For as long as we can remember, California has been the top dog in terms of solar markets and record headlines. Every quarter, the Golden State came in first in rankings, and the question was only how much bigger California would be than other emerging markets, and which states would position themselves in 2nd and 3rd place.

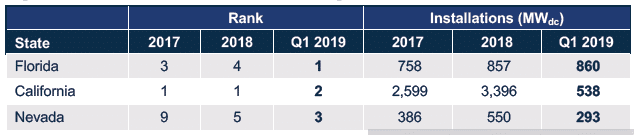

But 2019 is already showing itself to be different. According to the latest numbers from the quarterly SEIA/Wood Mackenzie Power & Renewables Solar Market Insight report, a whopping 860 MWdc was installed in Florida during Q1, compared to California’s 538 MW – the first time since 2012 that any state has exceeded California on a quarterly basis.

This is stunning growth for Florida, which saw very little activity as recently as a few years ago. Even in 2017 and 2018, Florida’s solar market was less than a third the size of California’s; however the state has now installed in one quarter more than it did in all of either year.

A lot of this comes from the activity of the state’s largest utility, Florida Power & Light, which has launched a program to install 30 million solar panels – more than 10 GW of capacity – by 2030.

Residential market recovery

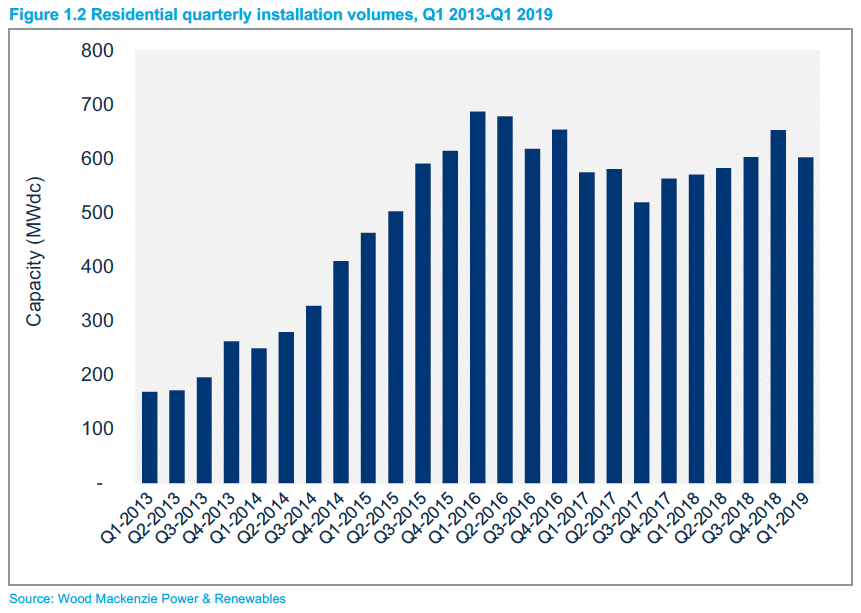

This push by Florida on top of a relatively normal Q1 for California has led to the largest volume deployed in any Q1 to date, 2.7 GWdc, which is 10% more than Q1 of last year. This was supported by not only healthy utility-scale installations, but also recovery in the residential market.

This was the third consecutive quarter with more than 600 MW of residential solar installations, in what Wood Mackenzie describes as the continuation of a “modest rebound” from the slide seen in 2016 and 2017.

Wood Mackenzie suggests that the market is adopting a “more sustainable growth profile”, but also notes that a lot of the progress is due to new emerging state markets – including Florida – and that states with high penetration rates are struggling with high customer acquisition costs.

Growing expectations

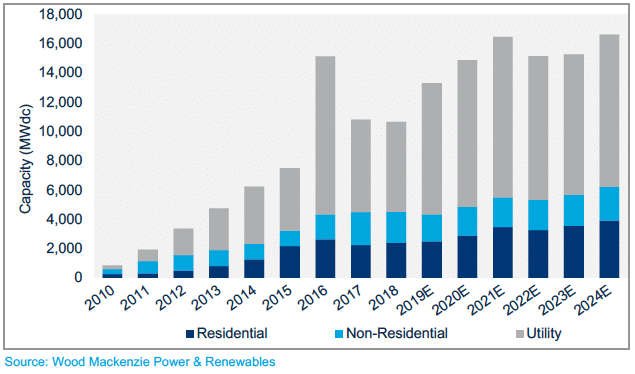

The report finds Wood Mackenzie upping its 2019 forecast to more than 13 GWdc, a growth of 25% over 2018 levels and an increase of 1.2 GW from its previous forecast. Based on what we have seen from the interconnection queues of grid operators, construction starts and other sources, we had felt that Wood Mackenzie’s earlier forecast was too conservative – and said so.

Wood Mackenzie credits this increase to progress in Texas, and this serves as further evidence that diversification is what is driving growth in the U.S. solar market. Over the next five years the firm expects Florida to be the largest market for utility-scale solar, but for California to remain the largest overall due to more robust residential and commercial and industrial segments.

Wood Mackenzie expects the U.S. solar market to grow over the next two years to more than 16 GWdc in 2021, showing a return to growth after the hangover in 2017 following 2016’s boom year and market disruption in 2018 due to the Section 201 tariffs. We will see if its forecast is again proven to be overly conservative, given the ongoing fall in system prices, more states, cities and utilities committing to 100% clean energy, and the rush to get projects online in advance of the expiration of the Investment Tax Credit.

There is one more data point that suggests an upside to these numbers: the 27.7 GWdc of solar projects that currently hold power purchase agreements, which includes 4.7 GW that are currently under construction.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I wonder how much bi-facial being exempt from the 201 tariffs will accelerate this.

I also wonder if the exemption will have companies reserve bi-facial for U.S. deployment.

While there is a small premium (10%) on bifacial modules, the global shortage combined with the US step-down of the ITC will drive sales of all tier-1 products including bi-facial. Developers are safe harboring product across the board. We have yet to install a bi-facial system, but it’s just a matter of time. Let’s grow solar!