As solar investments boom across North America, project developers and asset managers alike are under increasing pressure to deliver ever-higher returns, making long-term O&M strategies a necessity for ensuring optimal performance. But while the growing number of asset owners choosing to outsource solar operations and maintenance to third parties is a sign of the industry’s maturation, many attempt to save costs by picking the cheapest service provider – or limiting contract scopes to fit whatever’s left in the project budget.

These short-sighted sacrifices often end up costing asset owners more in the long run, and costs like this can grow exponentially when scaling up a business. As O&M services for solar power plants become more complex, less sophisticated third-party providers seeking to cut costs themselves may end up creating inefficiencies throughout the project lifecycle. And as O&M challenges inevitably emerge from weather events or equipment issues, asset owners opting for bare-bones O&M contracts may face unanticipated expenses for necessary services.

Borrego understands this challenge from both sides. While we’re typically thought of as a project developer and EPC, we’ve also become one of the leading third-party O&M providers in the country, with over 75% of the 1.4GW we manage built by other companies. Here’s what we’ve learned about how to keep O&M offerings ahead of the curve.

O&M services for solar power plants is a lifecycle job

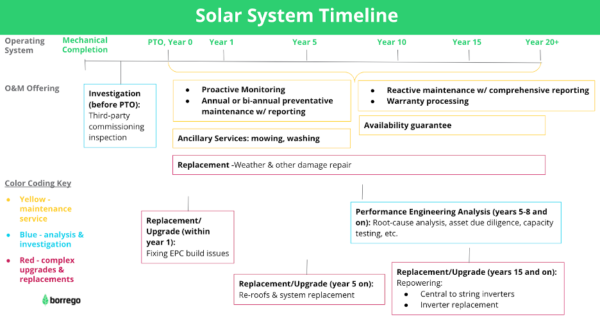

The industry has learned a lot of hard lessons since its early days when solar was considered to be practically maintenance-free other than occasional module cleaning and equipment checks. On the contrary, successful O&M requires continuous engagement across a variety of concerns throughout the project lifecycle, from due diligence during project development and construction to day-to-day operational performance and additional rounds of due diligence when buying or selling an asset.

For example, during the project development and construction phase, lenders may require third-party inspections, and in some cases, asset owners may need repair work for EPC build issues discoverable during the first year of operations such as poor underground cable installation or loose bolts. Projects then typically see growing needs for solar maintenance services to address system underperformance and equipment failures from year five onward. And as we see systems operating beyond 15 years, it often pencils out for asset owners to repower their systems (and potentially replace central inverters with string inverters).

Of course, unexpected O&M challenges can also occur at any time during a project’s life, often due to various forms of weather damage. These diverse and regionally-specific issues can include water damage from storms, misaligned equipment from erosion, panel damage from lightning, hail and wind damage, and soot from wildfires. Many if not all of these events have become increasingly common over the past decade, and climate change is virtually assured to increase their frequency given the decades-long lifespan of the solar assets being built today.

The hidden costs of inefficient solar operations & maintenance

Addressing any of these issues, whether owners discover them during regular operations or after a hurricane, can require O&M providers to conduct performance engineering analyses, site investigations and equipment upgrades or replacements.

Unfortunately, while system outages caused by aging equipment or weather damage are among the most common issues encountered by asset owners, these corrective steps may fall outside the scope of typical preventative maintenance packages. Yet many asset owners make the mistake of choosing O&M providers based on price alone – for instance, awarding a contract to an EPC offering a discount to close a follow-on O&M contract, or flexing down contract scope to match whatever’s left in the project budget – and end up incurring unplanned additional expenses to address issues on a case-by-case basis.

Process inefficiencies can also subtly erode returns. Many “national” O&M companies may not actually have the ability to quickly dispatch technicians in a given project region, leading to slow responses to outages and expensive downtime from delays in restoring service. Conversely, trying to juggle multiple local or regional O&M providers can become time-consuming and hard-to-meet quality standards as companies scale across geographies.

Further inefficiencies can emerge from poor technology and IT adoption. Companies of all sizes may fail to properly integrate IT capabilities across their business, leading to slow service or friction between different software tools. And when an O&M provider doesn’t provide real-time and adequate transparency in their data communications and reporting, they leave asset owners in the dark as these costs mount.

These additional costs potentially hidden in some O&M contracts are coming back to haunt a growing number of asset owners. Research from kWh Analytics found that US utility scale solar assets are underperforming their financed performance projections by 6.3% – and those single-digit production shortfalls today can compound into 40% reductions in equity cash flows over a decade. While underperformance isn’t always due to poor O&M services, cutting O&M spend and hoping for the best is a recipe for a vicious cycle that exacerbates shortfalls.

Poor financial performance is particularly problematic for organizations seeking to scale up their solar investments. Financing providers – who expect PV assets to deliver predictable cash flows – are demanding more precise modeling and becoming more careful in their scrutiny of operations, and persistent underperformance can impact access to capital for growth. Not surprisingly, all of these challenges multiply when project developers and owners seek to add battery storage, which promises increased project returns but also increased O&M complexity and new safety concerns.

How to recognize solar operations & maintenance done right

Sophisticated asset owners look for experience, communication and accountability, high standards and technology innovation in an O&M partner they can trust to support them in scaling up their solar and storage investments.

Experienceis understandably high on the list of O&M provider qualifications, but when asset owners are scaling up their solar investments, it’s experience with the entire project lifecycle, a deep technology bench and work across the full range of installation types and product manufacturers, and across geographies that has the most bankable impact. Experience across the entire project lifecycle helps to avoid inefficiencies of coordinating work across different companies and having the same provider who has been operating your plant for 15 years saves time and money when it’s time to repower. And an O&M partner with experience deploying teams across regions and working with diverse product manufacturers can help owners follow opportunities to grow in new market segments or regions.

Communication and accountability are key for any long-term partnership, and it’s absolutely essential when maximizing the performance of a complex asset with a 30-year lifespan. Having a provider that owners can trust to be proactive and transparent in their communications is table stakes for winning a contract, but some O&M providers will pitch cheaper packages to win deals while minimizing the likelihood of higher long-term costs. The best O&M providers are up front about the true lifetime costs of different contract options and will deliver detailed, timely reporting of maintenance service and operational performance across all of the projects in a portfolio.

High standards for quality of service should go without saying, but unfortunately, some O&M providers fall short on this. Rigorous standards need to be set for all O&M functions with safety at the top of the list, and providers must put in place processes geared to achieve total compliance across a customer’s entire portfolio. Responsible asset owners also demand a “trust but verify” approach. It’s important to have full transparency into what these standards are as well as the O&M provider’s level of performance against them as part of regular reporting.

Technology innovation is also a key differentiator for O&M providers, with a wide range of potential applications. Data-based decision-making tools quickly diagnose and remedy performance issues or even anticipate them before they become a problem; CMMS software ensures real-time responses to customer issues with consistent and efficient follow-up; and real-time asset monitoring dashboards deliver a steady flow of actionable data across project portfolios. That said, a company’s ability to smoothly integrate all of these tools into their daily operations is critical to take advantage of all these new capabilities without creating additional process inefficiencies, particularly as their customer base grows.

Scaling up O&M business alongside the industry

These insights about the factors that elevate leading providers of solar operations and maintenance guide how we are developing and scaling our own O&M business. Looking to maximize returns but ease their worries, savvy asset owners and investors scaling up their project portfolio can find value in an O&M provider that offers an owner’s mindset and the willingness and ability to scale with them, but the decision to invest in O&M must be made early in the financial analysis process. Like any other long-term relationship, successful solar O&M partnerships are built on trust, communication and a shared vision of the future.

***

Greg Shambo is the Vice President of Sales and Business Development for Borrego O&M and brings a strong business background with more than 10 years of experience in renewable energy. Greg’s passion for improving the sustainability of the planet through renewable energy projects spurs his approach to building long-lasting relationships with customers and teams.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Standardization of panel size, shape and wattage, quick mounting and unmounting hardware, spare parts in local storage.