Insurance losses on renewable energy projects due to natural catastrophes are becoming more prevalent and more severe by the year, according to a new report from insurer GCube.

The report, Hail or High Water, said that the average solar loss due to traditional natural catastrophes or extreme weather was almost 2400% higher than the average non-weather-related solar loss in 2019. The report also said that 70% of solar losses in the last 10 years have occurred since 2017.

Historically, solar projects have most often suffered catastrophic damage from wildfires. After all, much of the early solar market was focused in California, a state with a high annual wildfire risk. Once development began to expand to the Southeast, hurricanes, high wind events, and flooding became of more concern.

David Wagman

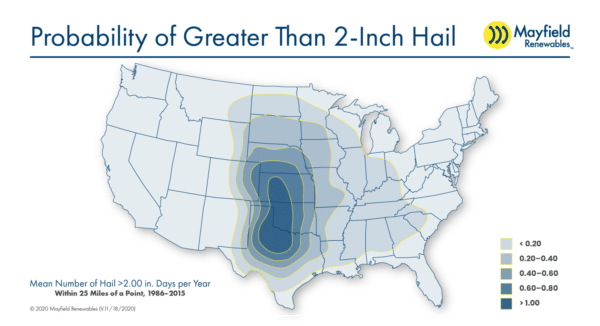

Now, as central Texas, Oklahoma, and the Plains States see solar projects coming their way, hail is the paramount issue, even as high winds remain as much a threat as ever.

Changing weather patterns and more instances of non-traditional, “unmodelled” extreme weather – storms that go beyond traditional predictive and modeling methodology – are partially to blame for the increased severity and frequency of renewable and insurance losses.

But another reason is also a factor of renewables’ success as resources: they’re being built in more areas across the country.

Disaster at Midway

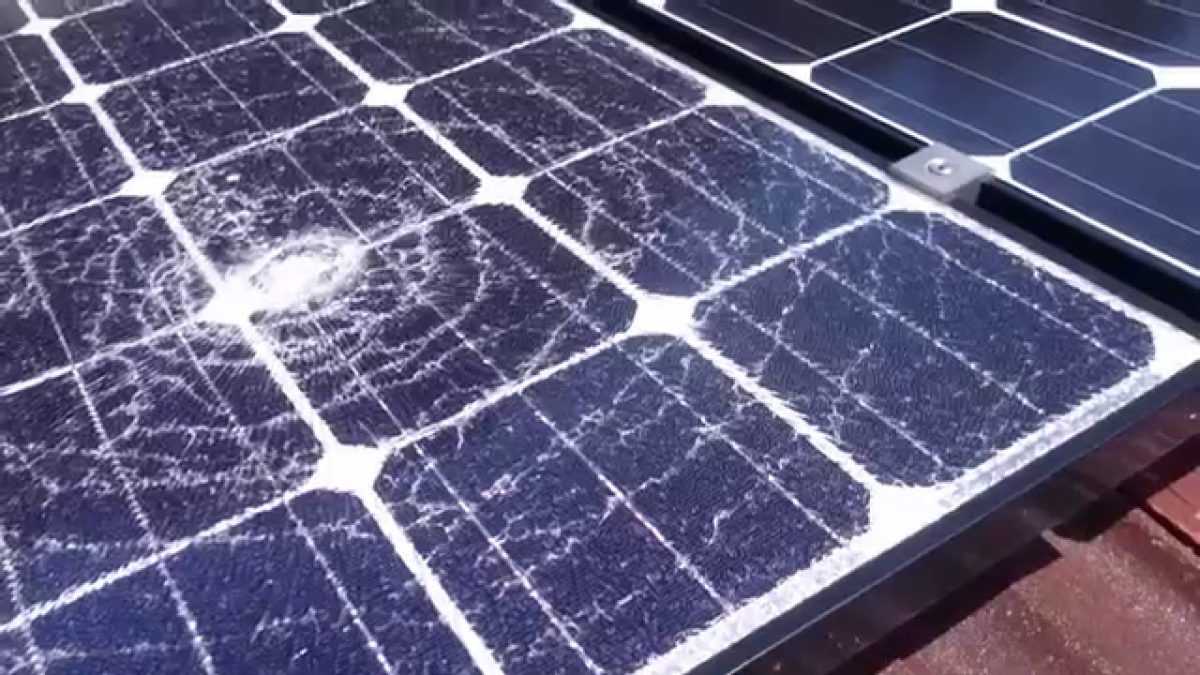

Such was the case with the 178 MW Midway Solar Project in Pecos County, Texas, a sprawling county in the western part of the state. There in 2019, a hail storm damaged more than 400,000 solar panels and caused insurance losses totaling $70 million. The incident opened the eyes of many to the types of weather events that large solar projects could fall victim to, as well as the shortcomings of current hardware reliability testing.

As a result, renewables’ enhanced economic viability has led in part to greater insurance losses as projects are built in areas that are prone to severe weather events, like central Texas and the Florida Coast.

In response, renewable energy insurance markets have hardened, with premiums increasing by as much as 400% over the past 21 months. Some insurers have introduced natural catastrophe sublimits. These set a maximum on the amount of money that can be used to cover losses related to a certain type of weather event.

Naive no longer?

Renewable asset owners face a larger financial burden, but that burden that must be supportable in order for the renewable asset insurance agency to survive. According to the GCube report, before Midway, the 2017 hurricane season was one of the first weather events to show just how soft the renewable insurance market was; the report went so far as to call it naive.

Today, even though the insurance market is harder, premiums have risen, and specific sublimits and extreme weather protection clauses have been introduced, the report said that the market is in a much stronger position to sustainably provide coverage for the renewable energy sector.

The catastrophic events experienced nationwide since 2017 have opened the eyes of insurers and developers alike, providing tangible examples of what severe weather events can do to solar energy projects, and what components are most likely to be damaged and experience failures.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It’s ironic that global warming is causing more severe storms, putting solar panels and solar farms at greater risk and raising insurance rates.

Solar farms, that have single axis trackers, could turn their solar arrays vertical when clouds pass over and then no glass damage would occur and any on edge hits on the frame or mounting would do little or no damage. leaving them vertical at night would also solve the over night snow loading and when the sun comes out, there would be no need to wait until the snow melts.

For fixed roof mount systems, a fine Kevlar thread mesh mounted 16 inches above the panels could stop the velocity of the larger hail just like a Baseball pithing net stops base balls but the visible optical diameter of the sun would only reduce output by 3% to 5% through the fine threads on 3/4 inch spaced threads. As the net fills up, the resulting slab of ice would protect against additional impacts

400,000 panels damaged? I have to wonder what kind of panels the Texas project was using. I like Edward’s suggestion of putting tracker panels on edge during the night and when storms are overhead. Like he said, it is a great way to keep the panels free of snow during the winter.