Enphase Energy, a leading California-based microinverter and energy storage provider, announced several milestones in its 2021 environmental, social, and governance report. Along with its major competitor SolarEdge, the company holds a dominant foothold in the market share of US residential solar.

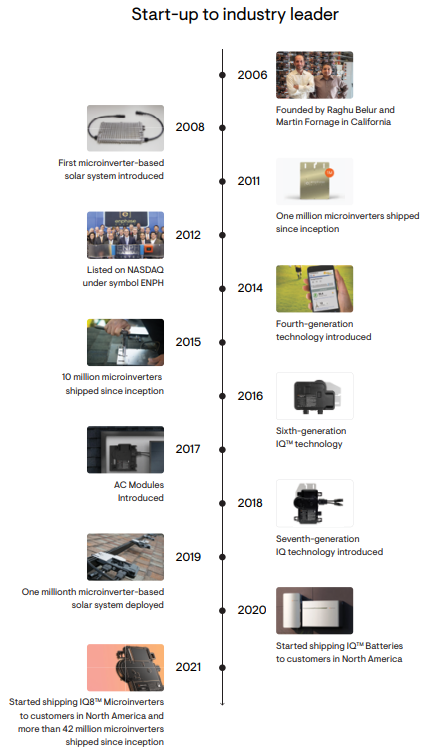

Founded in 2006, the company has reached 2,260 employees across its global offices. Worldwide, Enphase has partnerships with over 5,000 solar installation companies. To date, Enphase has shipped 43.4 TWh of microinverters, representing over 42 million microinverter units, deployed across nearly 2 million solar projects. This equates to 12 GW of microinverters shipped.

Its latest microinverter model, the IQ8, was launched in Q4 2021. The innovative design allows the IQ8 to form a microgrid, enabling backup power usage during an outage without the need for battery energy storage. This is a distinct advantage, as conventional solar arrays without storage must shut down during outages for safety reasons.

The company also operates a battery energy storage division and has shipped over 300 MWh of home batteries to date. In 2021, Enphase batteries backed up nearly 54,000 power outage events.

Systems using Enphase inverters have abated 31 million metric tons of carbon emissions to date, the equivalent of the consumption of 3.5 billion gallons of gasoline, or the electricity demand of 3.9 million homes in one year. It recycles 100% of its e-waste at its North America, India, and New Zealand operations.

Our strategy is simple. We focus on making best-in-class home energy systems that enable homeowners to make, use, save, and sell their own power. We are deeply committed to making these systems innovative, high-quality, and easy-to-use, helping millions of people gain access to cleaner, affordable, and more reliable energy while creating jobs and contributing towards a carbon-free future.

Badri Kothandaraman President and CEO

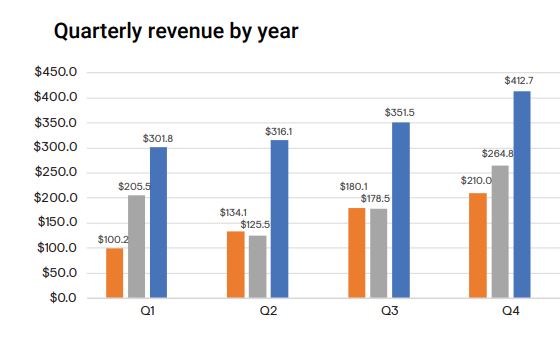

Financials

The company has been a unicorn stock since it joined the New York Stock Exchange in 2012, growing by over 2,700% at the time of writing. Revenues jumped 78% in 2021 to $1.4 billion, and 10.4 million microinverters were shipped that year. The company posted a non-GAAP gross margin of 40.7% in 2021.

![]()

Enphase has a $28 billion market capitalization and $1.2 billion in debt. ROTH Capital Partners has assigned it a 12-month price target of $270, compared to the trading price at the time of writing of $207.

The company’s stock is currently trading at about 50x 2022 consensus earnings per share (EPS). ROTH said it bases its price target by placing a 78x multiple to its 2022 EPS. This bullish attitude is based on the fact that the company is close to a 100% global market share of microinverters, said ROTH.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.