Hardware, labor, money, politics and technology are all having pricing effects on the solar industry.

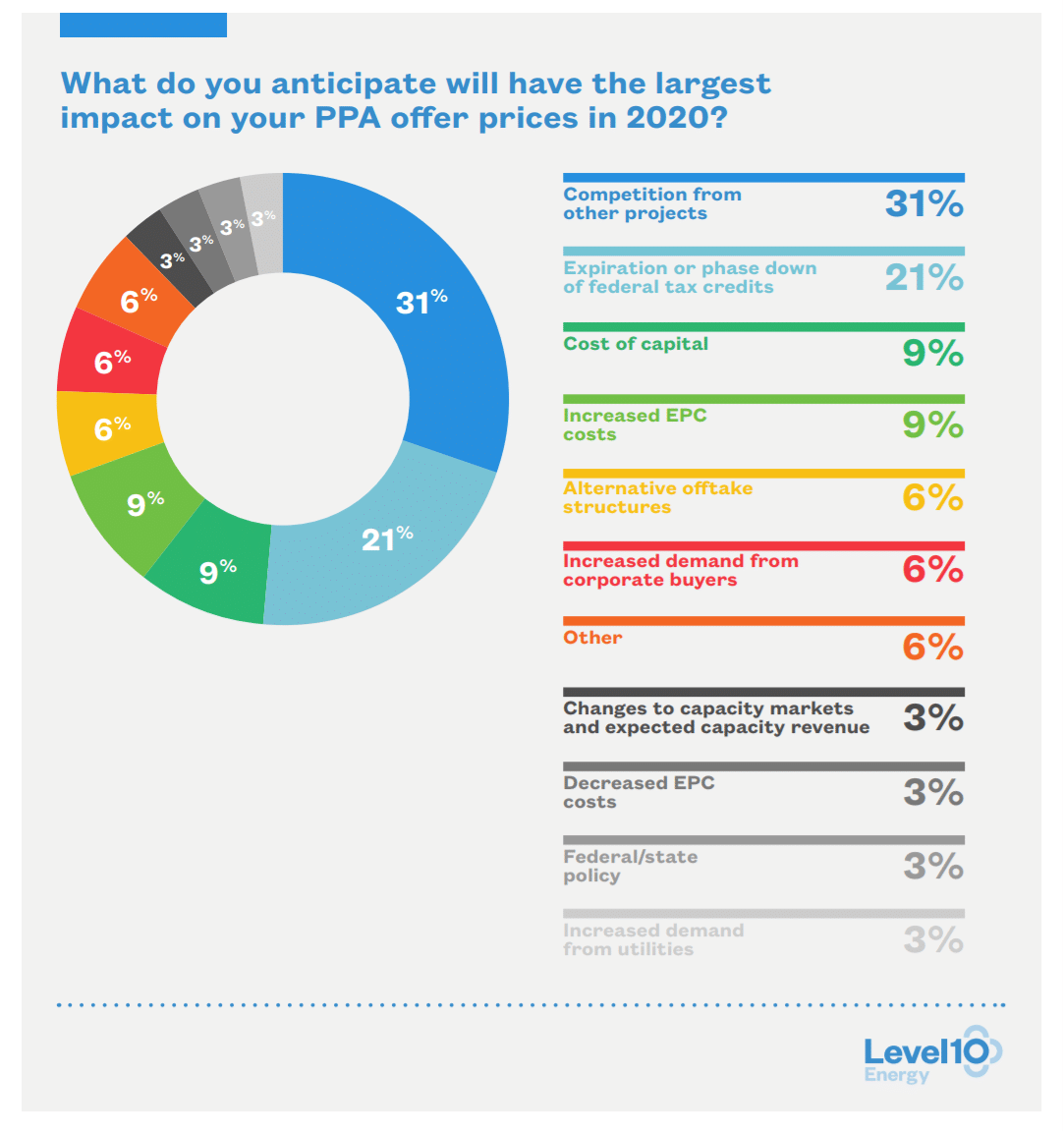

LevelTen Energy has published its Q2 2019 PPA Price Index and in the polling of their subscribers found a general feeling that solar power project pricing might stay flat in 2020, though a full 27% each think pricing will increase or decrease. There were a wide range of variables that those polled though might have an effect – with competition pushing pricing down coming in at #1 for 31% of people, and an increase due to the phase down of the tax credit from 21%.

LevelTen noted that its respondents don’t see the 2020 tax credit phase down (from 26% to 22%) increasing business much. This author wonders if we’ll see a 22% rush from the residential and commercial market like we did in 2016? The utility scale industry, with its 5% safe harbor, won’t see a reckoning till the end of 2023.

To calculate its Q2 pricing, LevelTen analyzed 269 projects with 722 pricing offers, totaling 25 GW offered, on their marketplace.

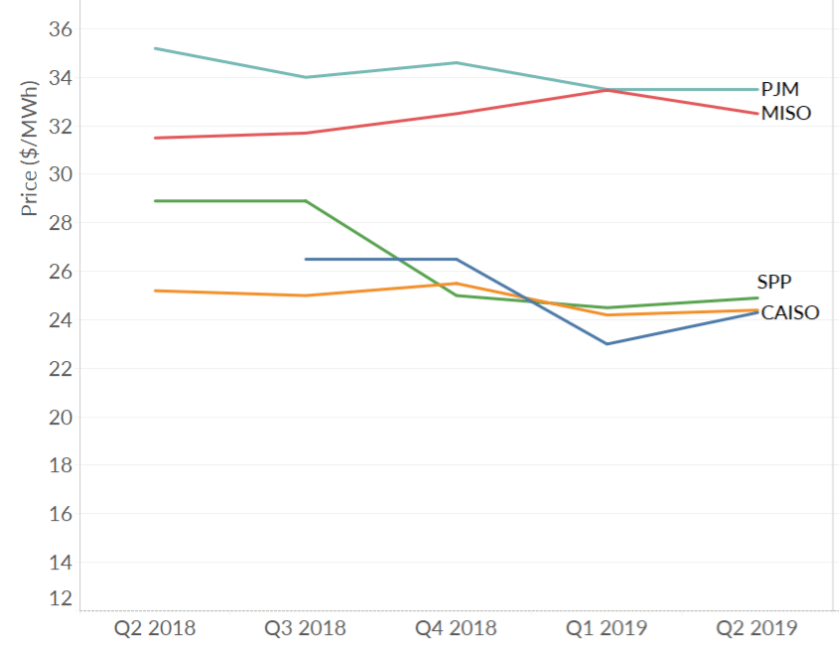

Comparing Q2 pricing versus Q1, there was a moderate pricing increase of about $0.19MWh, 1.0%, for solar power. Though the pricing varied across grid regions – CAISO up 5.7%, ERCOT up at 0.8%, MISO with a slight drop, PJM pricing unchanged, and SPP increasing 1.5%.

Year over year, pricing is down 5%. LevelTen noted that pricing increased lightly in Q3 ’18 headed into Q4 ’18 as well, before decreasing again the following quarters.

Term lengths are seen shortening as the average contract length for solar power projects fell from 14.4 to 14 years, aligning with prior coverage from pv magazine USA.

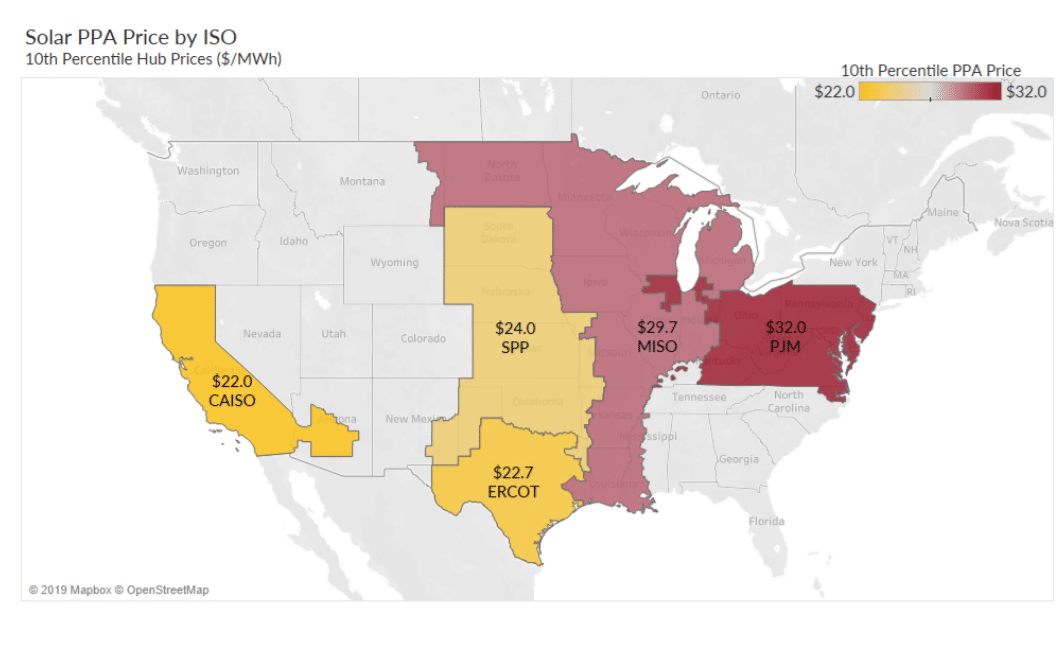

On a national level, pricing in the “10th percentile”, ranged from 2.2 to 3.2¢/kWh for those PPAs offered. We just saw Los Angeles sign a PPA for delivery at the end of 2023, for just under 2¢/kWh.

There have been suggestions of module pricing increasing due to tight supply, with multiple parties reaching out to pv magazine USA during the first half of 2019 nudging us on the topic. Of course, tariffs have increased pricing on hardware other than modules as well.

It is possible that we won’t see any pricing benefits due to bifacial solar modules, as anecdotal information is suggesting bifacial products coming into the United States are spoken for through the end of 2020. We’d expect this to evolve at least some as manufacturers retool their lines.

Internationally, we’ve seen downward price pressure as supplies increase on Mono PERC solar cells for a few weeks now (below tweet), however, it is possible that hasn’t – or won’t – filter to the U.S. market. With the 125 GW annual solar deployment projections still holding as of this morning, and China just awarding big numbers for the second half the year, it is also possible that we will see that downward pressure absorbed.

https://twitter.com/PvInfolink/status/1151437402705027072

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.