Tesla is never a boring company, but Q1 2019 was particularly dramatic. Despite promises to scale shipments of its Model 3, the company experienced hangups which were only alleviated at the end of the quarter, and as a result produced only 3% more of its Model 3s during Q1 than the previous quarter.

Along the way Tesla went through another chief financial officer, burned through $1.5 billion in cash, drove the global discussion on autonomous vehicles, and CEO Elon Musk had more conflicts with the Securities and Exchange Commission.

To be fair, Tesla’s Model 3 is still the best-selling premium car in the United States, and Tesla is still sitting on $2.2 billion of cash and equivalents as its builds out a new Gigafactory in Shanghai, which it says will greatly reduce production costs and allow it to serve its many Chinese customers.

Fall in deployments, profitability in solar and storage

But along the way, the company’s solar and energy storage division is continuing to contract. Solar deployments fell sequentially from 73 MW to 47 MW, the second sequential contraction from a high of 93 MW during the third quarter of 2018.

Tesla has moved away from traditional sales models for solar, at first moving to selling exclusively through its stores, and then closing a number of stores. The company now says that just like cars, it is moving to selling solar online, in standard increments of capacity. While this is happening as solar sales decline, Tesla continues to frame this as an evolution of its business model:

As we have done for the vehicle business, the key to accelerating mass adoption is to standardize the product offering, simplify the customer buying experience, and focus on the markets with the strongest economics.

Energy storage deployments showed marginal improvement during the quarter, with 229 megawatt-hours (MWh) deployed versus Q4’s 225 MWh, and the company’s shareholder letter states that battery capacity which had been re-routed to vehicle production has now been returned to stationary storage.

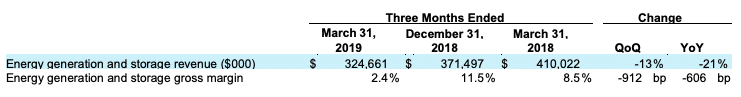

However, the Energy Generation and Storage division declined to only 2.4% gross margin, as the larger company returned to a loss of $522 million after profits in Q3 and Q4.

Promises of future progress

As for the company’s much-hyped Solar Roof, Elon Musk revealed that the company is on the third iteration of the product, but that roll-out is delayed due to accelerated aging testing to ensure that the product can last 30 years, as well as simplifying the installation process.

He also briefly addressed the Buffalo Gigafactory, which has been the subject of investigative reports which suggest that it is running far below capacity, stating that Tesla is “looking forward to scaling that up significantly through the balance of this year and next”.

Like a magician, Elon Musk was sure to leave vague hints of future developments in the company’s quarterly results call. Specifically, he stated that there would be “a new pricing and deployment strategy introduced in Q2” for solar and storage, and for observers to expect “a significant increase in retrofit solar”.

He also suggested that Tesla might reveal more on this next week.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.