Xendee, a microgrid design and decision support software developer, has launched a series of new features that integrate the latest tax incentives from the new Inflation Reduction Act directly into its platform.

In August, the US House of Representatives passed the landmark Inflation Reduction Act of 2022, hailed as the most significant piece of climate legislation in history. The 700+ document is not simple reading, and myriad groups have begun to distill the salient points for the solar industry. BlueGreen Alliance, for example, recently released a user guide to help energy professionals understand how to implement the incentives.

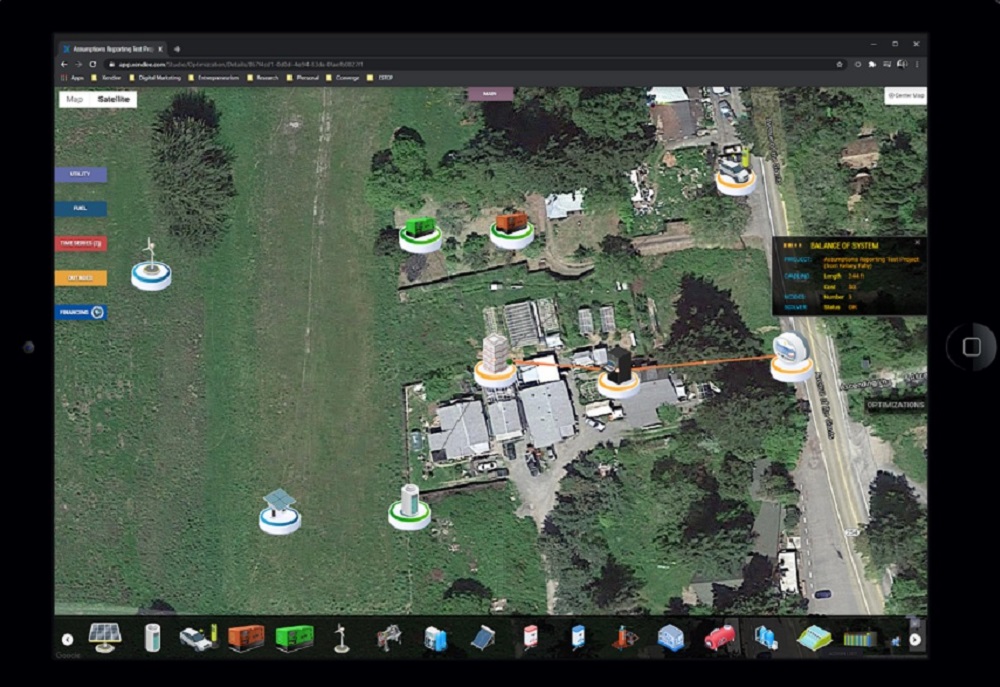

Now Xendee offers help by way of its modeling software, which is designed to allow engineers to design projects with the incentives in mind. The software enables them to see in advance how projects are going to pencil out, once the incentives are applied. Xendee expects that this modeling will result in more financially viable projects and increased investment in microgrids.

“These new features allow engineers to proactively design and optimize their energy project based on the real value streams and incentives that are available,” said Zack Pecenak, lead engineer at Xendee. “Instead of just adding these savings in later as a line item, this allows Xendee to plan and optimize the system around the new tax incentives. This creates both a more accurate view of project financials and allows Xendee to optimize the projects in light of the incentives. For instance, the applied tax credit may change which technologies are chosen or how they are sized or placed.”

To implement tax savings in the Xendee platform, users are now provided with an extended widget for each applicable technology. Users can then opt to implement the tax savings and can select the incentive they would like to apply. For instance, the investment tax credit (ITC) is a 30% credit that can be applied to both residential and commercial solar PV installations. Alternatively, engineers can elect to use the production tax credit (PTC), which pays tax incentives based on their production. Because you cannot opt for both incentives, Xendee allows the modeling of both systems as well as the capabilities to analyze each and determine which solution would be more beneficial to the project. Read more about the PTC here.

The PTC tax credit also applies to green hydrogen projects, and Xendee reports that it’s got that covered, too. Xendee already enabled modeling of hydrogen production, storage, but now engineers can model the ramifications of the $3 tax credit per kilogram of green hydrogen produced.

“Xendee’s new tax incentive features give decision makers an opportunity to consider sustainable technologies that may have earlier been financially unattractive or completely out of the scope of the project,” said Michael Stadler, co-founder and CTO of Xendee. “For instance, with the incentives for hydrogen production, a facility that never would have considered it might become a net exporter of hydrogen or even use it to power their own fleet of vehicles.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.