Renewable Energy Test Center (RETC), a leading independent lab for testing photovoltaic (PV) and battery products has released its 2022 PV Module Index (PVMI) report, highlighting module performance across a variety of lab tests, as well as providing industry-cited clarifications into the real-world significance of the results.

The 2022 PVMI marks the first edition released since VDE acquired a 70% stake in RECT. President and CEO Cherif Kedir said the move will allow RETC to expand its testing services to a broader network of manufacturers, investors, insurers and developers, all in pursuit of minimizing risk and uncertainty in favor of long-term reliability, sustainability and profitability by designing better data-driven risk mitigation programs and service products.

Eyes on 2023 and beyond

RETC Vice President of Business Development Daniel Chang told pv magazine the 2022 PVMI takes a more forward-looking approach than previous editions, supplementing testing results and hardware performance with emerging industry trends that are going to guide the use of this hardware and investments in projects that utilize it into 2023 and beyond.

“We focus on what we think are going to be topics that are going to be relevant for the upcoming year, like the onset of N-Type modules, and field services,” explained Chang. “There are a lot of installations out there degrading at a faster pace than expected. These installations are investments in assets made by banks to yield some sort of financial benefit to them, right? If they have some sort of degradation, then that’s not performing the way that was expected and planned for.”

Specifically, RETC is interested in forensic analysis for PV systems; a detailed investigation that seeks to establish the root cause of PV system underperformance. This investigation is the culmination of different analyses to be done over the life of a project, starting with a baseline third-party module health assessment during project commissioning.

In instances of underperformance, RETC recommends Electroluminescence (EL) testing. EL testing uses a special camera system to document the light emissions that occur when an electrical current passes through PV cells. The technology has long been used in labs to detect a wide range of hidden module defects.

Another aspect of forensic analysis is predictive maintenance, wherein a third party inspects plants from periodically to detect issues that may not be visible at a base overview, but could develop into much larger issues if allowed to linger.

While Chang brought to light the ongoing issue of degradation and the developing need for advanced field services, Kedir focused more on the technology side, researching where the next wave of module innovation will come in a post-large-format world.

That innovation, he thinks, will come from heterojunction n-type modules (HJT).

“I think leading manufacturers are kind of a crossroad point right now, in terms of how to get more power out of modules without making the modules just unreasonably large, because they’re already pretty damn big,” Kedir said. “The other reason I think manufacturers may be hesitant to make their modules larger is that everybody is testing the waters with heterojunction cells, so that they can eke out more more watts per module, without having to increase the size. With the module technologies they currently have, I don’t think they’re able to get a lot more efficiency out of the cell, so they’re trying to figure out how to get more power without increasing the module size, and the next, the next logical thing is to go to different technologies, Topcon and heterojunction.”

In an op-ed for pv magazine in Nov. 2021, Nadeem Haque, chief technology officer at Heliene outlined some of the distinct technology advantages that HJT presents.

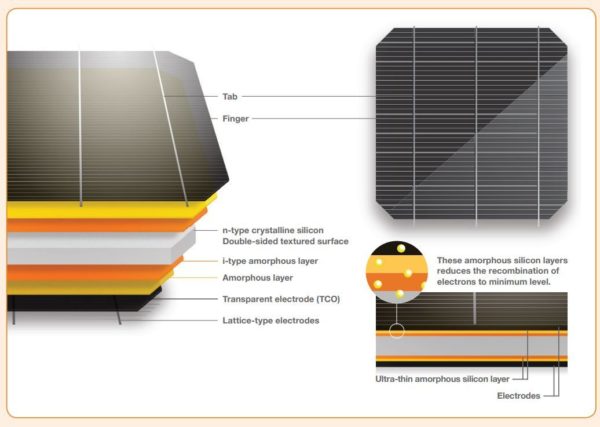

HJT cell manufacturing involves the deposition of an amorphous layer of silicon on both the top and bottom of the wafer followed by a transparent conducting oxide deposition and making of metal contacts.

HJT cell production lines are currently expensive, almost prohibitively so, and new lines need to be built. The cells require a more expensive metallization paste to manufacture. HJT cells are by nature bifacial, with bifaciality rates above 90%, the highest of any cell technology. The temperature coefficient of HJT cells is in the range of 0.25%/oC to 0.30%/oC.

Higher bifaciality and lower temperature coefficients result in higher energy output, and HJT cells in mass production are expected to reach about 27% efficiency.

“You can gauge where the industry is going based on where investment money is going, and we hear a lot about companies investing money in heterojunction cell lines in Asia, so I think that’s probably going to be a trend,” said Kedir.

The last industry trend examined by RETC is mitigating the effects of extreme weather on PV systems, a topic which pv magazine has reported on extensively with RETC and other partners, like VDE Americas.

Module index

The core of the report is a review of modules’ performance across a range of tests that are designed to go beyond the parameters of tests for certification and accurately project what each module’s strengths are, rather than compare and rank them against one another.

The tests are split up into three categories, each of which analyzes a different aspect of module excellence: quality indicators, performance indicators, and reliability indicators. In testing, the researchers at RETC noticed a new trend that some of the performance and reliability gaps from manufacturer to manufacturer have widened, as opposed to the narrowing they observed in recent years.

The tests are split up into three categories, each of which analyzes a different aspect of module excellence: quality indicators, performance indicators, and reliability indicators. In testing, the researchers at RETC noticed a new trend that some of the performance and reliability gaps from manufacturer to manufacturer have widened, as opposed to the narrowing they observed in recent years.

“Some of the issues that we saw over the last year have been related to manufacturers faced with their own supply chain issues and inability to get their raw materials,” explained Kedir. “They’ve had to go to other sources, secondary and tertiary sources of cells and backsheets, and then that triggered a few failures, we saw more of them last year. What’s been lingering is potential-induced degradation (PID) and some related performance stuff. On cells, PID, for all intents and purposes, had been completely solved a few years ago, but then it reappeared throughout the pandemic, with the supply chain issues, we see some of that leftover.”

This is a phenomenon that Kedir expects to see continue, at least in the short term. The issue may linger as a result of the recently-announced two year moratorium on the DOC’s anticircumvention case, he said.

“Demand is going to is going to pick up in the US,” he began. “The upcoming traceability requirements are going to put a constraint on the cell supply from forced labor regions, which means you’re not going to have enough cell supply for them for the market demands. This causes supply separation between manufacturers. Some larger manufacturers have already completely mitigated that issue, developed a new supply chain for polycrystal, and have new cell lines in Southeast Asia. Those guys are going to fare out much better than a manufacturer who hasn’t put in that infrastructure already. They’re going to have to try to source cells from other places or other manufacturers that may or may not be as good as their initial supply.”

While the gap between top-tier, established module manufacturers and some newer market entrants is widening, RETC still had a number of manufacturers perform well across their litany of tests.

Based on available testing data, RETC highlighted Hanwha Q CELLS, JA Solar, Jinko Solar, LONGi Solar, Trina Solar, and Yingli Solar as the overall top performers of the year. The recognition does not stop with the top performers, however, and RETC listed some of the manufacturers who scored the highest marks in individual tests, listed below.

Hail durability:

- LONGi Solar

- Jinko Solar

Thresher test:

- Hanwha Q CELLS

- JA Solar

- LONGi Solar

- Tesla

- Trina Solar

- Yingli Solar

LID resistance:

- Hanwha Q CELLS

- Jinko Solar

- LONGi Solar

- Trina Solar

LeTID resistance:

- Hanwha Q CELLS

- JA Solar

- Jinko Solar

- LONGi Solar

- Trina Solar

- Yingli Solar

Module efficiency:

- JA Solar

- LONGi Solar

- REC Solar

- Silfab Solar

- Tesla

- Yingli Solar

Pan file performance:

- JA Solar

- Jinko Solar

- LONGi Solar

- Trina Solar

PTC-to-STC ratio

- Hanwha Q CELLS

- JA Solar

- REC Solar

- Silfab Solar

- Tesla

- Yingli Solar

Damp heat test

- JA Solar

- LONGi Solar

- Hanwha Q CELLS

- Tesla

- Trina Solar

- Yingli Solar

Dynamic mechanical load test:

- JA Solar

- Jinko Solar

- LONGi Solar

- Trina Solar

- Yingli Solar

PID resistance:

- JA Solar

- Jinko Solar

- LONGi Solar

Thermal cycle test:

- Hanwha Q CELLS

- JA Solar

- Jinko Solar

- LONGi Solar

- Tesla

- Trina Solar

- Yingli Solar

RETC said the rankings are comprehensive only to data that the company has collected, so modules from other manufacturers could perform similarly to the ones listed above, but the organization cannot make an overall determination regarding high achievement in manufacturing without module tests data across the three categories.

The report concludes with a look at a number of notable changes and revisions anticipated in the upcoming edition of IEC 61730, a two-part standard pertaining to PV module safety qualification, as well as upcoming updates to IEC TS 62915, a technical specification pertaining to PV module approval, design and safety qualification.

The standards analysis is expansive, and pv magazine will cover these pending changes in a follow-up to this article.

Edit 6/24/22: This article was edited and re-published to recognize additional companies who earned recognition in individual tests, as well as top performers. We apologize for the oversight.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.