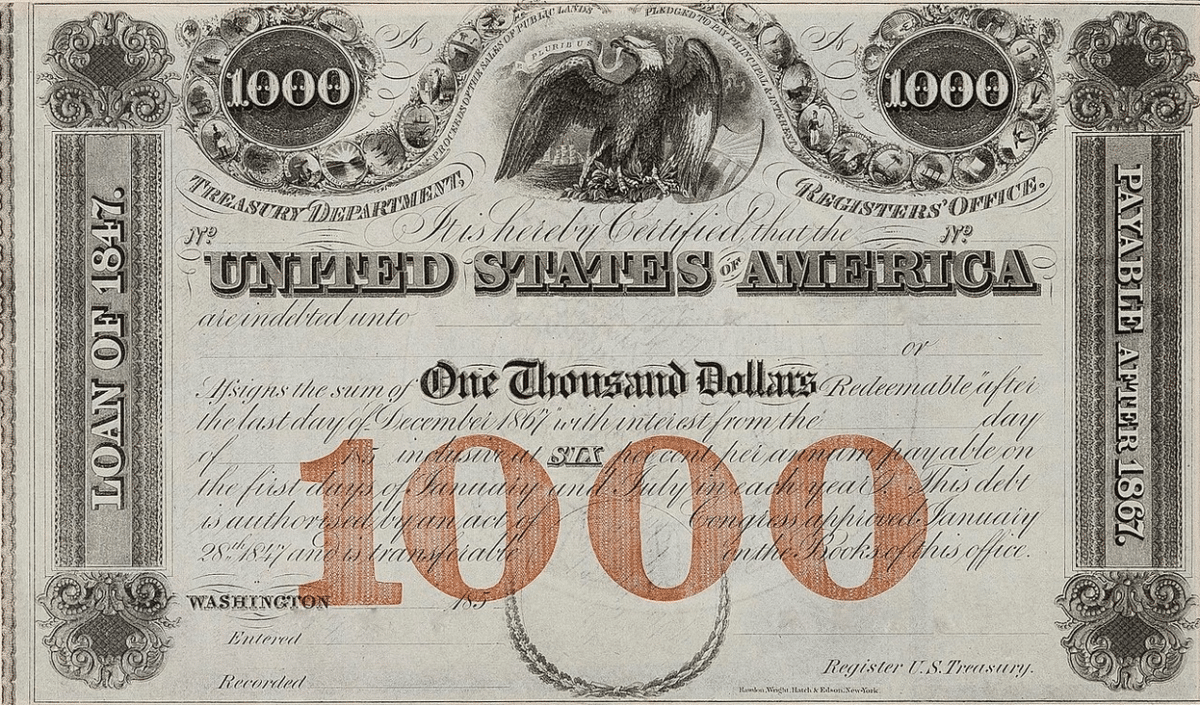

In an industry first, Connecticut Green Bank is launching a retail climate bond series in which all of the proceeds generated from the roughly $16.1 million issuance will support rooftop solar deployment in the state. Connecticut Green Bank’s new category of climate bond, which it calls “Green Liberty Bonds,” are modeled after the Series-E war bonds that half of all Americans bought during World War II.

“Instead of the U.S. government issuing war bonds to protect the Allies in World War II, the Connecticut Green Bank is issuing Green Liberty Bonds to confront climate change,” Bryan Garcia, Connecticut Green Bank’s president and CEO said. Through Green Liberty Bonds, residents can save for themselves and their families while supporting clean energy projects in Connecticut, he added.

The proceeds from Connecticut Green Bank’s A-rated, state-sponsored municipal bonds will be used to support incentives that will lead to $140 million of investment in rooftop solar in the state. “This will support the increasing demand for rooftop solar [in the state],” he said.

The bonds will refinance Connecticut Green Bank’s expenditures from its residential solar incentive program, which offers an incentive to homeowners and third-party owners who install solar panels. In exchange for these incentives, the bank will receive all rights and title to the solar home renewable energy credits (SHRECs) created from the generation. The Green Bank will then sell the SHRECs to Eversource and United Illuminating, Connecticut’s two investor-owned utilities, under a master purchase agreement at a pre-set price over the bonds’ 15-year life. For Eversource and United Illuminating, these SHRECs will help them comply with Connecticut’s renewable portfolio standard, which is 40% by 2020.

In keeping with the United Nations Sustainable Development Goals to combat poverty and reduce inequality, $32 million of the $140 million investment in rooftop solar will support the deployment of rooftop solar in low and moderate-income communities.

According to Garcia, future Green Liberty Bonds issuances could be used to put solar on municipal buildings and other state facilities and non-profits.

In 2014, the Center for American Progress estimated that the U.S. needs at least $200 billion in renewable energy and energy efficient investment every year for 20 years to reduce carbon emissions and avert a climate disaster. Likewise, the United Nations has estimated that by 2031 $90 trillion of investment is needed globally to advance sustainable development and confront the worst effects of climate change.

“To get there – beyond installing clean energy on our homes and businesses – we need to get citizens engaged in investing to confront climate change,” Garcia said.

During World War II, the U.S. federal government sold $185 billion of war bonds, the equivalent of over $3 trillion today. “That’s almost the equivalent to the amount of spending the U.S. government has made to combat Covid-19, except the war bonds were bought from 1941-1945,” Garcia said. In addition to hosting the first U.S. presidential motorcade in an electric vehicle, the state of Connecticut was one of the biggest Series-E bond sellers during World War II.

Like the three privately-placed climate bonds that Connecticut Green Bank has issued during the last few years, the bank’s Green Liberty Bonds will use an independent third-party certifier and a verifier that can attest that the proceeds of the bonds are being used to confront climate change and can track the performance of the projects supported by the bonds.

For its first Green Liberty Bonds, Connecticut Green Bank is working with Ramirez & Co. as lead underwriter and Stifel, Nicolaus & Company as co-underwriter, Shipman & Goodwin as bond counsel, Lamont Financial Services Corporation as senior advisor and the Bank of New York Mellon Trust Company as trustee. The Climate Bonds Initiative will certify the bonds and Kestrel Verifiers will verify the bonds over time.

A week ago, House Democrats passed a sweeping $1.5 trillion pro-solar infrastructure bill that, among other things, resurrected the idea of creating a national climate bank, which it called “Clean Energy and Sustainability Accelerator” this go-around.

About a dozen U.S. states, including California, Connecticut, Hawaii, New Jersey, New York and Rhode Island, have state-chartered green banks.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.