Bifacial solar modules have been excluded from Section 201 tariffs per a ruling by the office of the United States Trade Representative. The solar module product will no longer pay a fee of 25% added onto the cost at the point of import into the country.

The ruling, found in Product Exclusions: Particular Products from the Solar Products Safeguard Measure, states that the following products are to be excluded:

(15) bifacial solar panels that absorb light and generate electricity on each side of the panel and that consist of only bifacial solar cells that absorb light and generate electricity on each side of the cells;

Other products applied for exclusion, but in this ruling USTR declined to exclude 72 cell or greater products, or those without busbars or gridlines, and suggested that they were unlikely to revisit this. The ruling does also exclude flexible fiberglass solar panels with output from 250-900 watts from the Section 201 tariffs, and those with spacing greater than 10 mm between the individuals cells filled by optical film.

The effect will be blunted for for large projects with long construction timetables, but there is probably a developer on the phone right now, who sees a chance to change products getting put on a boat somewhere because the savings could be relatively substantial. A module that cost 25¢-35¢ per watt pre-tariff, will now save 6¢ to 9¢/W in the U.S. market by switching to bifacial. For developers seeing all-in pricing around $1 per watt-DC, a system price decrease on this level is significant.

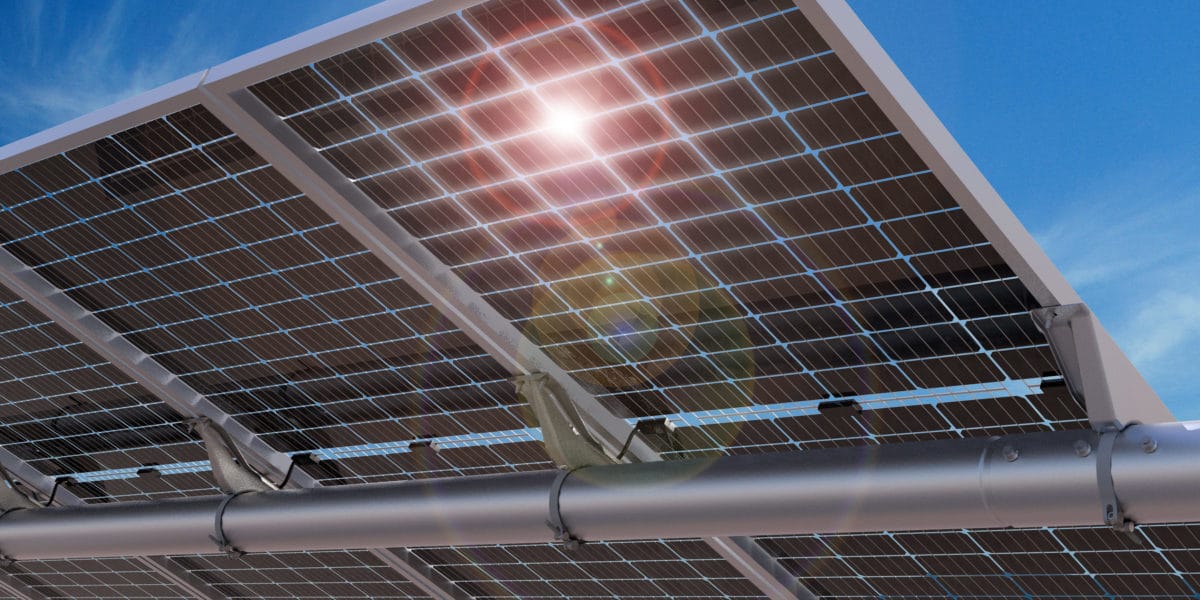

Large scale developers have a large delivery window is that can be years long – for instance the Palen Solar Project, in its filings with the Bureau of Land Management, suggested that solar modules would take 22 full months to be delivered to the site via more than 8,000 truck deliveries (above image). These modules, if delivery had begun this month, would first save 25% through early February 2020, then 20% and 15% as the tariff declines each year.

As these groups are already going all in on single axis trackers that are specifically designed to make use of bifacial modules, it could be that utility-scale product shifts will be limited, as the market has already shifted to greater adoption of bifacial technology.

Given that bifacial solar modules can often be found at a similar price point as standard solar modules, one might think that developers would purchase whatever product is cheapest even when you won’t get all of the bifacial benefit. We should expect to see some cannibalization of the market for standard solar modules.

However, this can only go so far. First off, manufacturing lines of certain product types can only change so fast, and secondly glass on glass bifacial modules don’t fit in the standard module supply chain as easily as their physical structure requires different installation hardware.

There is a chance that this legal change can be taken advantage of in manufacturing lines if Dupont can deliver its clear backsheet product to manufacturers who have dedicated lines selling standard solar modules to the United States, as most solar modules have some bifaciality to them.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

In your last paragraph are you implying that a transparent backsheet in a standard cell module will legally be considered “bi-facial”?

I’m assuming that. The ruling doesn’t seem to care about the backsheet material, but that the solar module and the solar cell can generate electricity via the backside of the product.

Bifacial offer our industry a chance to improve $/GWh. via better yields. Chilean projects , with lower cost plastic backsheets vs. dual glass in CdTe or Csi, are a cautionary case study in the comparable degradation of plastic vs. glass backsheets- based pv modules. Plastics get stiffer and more opaque as the higher UV loads crosslinks many polymers. Then hydrolytic attack from morning fog or coastal moisture plus heat cycles cleaves many polymer chains. Framed or frameless dual glass offers a more robust design life. Don’t bet on false economies and shorten life (especially in lower interest rate countries) if you own the project. If you must go plastic due to supply, then ensure a company like Dupont has the back-to-back warranty and reliable electrical & flame resistance.