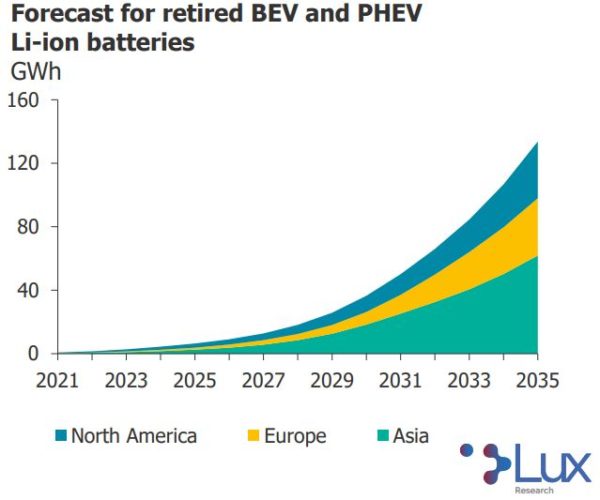

By the end of 2020, 17.6 GWh of lithium-ion batteries met their end of life; by 2035, that number may grow to over 140 GWh, said Lux research. Current recycling capabilities lag what is needed to meet this rapid growth in demand.

More than 1 million tons of batteries are expected to reach end-of-life and need to be recycled by 2030, Lux said. Currently, the supply of waste batteries is only about 2-3% of cumulative energy storage demand, presenting an opportunity for more value creation from end-of-life batteries.

The Lux report pointed to several drivers that it expects to help launch this market. One is the development of policies that support battery handling and reuse. Currently, under most jurisdictions, lithium-ion batteries are classified as hazardous materials, and lack specific regulations for disposal and recycling. A clear set of standards will enable faster and more efficient adoption of recycling, Lux said.

The Lux report pointed to several drivers that it expects to help launch this market. One is the development of policies that support battery handling and reuse. Currently, under most jurisdictions, lithium-ion batteries are classified as hazardous materials, and lack specific regulations for disposal and recycling. A clear set of standards will enable faster and more efficient adoption of recycling, Lux said.

Technology developments also will spur growth in this emerging market, the report said. Lithium-ion battery recycling has made significant advancements in recent years, and recyclers now claim lithium recovery rates upwards of 98%. Patent filings for recycling techniques have also occurred at an increased rate, said Lux.

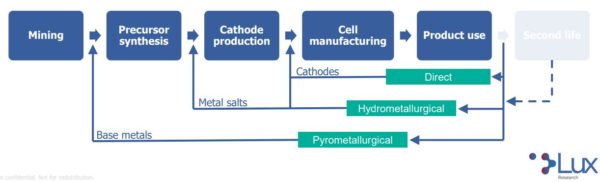

Lux offered a handful of ways that recycling is conducted. Mechanical recycling is the initial step of separating components. In this step, housing, wiring, and circuitry are disposed. Following that, one of three different prevailing recycling techniques is used.

One method is known as direct recycling, which uses nonchemical methods to process materials for reuse in future batteries. An advantage of this method is it derives a product that can be used farther down the value chain. Rather than repurposing the battery back to a raw material and sending it through the entire through the manufacturing process again, direct recycling offers an already-refined product.

A second method is hydrometallurgy, which uses chemical precipitation to gather metal salts or cathode materials, and, in some cases, anode and current collector materials. This method creates refined materials that can quickly be integrated into cathode production and cell manufacturing.

The third type, pyrometallurgy, is less common, but has shown some success in case studies in terms of improving its extraction rates. Pyrometallurgy uses smelters to recover base metals and composite slurries. The method requires further refinement, and essentially restarts the battery production process.

Lux said a variety of technologies and further innovation will be needed to meet the demand of end-of-life batteries, and capacity will need to be expanded.

One barrier to growth is the lack of standardization in EV batteries. The high variability in design makes it difficult to develop efficient and cost-effective recycling processes. Lux said this may benefit hydrometallurgy’s ability to extract value across different battery structures and chemistries.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.