Fitch Ratings has released a report, Global Renewables Performance Review: Solar Continues to Surpass Wind, a follow up to last year’s Solar Outperforms Wind on a Global Scale, both of which cover a multitude of solar and wind projects worldwide, comparing their performance based on production ratings and predictability of revenue.

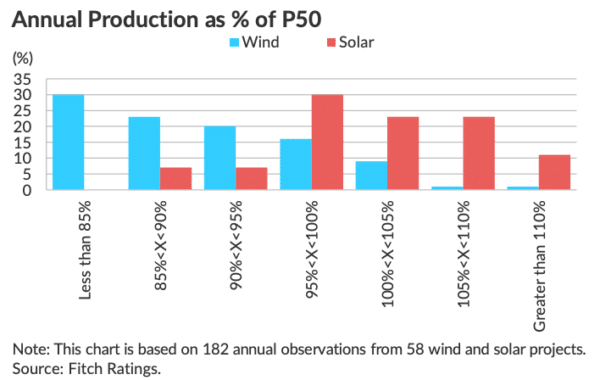

This year’s report expanded the scope of the study to include 182 annual observations from 58 wind and solar projects. The report compared actual production data from dozens of renewable projects against their initial P50 forecasts (a P50 forecast is the annual production level the project is expected to exceed 50% of the time).

Fitch found that 86% of annual observations across solar projects were within 5% or better of the original P50 projections, with just 7% significantly (i.e. more than 10%) under initial forecasts. In comparison, around 89% of wind project observations were below P50 level and 53% were more than 10% below.

And for those less-than-successful projects that are not meeting or are far below their P50 projections, Fitch has found that the downgrade may not come from the shortcomings of the project, but rather the finance models and partners that the project is dependent upon.

The report outlines: “Counterparty credit quality is the largest driver of volatility in solar project ratings… All rated renewable projects depend on some form of incentive structure underpinning revenue generation, providing stability and predictability… Utility ratings are often a cap on U.S. project ratings since PPAs are bilateral contracts where revenue is fully dependent on the creditworthiness of those off-takers… The dependence on a single off-taker indicates that the project’s revenue stream can be no stronger than the off-taker’s credit quality.”

Essentially, the solar projects are performing so well that any downgrade is more reflective of the financial health of the project’s off-taker, rather than equipment failure or poor development. This position is supported by the developments of Pacific Gas and Electric’s (PG&E) ongoing bankruptcy.

As PG&E filed petitions for reorganization, the proceedings obviously led to a downfall in the company’s creditworthiness. Now, because the company that held the power contract for the project’s generation is no longer entirely financially stable, an otherwise flawless project, or multiple projects in this instance, is downgraded.

Fitch then shares that this phenomenon does not happen outside of the United States — international power sector frameworks largely support the characterization of counter-party risk as a systemic one, rather than the fault of a project developer choosing a buyer that would unexpectedly lose creditworthiness over time.

Because of this, at the end of the report, Fitch predicts an upheaval in the way renewable projects are contracted in the United States:

In the U.S., the outcome of PG&E’s bankruptcy filing could provide a signal for new projects to move further away from the traditional utility PPA model. Overall, we are seeing a shift in the typical energy project finance paradigms as new off-taker types are becoming commonplace and merchant exposure is being incorporated into portfolio financings.

The last part of that quote references the growing phenomenon around wind projects where contract termination dates are staggered, resulting in projects that become merchant while some level of debt is still outstanding. The group implies that developers could consider and prepare for this growing possibility early on, in order to have a plan when it happens decades down the line, instead of being left up the creek without a paddle.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Glad to see someone else wondering about this detail as IOUs are not going to be stable going forward as can’t justify their debt, costs as their demand mostly produces their own for $.05/kwh retail.

Stranded PPAS can supply the munis, co-ops, etc that takes over after the fall of the IOUs though.

Or have a plan be producing things like battery plates, synfuels, metal refining, etc.