Installer confidence in the solar industry is on the rise for the second year in a row, according to EnergySage and NABCEP’s 2018 Solar Installer Survey, the fourth annual edition of the series. The survey is comprised of 871 solar installers across 48 states, Washington DC and Puerto Rico. The lonely Dakotas were not represented in the survey.

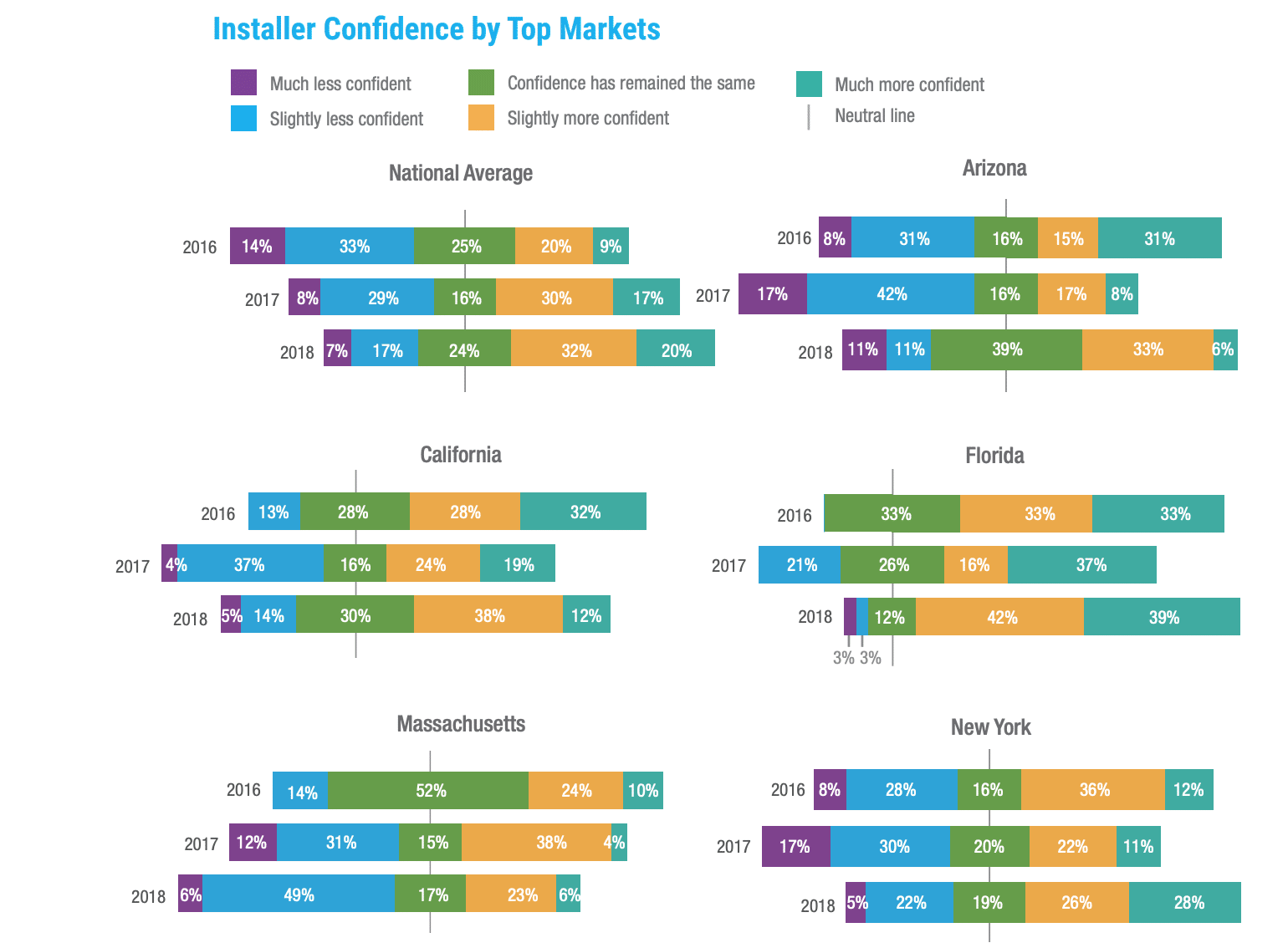

Among those hundreds of installers, over half (52%) expressed growing confidence in the solar industry. This is up from 29% in 2016 and 47% in 2017. This is not to say that more than half of installers were not confident in the industry the past two years, as the stated figure are only representative of whether or not confidence is growing or falling. If sustained/level confidence is included these numbers rise to 76%, 63% and 54% for 2018, 2017 and 2016 respectively.

At the state level, confidence increased in Arizona, California, Florida and New York, while it fell by 13% in Massachusetts. EnergySage and NABCEP have remarked that the delay in releasing the successor to the SREC program and the speed of filling the blocks of the SMART program contributed to the dip in the outlook of Massachusetts installers.

These numbers are a positive indication of the overall comfort level of an industry that experienced uncertainty and change in 2018. First, tariffs did do damage to the nation’s solar market, but despite that the total solar installation volume grew 6% in 2018 to 11.7 GWdc. More installations are good for installers, yes? Well, yes, but this survey may not be reflective of those installations.

This is because the majority of companies that contributed to the survey are small to mid-sized residential and commercial installers, not the big developers and contractors building utility-scale solar. While there were some larger installers, even those who had hundreds of MW in their portfolios, the majority fell on this more modest scale.

Since residential installations have stagnated over the last couple of years, it would most likely seem that the confidence of these smaller installers is coming from the C&I end or from community solar, which took off in certain key states like Maryland in 2018.

The final interesting point of note is that this confidence lies in stark juxtaposition to the 8,000 jobs lost across the industry in 2018. What is especially noteworthy about that figure is the rising confidence of California installers. California installers’ confidence rose from 43% in 2017 to 50% in 2018, despite the fact that the state lost more than 9,000 jobs. This job loss was so significant in fact, that it cancelled out the growth of 29 states. The confidence could indicate that the state’s market is now rebounding, likely assisted by the state’s rooftop solar mandate and the employment that will create.

Like California, Massachusetts saw significant losses in jobs in the solar industry in 2018, yet unlike California, this loss was represented in the state’s falling confidence in the solar industry moving forward. Unlike California, Massachusetts can’t rely on multitudes of massive utility-scale projects to provide a guaranteed spark. In fact, 2018 marked the second year of market stagnation in the above 25 kW space in Massachusetts, with the slowdown at the end of SREC II again hampering development. And while the state is seeing a boom in development following the roll-out of the SMART program, net metering caps throw a wrench in that.

But all in all, it is never a bad sign to have over half of the key players in any industry confident with what the future brings.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.