Jupiter Power announced it achieved commercial operations for its 200 MW / 200 MWh Crossett Power Management battery energy storage system. Placed in Crane County, Texas, the storage system will support grid reliability and the massive buildout of utility-scale solar in west Texas and the large capacity of wind power in the northern band across the state.

The company said the storage facilities can “time shift” or store low-cost, off-peak energy, and discharge it during periods of high demand. Battery energy storage can provide additional support to electricity grids to manage demand through ancillary services, managing load, congestion, and resiliency.

At the 2022 RE+ conference in San Antonio, solar and storage developer 8minute Energy shared that 95% of revenues in a two-hour duration battery occur in the first hour of discharge in Texas. Designed around these market signals, the Crossett Power Management system is configured to one-hour duration.

The service is increasingly important for the Texas grid, which operates on a wholesale energy market basis that experiences steep rises in electricity prices when peak demand reaches levels that challenge power supply. David Kinchen, chief operating officer for Energy Ogre, said prices have gone up sharply, nearly doubling since last year. Part of this is due to a dwindling supply of reserve power, said Kinchen.

“The direct correlation is natural gas setting that marginal price unit and causing prices to double,” said Kinchen. “Say we get to an event and we need large amounts of natural gas. We can only pull so much out of production. A lot of that has to come out of storage. As you can imagine, when you get to these very brief periods of high demand, having that sitting there in storage ready to go has a lot of value. When that number’s not sitting there in storage, it has to come out of production.”

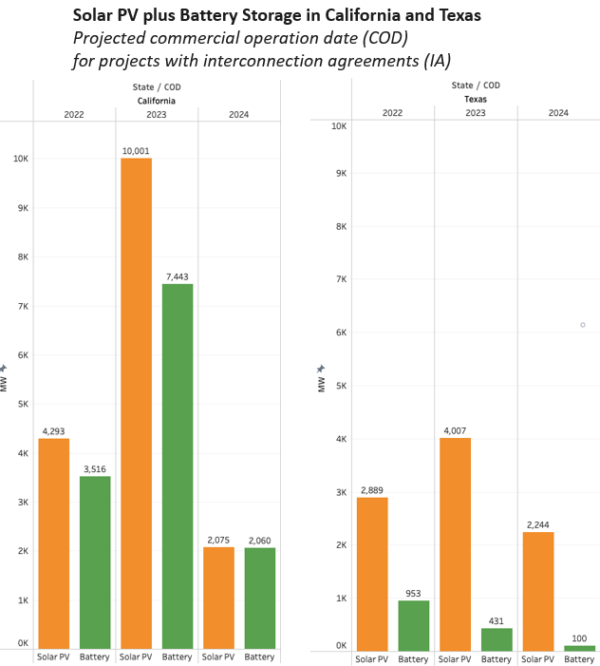

Looking ahead, the state has 28 GW of solar projects with signed interconnection agreements in hand and a projected commercial operation date (COD) through the end of 2024.

This massive buildout of renewable energy will likely be followed by battery energy storage to support it, but 8minute Energy argued stronger market signals are needed to support it, including pre-defined revenue streams like the capacity-based markets that exist in California’s CAISO market.

Currently, nearly all large-scale solar projects in California are co-located with energy storage, while only 28% of the 120 solar projects in ERCOT with completed interconnection agreements are solar + battery projects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hours of battery storage are gonna’ do what?

Think again…

Renewables with battery storarge cannot do it all; especially if there is a massive volcanic event that darkens large portions of earth’s skies for days at a time or more…or you know “what” hits the windmills…

High capacity factor nuclear build out is needed NOW, not after 20 years of politicized eco-maniac approval processes.

And getting rid of Jimmy Carter’s 1970s ban on nuclear fuel reprocessing will ensure we’ll have enough fuel to last through the next ice age 60,000 years from now that will bury solar and wind farms under ice sheets up to two miles thick, like the last glaciation that ended a mere 14,000 years ago.

😜

The smartest and safest way to go:

HUGE off-shore wind farms + solar farms/rooftops+ HUGE battery storage (non-flammable &non-lithium) + home & EV ‘storage’ + Hydro + Geothermal + small/modular nuclear (prefererably thorium) where needed.