The Biden administration and its Department of Energy (DOE) has set a target to power 5 million homes by 2025 with community solar, with goals explicitly targeting moderate to low income households and those who don’t own homes.

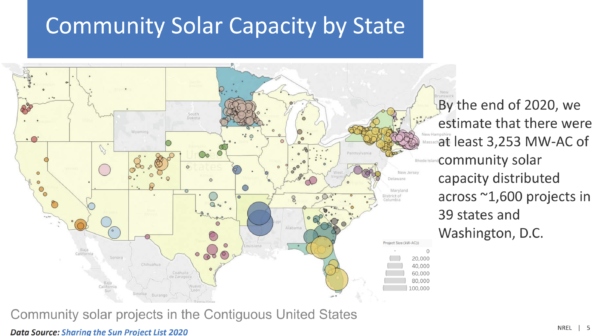

In making its announcement, the DOE said there is currently enough community solar installed in the U.S. today to power 600,000 households. It also provides a great community solar reference in the Solar Futures Study and the Sharing the Sun Report studies, both referenced in the press briefing.

However, to go from powering 600,000 homes to 5 million means we must grow community solar by 700%. That is roughly equivalent to deploying 27.1 GWac / 34 GW of solar power.

To meet this goal, the administration is funding the National Community Solar Partnership. This tool aims to support various community solar stakeholders, from solar developers, to software coders, to public-policy crafters. Essentially, the partnership is intended to train and develop industry professionals in order to ramp up community solar deployment.

Growing an industry by 700% or more clearly is going to take a lot of work.

Community solar capacity has more than doubled every year since 2010, with over 1.1 GW coming online in 2020. And 21 states and Washington, D.C. have passed legislation to enable community solar either through state-required programs or through pilot projects.

That means that if we’re going to deploy 700% more community solar in the next five years, we’ll need to bring online greater than five times what was deployed in 2020, every year, for the next five years. That is not going to just happen; we’re going to have to work very hard on policy.

First, the projects must make financial sense. Second, they must have a legislative path to market for their electricity. Third, and ultimately, they must be able to connect to the power grid in a timely and cost-effective manner.

Tale of two states

New York and Pennsylvania are two states of consequence for community solar right now, but for very different reasons.

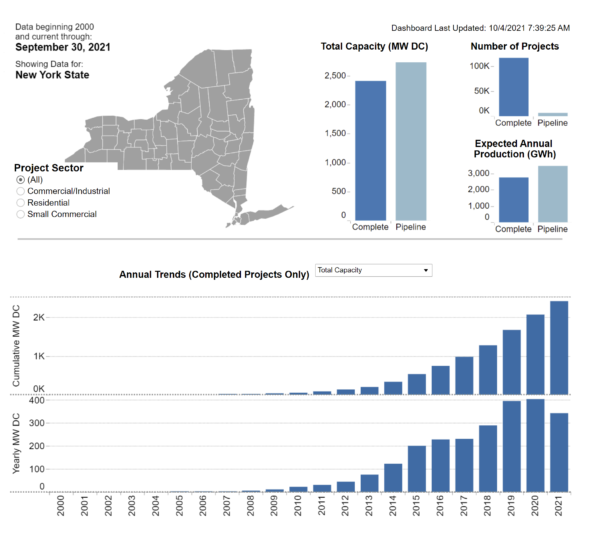

New York has successfully deployed or developed 6 GW of distributed solar power — ranging in size from 5 MWac on down –meeting state goals several years early. Now, the state aims to increase that figure with an additional 4 GW capacity.

New York also is in the early stages of its energy storage deployment program, and is beginning to build transmission power lines to bring electricity from rural lands in the north to load centers around New York City.

However, New York’s community solar program isn’t selling anything new right now. Instead, it is building projects already signed within the last couple of years. As the community aolar program has already met its goals, funding — to the tune of about 2 cents per kilowatt hour — is no longer available. Portfolios of new projects are sitting in the hands of finance institutions, unable to close, as the financial side of projects no longer meets investors’ requirements.

Another reason that projects are unable to meet investor requirements is interconnection costs. These range from $500,000 to several million dollars to connect anywhere from 2 MWac through 5 MWac to the grids. Solar developers have already scoured the publicly available data in the hosting capacity maps to find the low-hanging fruit. And they’ve also shouldered the costs of grid upgrades for many years.

Image: Community Energy

The local utilities, hoping to hold onto power and profits, have floated a proposal that is being opposed by the solar industry. The State of New York has also increased the social cost of carbon; this help to bridge the gap (but by only a penny so far) which is not enough to get most financiers moving forward given our current inflationary climate.

All this means that New York has a legislative pathway to the market, and an open interconnection process, but the financials don’t add up because interconnection costs have increased and the unrealized costs of fossils still allow for cheap electricity.

Key to the Keystone State

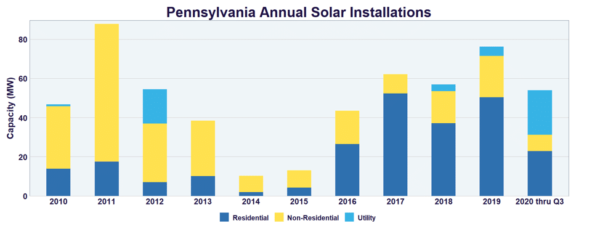

New York’s southern neighbor offers a very different solar market. The power grid in Pennsylvania is wide open, with less than 1% of electricity coming from solar power. But there still isn’t a path for community solar electricity to get to market. As a result, there’s no financial certainty for most small-scale utility projects.

In fact, Pennsylvania doesn’t even have a community solar program. Multiple pieces of legislation have been introduced, but none has made it to the desk of a signature-ready-and-willing governor.

Even with the lower cost of installation in the state, greater solar insolation values, and more expensive wholesale electricity when compared with cheap upstate New York hydroelectric power, these benefits are irrelevant without a community solar program.

Even so, we can even see hints of an unsubsidized solar market developing. But right now, that market is only for large projects whose costs can scale and compete in the 3-4¢/kWh wholesale market game.

And for an extreme example, take Minnesota, whose community solar program has been called the most successful nationwide. But it now has led to some customers being told they’ll need to wait 15 years to interconnect their solar power.

If the Biden administration is to deploy huge amounts of community over the next several years, it must aggressively push policy makers to adequately prepare markets. That means electricity markets need a pathway for the electricity to be sold. And policies must consider and solve financial constraints. Doing all of this will enable renewable assets to connect to the power grid on time, and in a financially viable manner.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.