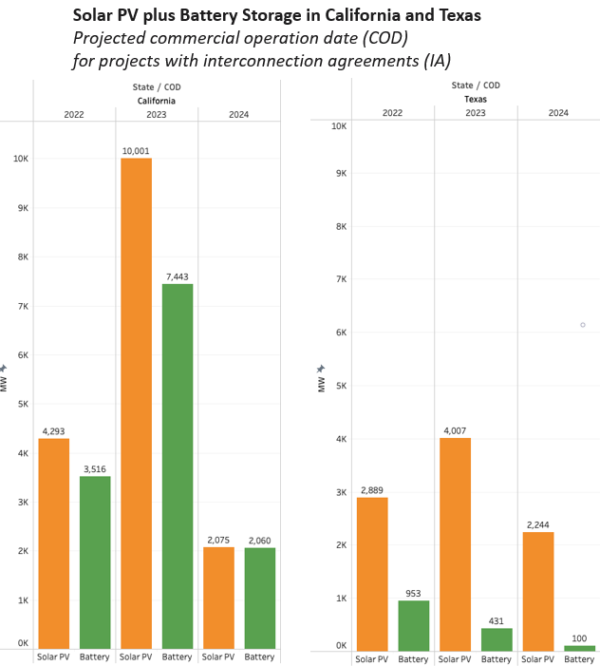

California has been the unquestioned leader in the energy transition, and it has matured to a solar plus battery market. Looking ahead, the state has 16 GW of projects with signed interconnection agreements in hand and a projected commercial operation date (COD) through the end of 2024. Almost 99% of these projects are solar plus energy storage hybrid projects.

Meanwhile, under those same parameters, Texas has a whopping 28 GW of solar on the way, or 50% more than California in a three-year horizon.

But Texas solar projects often come with a “batteries not included” designation. In the Lone Star State, among Interconnection Agreement-signed projects expected to reach COD through 2024, only 28% of the 120 solar projects with completed are solar + battery projects. Again, this compares to nearly 99% of solar projects in California.

These insights were gleaned by PV intel, which took a deep dive into the California Independent System Operator (CAISO) and Electric Reliability Council of Texas (ERCOT) interconnection queues to see what may lie ahead for projects designated as utility scale.

PV intel found that when viewing the ERCOT and CAISO queues, in Texas PV plus battery hybrid projects meeting the above description total 9.1 GW in solar capacity, and just under 1.5 GW in storage. This compares to California, which has a solar capacity of 16.4 GW of projects under those criteria, and has matched a vast portion of it with 13 GW of storage.

There are vast differences in the profile of sector distribution between the states, as well. California represents nearly 50% of the US residential solar market, and residential’s share in the state’s PV electric generation is significant. Texas has yet to mature its rooftop solar market as fully as California.

The Energy Information Administration reports that through 2021, residential solar generated 12,383 GWh of energy in California, out of a total PV generation across all sectors of 52,057 GWh, which means residential solar provided 23.79% of solar’s share. Compare this to Texas, where 16,364 GWh of solar electricity was generated, and residential solar provided 1,848 GWh, or about 11.29%.

Two philosophies

California, now with an increasingly higher penetration of solar in its generation mix, is known for encountering issues with the “duck curve,” where solar energy floods the grid mid-day and forces other sources of power to ramp up quickly in the evening to meet demand when the sun goes down. This has led to demand-response programs, natural gas peaker plants, and a huge boom in batteries.

“Energy is not just technological, it’s also social. I think it’s fair to say that Texas is a very Libertarian state while California is more Communitarian – which is not the same thing as Communism. Simply put, the focus is more on the individual in Texas and more on community in California. Policies and regulations (or deregulation) that reflect these different world views have emerged in each state over time. These policies contribute greatly to the trends we now see in how solar and battery technologies are deployed very differently in each state,” said Jason O’Leary, principal analyst at PV intel.

In California, the energy transition is largely dictated by an Integrated Resource Plan (IRP) that is administered by the Public Utilities Commission. IRPs require utilities to present 10-year forward-looking plans that address the grid’s system reliability needs, local transmission and distribution needs, and needs for flexibility. The IRP requires that the “loading order” of projects approved by the Commission must first serve energy efficiency and demand response, then renewable energy, and lastly “clean” fossil generation.

The IRP process makes it evident why so much battery capacity is being commissioned and deployed, as storage serves the baseload reliability and demand needs of the system. It also explains why California is investing in large-scale, long duration energy storage projects, as it has a mandate to reliably supply 100% emissions-free power by 2045.

Texas’ ERCOT does not have Integrated Resource Planning, but some municipal utilities and electric cooperatives operating within ERCOT territory do have publicly stated forward-looking plans. There are five major electric utility providers in Texas, and thousands of retail energy delivery companies working within (and sometimes across) their respective territories. This fractured nature of energy delivery in Texas may be supportive of the state’s pro-competition philosophy, but it may also cause problems with clarity and oversight into what the needs of the grid will be in a long-term view.

In Texas, the market is deregulated, and market participants, including battery deployers participate in a pure-play wholesale market. The projects that are deployed are dictated by supply and demand, and batteries are often deployed with shorter durations, often operating in demand-response market programs in a role similar to natural gas peaker plants.

ERCOT does release a Long-Term System Assessment, which does not create mandates, but provides informational guidelines to its utilities. In its 2020 assessment, it said the scale and location of solar generation additions are dependent upon sufficient transmission capacity between resource-rich regions (mostly in the western part of the state) and demand centers (large cities in the east).

ERCOT estimated if current transmission constraints do not improve, the state could see 7 GW less of solar and wind generation through 2035.

Energy storage is seen as an essential way to reduce the need for increasing large-scale transmission and providing greater grid flexibility and resilience. In 2019, a Battery Energy Storage Task Force was formed. The task force’s guidance for how energy storage is integrated with ERCOT’s wholesale market, as well as technical requirements for grid-scale storage, can be found here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It’s the money. California has time of day electrical rates as high a 41 cents per kilo watt hour between the hours of 4:00 PM and 9:00 PM every day. programable batteries can actually power the home plus put power back on the grid at those hours and under NEM-2.0, get paid the same 41 cents per kilo watt hour making batteries pay for themselves over the 10-year rated life. If a home uses just 1 kilo watt hour each hour of peak time, the 3650 days (10 years) times 5 hours equals 18,250 kilo watt hours over 10 years. 18,250 times .41 = $7,482.50 or the price of a Tesla Power Wall. Remember, 4:00 PM to 9;00 PM is when most people come home, fix the evening meals, turn on the TV, Video Games and computers and turn on their lights so 1 Kilo Watt per hour is a modest estimate. My home uses 1.560 Kilo watt hours over the 5-hour evening peak, so my savings is over 50% more at today’s rates that are scheduled to go up even higher later this year here in California.

Pacific Gas and Electric rates.

Tier 1

Peak

4-9pm

$0.58/kWh

Off-Peak

12am-4pm, 9-11:59pm

$0.54/kWh

This is why batteries sell in California. Electricity generated and stored costs 20 cents per kilo watt hour when pro-rated over 25 years with one battery exchange at 12 years. Texans pay less than 20 cents per kilo watt hour and Californians pay more than 20 cents per kilo watt hour.

About time those Texans makes sense about something .. I am never a fan of battery storage when it comes to solar energy or even fossil fuel generators as well. Anyone who needlessly include battery storage are clearly cost insensitive and politic sensitive .. They think it creates votes pretty much .. They are not as focused toward reducing climate change as toward job creation just for sake of job creation and votes.. I dont care about creating jobs and politics in other unrelated industries but it is climate change, stupid! We need every damn solar watt out as cheaply as we can get.. Texans understand that and they are smart!

EVs use the cheapest mode of battery storage which I am ok with .. But not for utilty , household, gadget mode of battery storage is too expensive . You have to be rich to afford the latter.. I know some people are insensitive toward costs but this doesnt mean that they are qualified to run solar, I think.

We have a fine solar panel manufacturer here in US of A but they are not getting as much business they deserve because people are not really concerned about climate change at all because they choose wrong costly combinations of solar energy designs ,, etc.. our government has no business throwing off too much federal tax credits here. or that they should give tax credits only on solar panels or basic CSP systems not battery storage or labor costs from installing them.