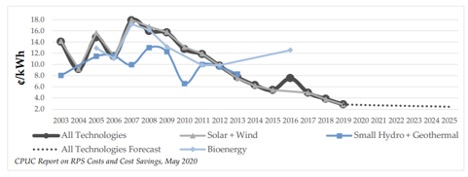

The California Public Utilities Commission (CPUC) just released its 2020 Padilla Report, an annual accounting of costs and cost savings from the state’s renewable portfolio standard (RPS), now targeting a 100% clean energy supply by 2045. The chart-filled report documents the uneven workings of the RPS and ongoing gaps in critical data.

A key figure — contract costs per kilowatt-hour (kWh) — dropped about a cent, from 3.81 cents per kWh in 2018 to 2.82 cents per kWh in 2019 (see below), contributing to a slight drop in RPS spending by investor-owned utilities (IOUs) and a parallel, incremental rise in electricity generated. The report’s top-line figures show the IOUs spending $5.4 billion on RPS procurements in 2019 versus $5.6 billion in 2018; the corresponding gigawatt-hours of renewable power rose from 52,936 GWh in 2018 to 53,244 GWh last year.

Source: CPUC

But these and other figures in the report come with various caveats and qualifications:

IOU procurements: The problem here is that the billions in IOU spending don’t represent actual contracts signed in 2019, but rather procurements from previous years, reflecting the lag between when contracts are signed and when the associated expenditures go on the books. Further, they may not, in all cases, represent new solar, wind or other renewable generation, but unbundled renewable energy credits (RECs), although the exact numbers for RECs are not documented. Last year, Bear Valley Electric Service, one of the state’s small utilities, used RECs for its entire RPS procurement.

CCAs’ growing impact: Further, a chart tucked away in Appendix C, shows that Southern California Edison (SCE) was the only IOU signing a contract for new solar last year — a project of less than 3 MW — while San Diego Gas & Electric (SDG&E) procured an equally small new hydro plant. Instead, California’s still-growing band of community choice aggregators (CCAs) — locally based, retail power providers — became the main drivers of renewable procurement last year, signing ten contracts for projects larger than 3 MW. Total expenditures here were $932 million, up from $555 million in 2018, while renewable generation grew from 10,000 GWh in 2018 to 15,500 GWh last year.

Cost savings: Determining the value of renewables and the savings they produce has long been a point of contention between the electric power and renewable energy industries, and the CPUC report attempts no new answers. “It is difficult to quantify the cost savings, or avoided costs, associated with the RPS program,” the report argues, “because this would require assessing to what extent the RPS program deferred construction of alternative generation facilities and the theoretical cost of those alternative resources.” Instead, the report compares the per-kWh costs of RPS and non-RPS procurements, with renewables averaging out at 10.23 cents per kWh, a bit over a quarter of cent more than 9.95 cents for non-RPS procurement.

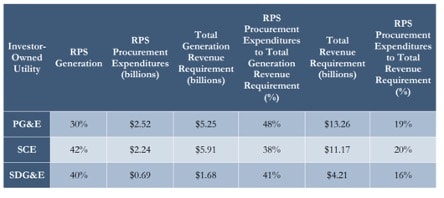

A more interesting approach might have compared the costs of RPS procurement to the IOUs’ generation and total revenue requirements, as shown below. When measured in billions, renewables consistently make up less than half of the IOUs’ generation requirement and well under a quarter of their total revenue requirements.

Source: CPUC

Data gaps: Cost savings aren’t the only section where data gaps may be skewing the report’s analysis of RPS procurement in the state. The annual report was first mandated in 2011, when the California solar market was still recovering from the recession of 2008-2009, and its approach and analysis are clearly dated. For example, while a hybrid project — solar, wind and storage — is pictured on the cover of the 2020 report, the ongoing evolution of renewable technologies, particularly the growing role of energy storage, is not included. Yet, cost savings have become an integral part of the CPUC’s calculations when evaluating proposals to replace natural gas peakers with standalone storage projects or those pairing solar and storage. Issues surrounding negative wholesale power prices and curtailment — both growing challenges on the state’s grid — are also not discussed. Moving toward a 100% RPS means taking into account the complexities of the California market and developing a more comprehensive, sophisticated framework for analysis.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.