it specifically pushes against solar cells from China, it leaves plenty of wiggle room for Chinese companies to comply. Four companies, three of which are clearly Chinese and use mostly Chinese polysilicon, were not found to be circumventing the ruling. The ruling also seems to extend an olive branch for those companies still using Chinese solar cells to differentiate their supply chain and regain access to the U.S. marketplace.

Additionally, the Biden administration has paused the tariffs of this ruling until June 6, 2024, giving the U.S. solar manufacturing industry a chance to grow. However, Roth Capital expects that there will be a lawsuit against the Biden tariff delay.

It’s also important to remember that this is only a preliminary ruling, and that there may be refinements and guidance coming from the Commerce Department by the date of the final determination: May 1, 2023.

The original document has two key sentences to consider, noting “these circumvention inquiries cover”:

- Crystalline silicon photovoltaic cells that meet the physical description of crystalline silicon photovoltaic cells in the scope of the underlying Orders, subject to the exclusions therein, whether or not partially or fully assembled into other products, that were produced in Cambodia, Malaysia, Thailand, or Vietnam, from wafers produced in China.

- Modules, laminates, and panels consisting of crystalline silicon photovoltaic cells, subject to the exclusions for certain panels in the scope of the underlying orders, whether or not partially or fully assembled into other products, that were produced in Cambodia, Malaysia, Thailand, or Vietnam from wafers produced in China and where more than two of the following components in the module/laminate/panel were produced in China: (1) silver paste; (2) aluminum frames (3) glass; (4) backsheets; (5) ethylene vinyl acetate sheets; and (6) junction boxes.

The first point highlights that wafers and cells coming from China are a key point of consideration. The document also states that these anti-circumvention tariffs are the same as those implemented in the 2012 case, and have been adjusted every two years.

The second point seems to say that a company defined as circumventing could still export solar modules to the U.S., provided that at least four of the six listed components are manufactured outside of China.

Industry analyst Clean Energy Associates (CEA) seems to confirm this logic, and provides some nuance, in a document it published.

CEA notes that a significant volume of solar cells and wafers made in southeast Asia by the largest solar manufacturers in the world – Jinko, JA Solar, LONGi, Trina – have the opportunity to legally avoid the tariffs.

In fact, one of the world’s largest Chinese manufacturers of solar modules – Jinko Solar – was not found to be circumventing at all. It was suggested by others that Jinko was found to be in compliance by Commerce because they manufacture solar cells in Vietnam for their factory in Malaysia.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.