Elon Musk finally did it. This writer was among the many watching Tesla’s massive losses every quarter, and wondering aloud if the company would ever turn a profit, and how long it could carry on as a Silicon Valley unicorn, with both market share and debt ballooning but coming in the red every quarter.

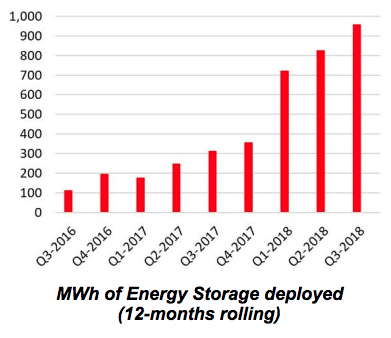

Overshadowed in the accounts of Tesla’s first quarterly profit of $255 million is that the company’s solar and energy storage divisions are showing steady growth. Solar deployments rose to 93 MW, an 11% sequential increase and a minor rebound from the fall that the company experienced in 2017. Meanwhile, energy storage deployments grew 18% to 239 megawatt-hours (MWh).

Set into 12-month rolling averages, the momentum of this division is clear.

Set into 12-month rolling averages, the momentum of this division is clear.

Assuming that Tesla is deploying its lithium-ion batteries with four-hour ratings, this means around 80 MW of energy storage – or only 14% less capacity than the solar it put online. This is an odd ratio given that the battery storage market is still much smaller than the solar market, and Tesla’s investor letter gives hints as to why this is happening.

We are prioritizing residential solar installations that are combined with our energy storage products because this combination provides a better customer experience and improves both our revenues and profits

The margins in the division weren’t bad at 17%, however this is a gross margin and not an operating margin, and given that operating margins are not calculated at the division level it is hard to compare the division’s profitability to that of companies whose primary focus is solar and/or batteries.

Tesla has suggested that the improvement in margins – up from 12% last quarter – is due to more than just pairing solar and storage. The company notes that most of its solar sales now come from its website and stores, which has brought down customer acquisition costs. This appears to be part of Musk’s strategy to offer a combined EV solar and storage solution to his customers.

According to the shareholder letter:

At the end of Q3, there were almost 450,000 Tesla vehicle owners around the world. Ultimately, we believe this group will become the largest demand generator for our residential solar and Powerwall business.

However, the company’s much ballyhooed Solar Roof is not exactly proceeding quickly. In the letter Tesla states that it is continuing to iterate the design of the product via “intensive reliability testing”, noting its complexity, and says that it is also refining the installation process.

Tesla says that it expects to ramp production of the Solar Roof product more quickly in the first half of 2019, but it remains to be seen if this product will be the success that the Model 3 is showing itself to be. What is clear is that Solar Roof has inspired a number of other companies to get into the solar roof tile space, with RGS Energy reviving Dow’s Powerhouse shingle.

Before the results were even released, some of the most poignant commentary came on CNBC, where yesterday former Tesla short-seller Andrew Left of Citroen Research noted how Musk’s personal scandals have become a distraction from the success of the company.

“TSLA is not just pulling customers from BMW and Mercedes but also from Toyota and Honda,” stated Left. “Like a magic trick, while everyone is focused on Elon smoking weed, he is quietly smoking the whole automotive industry.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.