The Northern Indiana Public Service Company (NIPSCO) learns fast. In 2018, the utility published research suggesting that closing coal plants early, and replacing them with renewables and energy storage, would save customers $4.3 billion. Around the same time as the above bids, the utility announced it would be closing a majority of its coal facilities by 2023 (thus the need for the following procurement), and all coal facilities by 2028. Coal lobbyists, expectedly, have flooded the state’s legislature.

On October 1 the utility issued three separate Request for Proposals (RFP), one seeking 2.3 GW of capacity from solar power plants coupled with energy storage, a second for 300 MW of wind power, and a third for thermal/other resources. Notice of intent to bid is due by October 16, with proposals due by November 20, evaluations being completed by January 10, and agreements being signed throughout 2020.

In the Evaluation Criteria (pdf), the utility notes it will accept bids that are either power purchase agreements (PPA) or asset purchase agreements (APA). If the project is an APA, the utility expects tax benefits to be part of the project bid.

The first factor considered will be the anticipated levelized cost of electricity (LCOE) from the plant. Costs considered in this will include the asset purchase price, interconnection costs, any capital required to meet the transmission reliability benchmark, projected CAPEX requirements over the facility life, and CAPEX required to meet any pending environmental restrictions or action.

A second, equally important but not clearly titled, variable is the “Capacity Asset Reliability and Deliverability” measure. This variable is a combination of project viability, and information produced at the time of bid, as well age of resources that already exist, and whether production projections align with historical data.

The project’s status in the development process is also a big point consideration, with the following stages important:

- Executed a pro-forma MISO Service Agreement and Interconnection Construction Services Agreement

- Completed a MISO Facilities Study

- Completed a MISO System Impact Study

- Site control, zoning requirements, and permitting status

- EPC Contract awarded.

In the PPA Key Commercial Terminology (pdf) document we see a broad outline of the insurance needs, how bid pricing should be labeled, a few operations and maintenance requirements, damages considerations for not delivering on time or producing at required levels, and a bit more. The APA Key Commercial Terminology (pdf) document notes that an independent engineer will be required, a workmanship warranty of some number of years must be included, that payments to the developer will be associated with key mechanical milestones, and other considerations.

In the document All Source Request for Proposal Solar Final, it is noted that PPA providers, “shall state the nameplate capacity, net summer operating capacity, net winter operating capacity and the unforced capacity (UCAP) of the facility for the 2019/2020 MISO planning year.” This, and other language in the document package, means the actual amount of solar power build will be greater than the noted 2.3 GWac that the company is looking for, and that the DC sizing will possibly be much greater than that value.

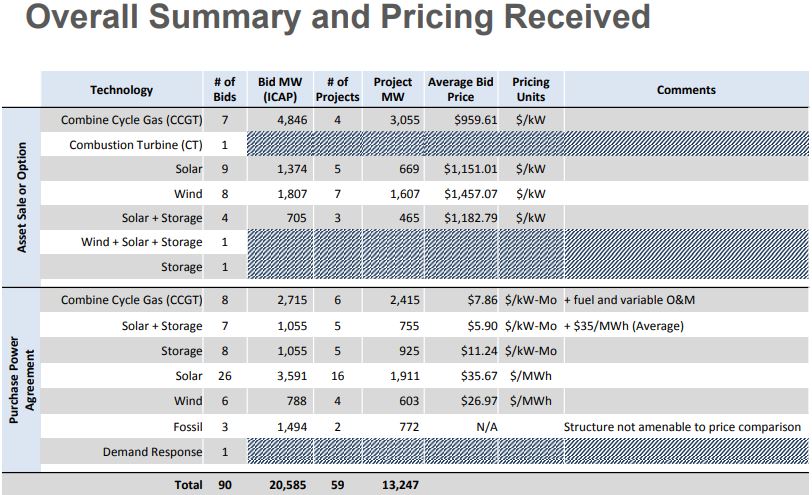

A preview of where pricing might come in could be seen in the below image, from a summer of 2018 NIPSCO RFP, where we saw bids for solar power at 3.57¢/kWh for 1.3 GW-AC, and 705 MW-AC of solar+storage at an extra charge of $5.90/kW-Mo.

Another Indiana utility, Vectren, is currently working on its own 700 MW RFP, which was needed after state regulators rejected a gas plant. While pricing and winners haven’t been released yet, utility documents showed a large majority of the bids were submitted by wind, solar and energy storage developers.

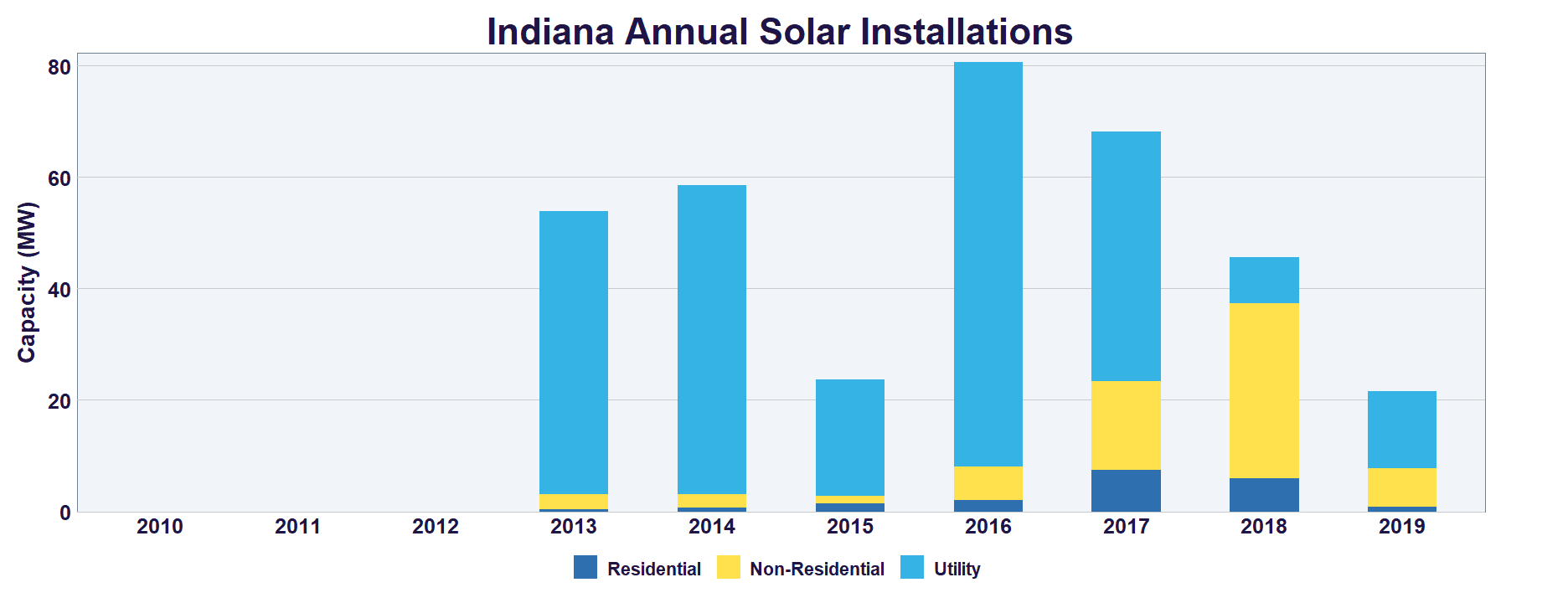

The Solar Energy Industries Association (SEIA) estimates that Indiana currently had 354 MWdc of solar power installed by the middle of 2019, making it the 24th ranked state. The above link suggests that ranking will increase to 18th over the next 5 years with just over 1.2 GW of solar being expected.

But now that expected volume has just tripled. At least.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.