From the pv magazine Germany website

The decision to rein in PV subsidies in China at the end of May means the rate of new PV capacity installation will decline on a global level this year, according to PV Info Link analysts, who expect around 88 GW of new capacity.

At the same time, the Beijing policy change led to a reduction in spot market prices of around 30% along the PV value chain. For 2019, however, the analysts expect a significant increase in demand, with module sales estimated at around 112 GW. The reasons are the upgrading of China’s solar targets up to 2020, and renewed market growth in India and the USA.

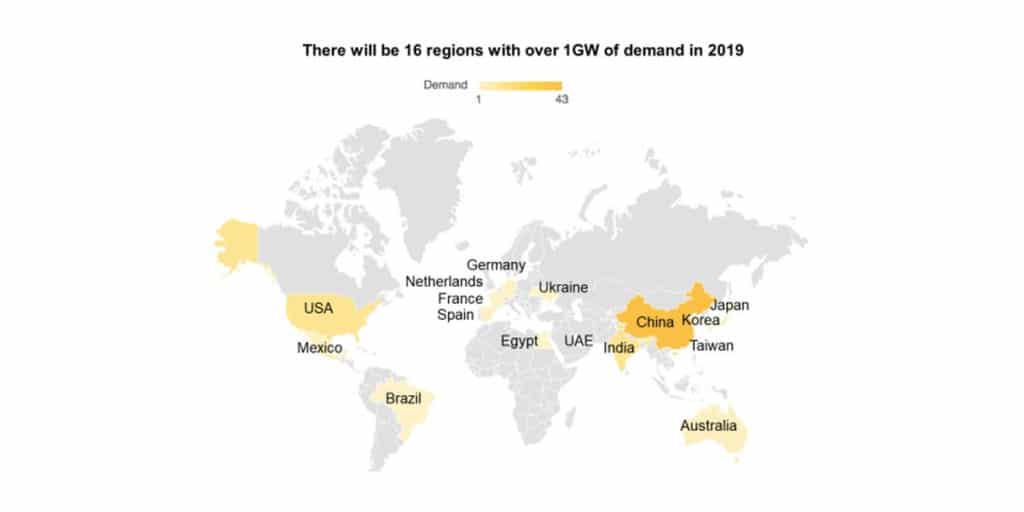

In addition, PV Info Link expects 16 countries worldwide will achieve an increase of more than 1 GW in installed capacity next year. In Europe, the nations in question will be Germany, Spain, France, the Netherlands and Ukraine.

China’s share of installed global PV capacity, which stood at more than half the world market last year, is gradually decreasing. PV Info Link expects the world’s biggest solar market to account for 39% of global capacity this year and 38% next year. The share held by EU member states of the global solar module market is expected to increase from 11% to 12%, and is expected to be accompanied by an increase in capacity in Europe, from 9.5 GW to around 13.5 GW.

Increasing concentration among manufacturers

The analysts identified five trends for 2019. They expect increased consolidation among manufacturers, with the largest polysilicon makers – especially those based in western China – expanding rapidly, and at the expense of smaller peers, because of their ability to reduce costs. It is a development that will also adversely affect leading overseas manufacturers, according to PV Info Link.

Many small wafer manufacturers are also likely to disappear, and consolidation of the mono wafer market will follow a similar pattern.

For multicrystalline wafer vendors though, analysts see lower price differences, meaning consolidation will be slower and PV Info Link says many such manufacturers could return to the market when demand picks up again next year.

For cell manufacturers, the analysts see clear advantages for the big players, but producers with slower cost reductions are likely to be marginalized.

Mono PERC in the ascendancy

With the help of China’s quality-focused Top Runner Program, the production and efficiency of mono PERC products has further advanced and PV Info Link predicts such products will finally have the upper hand this year, with mono PERC’s market share to increase from 28% to 46%.

If, as expected, mono PERC products reach 310 W – 35 W more than multicrystalline modules – next year, more global manufacturers will turn to the technology. Thinner wafers that reduce costs and increase cell efficiency will exacerbate the trend, and a new round of the Top Runner program could strengthen the attractiveness of p-type mono-products.

PV manufacturers are also expected to continue the trend, seen this year, of using larger wafers and modules, with 160 μm thickness mono wafers increasingly used.

Next level in cell and module technologies

This year, many conventional mono producers switched to mono PERC. Next year, according to PV Info Link, selective emitters will become the standard equipment. A breakthrough in Topcon technology and p-type mono cells is expected in the near future, and module technologies are expected to increase efficiency further.

In the second half of this year, half-cells are already expected to have prevailed, ensuring more manufacturers make the switch in 2019. Multi-busbar technology is also expected to make further advances, although analysts do not see such products becoming mainstream until after 2020.

Progress towards bifacial modules, however, continues to be slow, despite the small costs for manufacturers to adopt the technology. Most bifacial modules are likely to be delivered in China, with overseas customers making the change further down the line, according to PV Info Link.

Strong surge in demand in the second half

For the first six months of next year, analysts expect weak demand, with PV Info Link citing three reasons. Firstly, the Chinese New Year falls in the first quarter and secondly, only a small proportion of projects from the Top Runner program will be completed during the first half.

The third reason is that countries with normally high demand in the first quarter – such as India, Japan and Australia – are likely to see a less spectacular than usual increase.

As a result, analysts predict a further price fall by the middle of next year, with the lowest prices in April.

By contrast, strong new construction is expected in the second half, which could lead to regional supply bottlenecks. Demand is expected to reach at least 32 GW in each of the third and fourth quarters, with mono products likely to account for 60% of that market. This could also lead to bottlenecks in the supply of polysilicon and monocrystalline wafers.

Overall, however, the solar industry will then return to higher prosperity, according to PV Info Link.

Translated from German by Emiliano Bellini

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.