Two rural electric co-ops have asked Colorado regulators to establish a fair fee for them to exit from their wholesale power contracts with Tri-State Generation & Transmission Association. In response, regulators have issued the co-ops a challenge.

The Colorado co-ops have until December 13 to propose to the Colorado Public Utilities Commission “what evidence will allow the Commission” to determine a “just and reasonable” fee to exit their respective contracts with Tri-State (PUC docket 19F-0620E). The two co-ops are United Power and La Plata Electric Association.

United Power said in a regulatory filing, referencing the exit of New Mexico co-op Kit Carson from Tri-State in 2016, that “the exit charge to which Tri-State and Kit Carson agreed, together with the surrender of Kit Carson’s patronage capital, represented an approximately 2.5 multiplier on Kit Carson’s yearly power purchases from Tri-State (of approximately $20 million prior to its withdrawal).” United Power added that “Tri-State publicly endorsed that exit charge as ‘fair’ and sufficient to ‘protect the interests of all [Tri-State’s remaining] members,'” and that Tri-State’s board approved the charge (PUC docket 19F-0621E).

Apparently no other guidance on setting a fair exit fee is available, because the two co-ops that have already set a fee for exiting from Tri-State are silenced by non-disclosure agreements. Kit Carson exited for a $37 million fee plus its patronage capital, but the formula, if any, for setting that fee has not been disclosed. In 2016, reporter J.R. Logan with Taos News projected that based on Tri-State’s 2015 electricity sales to Kit Carson and its net margin, Tri-State would have earned $20.8 million in profit from Kit Carson through 2040, while Kit Carson would have been awarded $23 million in capital credits during that time.

Also secret are both the exit fee agreed between the Colorado co-op Delta-Montrose Electric Association and Tri-State last summer, and any formula that may have been used to set the fee. (DMEA will exit from Tri-State on May 1, 2020.) DMEA did say in a regulatory filing that the fee initially proposed by Tri-State, if comparably assessed against all Tri-State member co-ops, would have yielded Tri-State billions of dollars after paying off all its debt, and still leave Tri-State with all its operating assets.

Similarly, United Power said in its filing that Tri-State has proposed an exit fee that “represented nearly six times” United Power’s annual power purchases from Tri-State, such that

if all but one of the current Tri-State members elected to exit Tri-State at this time and paid a similar exit charge, it would amount to an approximately $3 billion windfall to the last remaining member (even after satisfying all outstanding debts and obligations).”

Renewables goals

Both United Power and La Plata seek to increase renewable generation while lowering costs to their customers. United Power “is seeking out all possible alternatives to build in rate reductions and offer more renewable options to our energy mix,” it said in a press release. La Plata says on the home page of its website that it aims to “reduce its carbon footprint by 50% from 2018 levels by 2030 while keeping members’ cost of electricity lower than 70% of its Colorado cooperative peers.”

Co-ops that have already left Tri-State, or have one foot out the door, also have renewables goals. The Kit Carson co-op will reach 38 MW of solar and 15 MW of storage by 2022, to meet more than one-third of its annual demand. The co-op, which purchases wholesale power from Guzman Energy, projects that its ten-year contract with Guzman will save its members from $50 – 70 million.

DMEA says on its home page that it is working toward “a future that embraces local renewable energy [and] stable electric rates.” DMEA will also buy wholesale power from Guzman Energy, starting May 1, 2020.

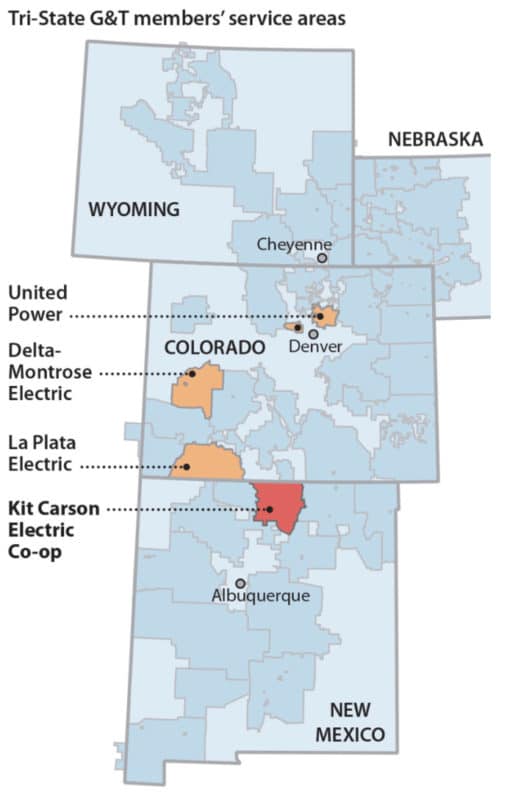

The service territories of the four co-ops, and of Tri-State, are shown in the image at right from the nonprofit group IEEFA.

Tri-State’s generation mix

Tri-State’s generation is largely coal-fired; the not-for-profit association also recently added natural gas supplier MIECO as its first non-utility member. The utility has announced a 100 MW solar project that will bring its solar generation to 130 MW, along with a 104 MW wind project, and claims a total of 475 MW of “utility-scale wind, solar and other renewable projects in its portfolio,” including hydropower. That compares to the 2,500 MW of solar and wind power needed to save customers $600 million by shutting coal plants, according to a study last year by the Rocky Mountain Institute.

Under their contracts with Tri-State, member co-ops must purchase at least 95% of their electricity from Tri-State, or at least 93% if they add community solar. United Power indicated in a filing that it would like the option to consider a partial requirements contract, with a lower required purchase percentage, if Tri-State were to offer that option. La Plata is also exploring that possible option.

Beyond Colorado, the city of Memphis is also considering exiting a wholesale power contract with the Tennessee Valley Authority, while San Francisco has offered to purchase PG&E assets to establish a municipal utility.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“Similarly, United Power said in its filing that Tri-State has proposed an exit fee that “represented nearly six times” United Power’s annual power purchases from Tri-State,….”

I’m sure there were different terms of energy purchase between the now shut down NGS coal fired plant in Northern Arizona and its many power providers in Arizona proper. APS, SRP, and TEV. Although at one time a light provided by ACE 20 and just one large electricity user could have “saved” the coal fired plant from shut down. The CAP decided not to sign any more energy contracts with NGS and instead found some property for a large solar PV facility to provide power to it’s canal and control sites, communications, administration buildings.

Tri-State should be very careful, they may find themselves flapping in the breeze with power generation that no one wants or needs. It all depends on how those power purchase agreements are worded as to how co-ops might float their own bonds and put in their own non-fueled infrastructure.